Data News - Page 9

Avoid trading in Nifty, Sensex bullish

It is positive to note that the BSE index managed to hold above the 26 August swing low of 15,765. The short-term trend remains bullish and the index could rally to the immediate resistance at 16,750.

Dollar shakes off bear hold; gives bullish signal

The US dollar, written off by several experts in the market, has staged a turnaround and shaken off the bear hold at least for the medium term.

Real estate investment: don't ignore the data

Smart residential property investors will identify the right products priced below Rs 4000 per sq ft in key growth cities as a best option. The simple fact is that investment into residential real estate is today the wisest route that a retail investor can take.

Dollar smashes equity, gold, silver; but don't count on it

The US Fed's announcement last week spurred the dollar even though the economic news is negative. So watch the dollar to see how the Sensex will move.

Nifty could tumble all the way to 4680, rupee to 50.40

The falling rupee and the events of last week show that bearishness is growing. The Nifty and Sensex could be shorted now. Hindustan Lever seems to be worth a punt on the upside.

Has the bear market rally petered out? Jury is out

Friday's sharp fall in the equity indices shows that the markets may be at another turning point. Will they now reverse gear?

Copper's breakout may see a short bull run next week

The small rally in copper looks like a lead indicator for an equity rally. But any bull run will be only for the short term, one must note

Why Chembur, Wadala, Ulwe are hot investments in Mumbai

Ulwe, Chembur and Wadala in the Mumbai Metropolitan region have emerged as the top three investment destinations in India, with forecasts price appreciation by 145%, 133% and 125%, respectively in five years.

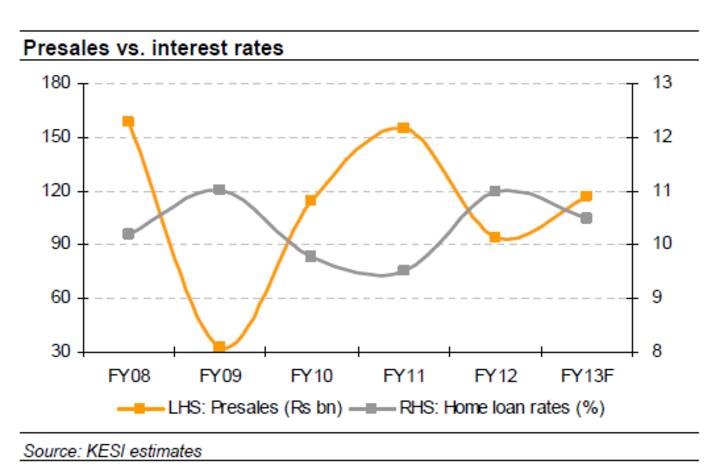

How developers have avoided the property crash '09 scenario

Despite apartments being unaffordable for a large section of buyers, most realty experts do not expect prices to crash any time soon. Here's why

Stock indices in no man's land - and bears haven't shut shop

The Nifty and Sensex have not been making decisive moves. Till they do that, one can't assume the bears are in retreat. But two shares - Eros and Bharat Forge - appear promising from a technical viewpoint.

Equities are in conflict with dollar, gold and bonds

Equities do well when risk appetite increases. But the performance of the dollar, gold and bonds shows that this is far from being the case so far. Going long is not an option in the short term

Don't count on the bulls; SBI, Sail are still on downtrend

Despite the rally last Thursday, the charts do not show a decisive breakout either for the Nifty or the Sensex. It is best to wait and watch till the bear trend is clearly broken.

Bears still on the prowl, the waiting game is on

There is a definite weak trend in index heavyweights. This could set the tone for the coming week.

Chart: Mumbai realty is of the rich, by the rich, for the rich

Thanks to skyrocketing real estate prices, lakhpatis of 2005 are now crorepatis in real estate terms. Mumbai is now out of reach of the middle class

What's in store for indices and stocks next week

Both the Nifty and the Sensex rallied last week, but their gains were not decisive. Among stocks, while Hindalco appeared in a downtrend, Hindustan Unilever was in an uptrend. Watch out for them next week.

