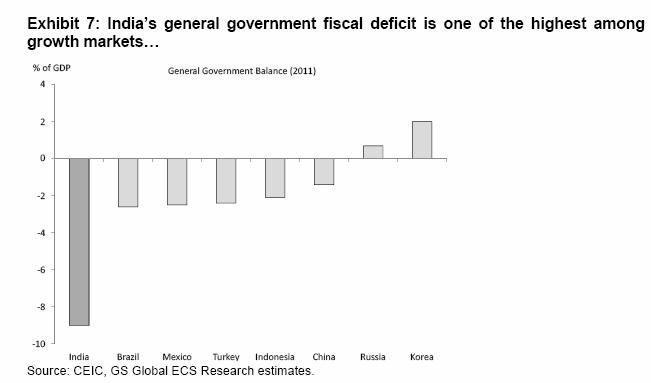

The Indian government’s overall fiscal deficit (centre and states) is one of the highest among growth markets, said Goldman Sachs in a recent report (see chart below). The brokerage estimated the overall deficit at 9 percent of GDP for the financial year ending March 2012, driven largely by a slump in tax revenues and a large increase in fuel subsidies.

This is largely due to a low tax base, rather than too much government spending, the brokerage said. Like most other experts, the brokerage’s economists, Tushar Poddar and Vishal Vaibhaw, thought that Finance Minister Pranab Mukherjee would focus primarily on fiscal consolidation, or getting its finances back into shape.

To do that, the brokerage predicted the government would focus on raising taxes. Goldman Sachs predicted that excise duties would increase from 10 percent to 12 percent and the introduction of a negative list for service tax (only services not subject to service tax will be included in this list; every other service will be subject to tax).

“On the expenditure front, while we expect increases in food subsidies due to the implementation of the Food Security Bill, we expect the Budget to have growth in total expenditure lower than in the financial year ending March 2012. We think this will come from slower growth in non-subsidy current spending,” the report said.

From the original target of 4.6 percent, the central government’s fiscal deficit is expected to balloon to almost 5.6 percent in the financial year ending March 2012. According to Goldman Sachs, 45 percent of the increase in the fiscal deficit can be explained by tax revenue shortfalls, while another 22 percent was caused by unbudgeted subsidy increases (see chart below).

“The big shortfalls are in corporate income tax and excise duties, or production level taxes. These suggest that the shortfalls are mostly to do with the slowdown in economic activity,” the report said.

Overall, don’t expect any robust measures to improve taxes by improving the tax-to-GDP ratio.“While we expect the FY13 budget to begin fiscal consolidation, we do notenvisage the tough, structural reforms that are necessary to lead to a sustainable increase in the tax-to-GDP ratio. These would comprise broad-basing the tax regime, implementing the Goods and Services Tax, and improving tax administration to reduce the extent of the underground economy,” the brokerage said.

)

)

)

)

)

)

)

)

)