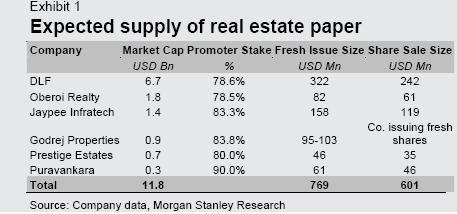

The real estate sector could see around $600-$800 million (Rs 3,000-4,000 crore) of fresh equity supplies in the forthcoming quarters, says Morgan Stanley in its latest report on the sector.

According to Sebi regulations, it is mandatory for all listed companies to achieve a minimum public float of 25 percent by 4 June 2013, in line with the listing guidelines, the report added.

[caption id=“attachment_252591” align=“aligncenter” width=“457” caption=“Source :Morgan Stanley”]  [/caption]

This follows up from the earlier announcement made by the finance minister in 2009 that companies will have to comply with the minimum public shareholding norms. According to the announcement, the finance minister had made it mandatory for all private listed companies to have a minimum public holding of 25 percent and for public sector companies to have a minimum holding of 10 percent.

While many real estate companies like Godrej Properties and Jaypee Infratech have received board approvals for the dilution, approvals from DLF, Prestige and Puravankara are said to be in the pipeline.

Companies have two routes by which they can facilitate a reduction in promoter holdings. One is to make a further public offer through prospectus, and the other is an offer for sale through the stock exchange. Many real estate firms have more than a 75 percent stake in their promoter holding. eg promoter holding in Puravankar Projects stands at 90 percent while public holding is a meager 10 percent.

Given the current market scenario, it will be difficult for the real estate companies to off load their stake in the short run. However, institutions with a long term view on the sector may be interested in taking a stake.

Impact Shorts

More Shortsvalue=“yes” />

Powered by Tableau

)

)

)

)

)

)

)

)

)