What's in store for the stock markets next week

After a blip in the first few trading sessions of the week, the BSE posted a sharp recovery from Wednesday. The technical indicators support the view that the index could target the short-term resistance at 18,615.

Why the rupee is marching to its own gloomy beat

The rupee is in a decline of its own making. But the stock markets seem to be holding up. What is the reason for this divergence?

Chart: How yo-yoing rupee erased India's gains from falling crude prices

The rupee's value has been anything but steady, which has caused any gains from declining crude prices to evaporate.

Berkshire Hathaway among least transparent corporations in world

Warren Buffet's Berkshire Hathaway is among the least transparent with a score of 2.4.

What you need to know about food habits of rural India

Rural India spends around 54 percent of its income on food. However, food items as an overall category have declined as share of consumption expenditure from 64 percent earlier.

Why is India's tax-to-GDP ratio so low?

According to a report by Moody's, India's tax-to-GDP ratio, at just under 15 percent, is lower than countries with similar sovereign ratings

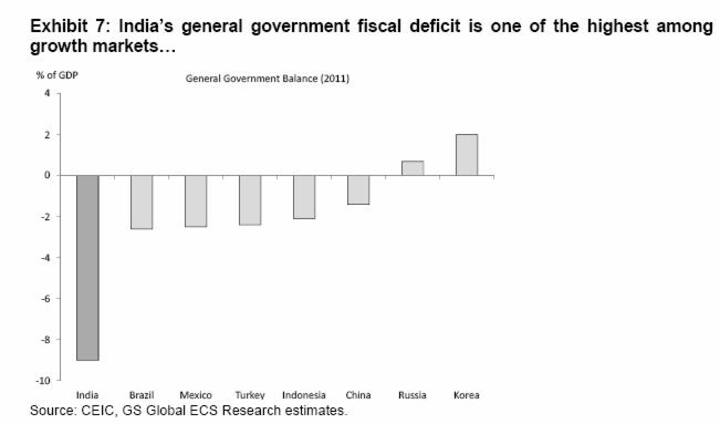

Why India's fiscal deficit is among highest in growth markets

Goldman Sachs estimated the overall deficit at 9 percent of GDP for the financial year ending March 2012, driven largely by a slump in tax revenues and a large increase in fuel subsidies.

Why Facebook fell flat on its face after Nasdaq listing

The Facebook listing, which saw huge trading but not much price strength, shows that the jury is out on its business model

Operation Twist: US Fed has failed and it has no tools left

The US Fed's Operation Twist failed to reduce long bond prices but gave stocks a push. There are no further tools left with the Fed to help the economy.

Will the BSNL-MTNL merger work?

The merger issue has been put on hold for a long time. Since the last three to four years, the DoT was considering the merger so as to allow the two companies to work as one seamless organisation.

Cement, IT and telecom to outperform in March quarter

Driven by an increase in prices and higher volumes, cement companies are expected to report an 18 percent growth and IT service providers a growth of around 25 percent due to an increase in offshore volumes and rupee depreciation.

NSE, BSE are nowhere near global competition

According to a report by IDFC, Indian exchanges have the lowest turn over velocity in spite of having the largest listed customer base in the world.

Chart : Why promoters of DLF, Godrej Prop may soon dilute stakes

It will be difficult for realty firms to off load their stake in the short run. However, institutions with a long term view on the sector may be interested in buying stake.

Infratel-Blackstone deal: How RCom can wipe out its massive debt

RCom is looking at selling up to a 95 percent stake in Reliance Infratel, which owns nearly 50,000 towers.

SKS: An image makeover won't solve its valuation problem

Today the company announced it has raised Rs 243 crore by way of securitising cash flows of its non-Andhra Pradesh portfolio.