By Om Ahuja

Being euphoric about one’s residential real estate investments may sound fairly justified. While intending buyers decry the rapid rise in real estate prices, investors are on Cloud Nine. It’s actually quite interesting to note how the same people who first complain about how expensive homes in India have become go on to exult about how well their properties are appreciating once they have bought them.

This fact is quite interesting from a psychology point of view. The simple fact is that investment into residential real estate is today the wisest route that a retail investor can take.

Most people do not ask for relevant statistics or a comparative analysis of real estate against other asset classes. Nobody denies that hope, faith and belief are our ultimate assets, but investment into assets such as gold, silver, real estate, equity, bonds and mutual funds should be done with the head as well as the heart.

Show Me The Data

When it comes to equities, bonds, commodities and currencies, one can rely on global trends and domestic data to take investment decisions. Decoding data and trends into an investment strategy is the very basis of success in all asset classes. However, when it comes to real estate - the largest and most preferred investment asset class in India - smaller investors seem to rely almost exclusively on hope, faith and belief. The information available to such buyers in India is usually fragmented, and its reliability for providing indications on ROI comparable to that of a satellite’s monsoon predictions.

Data points are crucial, but they become relevant only when they are backed by ground intelligence and based on multiple parameters. For instance, an interesting picture emerges when one considers how India’s young population is driving the consumption story. This story has, in fact, been driving most of the domestic business sectors for the whole of the last decade.

Cars and property - two faces of consumption

In this light, let us consider the automobile market, which is certainly ‘driven’ by young, aspirational and demanding consumers. There are striking points of comparison between the automobile and real estate sectors. Volumes, features and price points are key similarities in both. Sales in both sectors depend on the right sizes, configurations and price tags of the products. A reduction in the cost of borrowing - read interest rates on loans - has a direct impact on the buying patterns and trends in both sectors.

Back to real estate

Most research reports highlight factors such as over-supply and low absorption. Many find this worrying and take a cautious approach. Volume and supply trends differ from location to location, and market trends vary between cities. In other words, there is no way to generalise when it comes to property investment viability.

Cities with a high level of job creation continue to see high volumes of real estate supply and absorption.

Cities with few or no economic drivers to spur the growth of employment fall behind, no matter what other factors seem to work in their favour. Earlier, Mumbai and Delhi attracted the most talent from rural areas. Today, cities like Bangalore, Hyderabad, Chennai, Pune and Gurgaon have taken lead positions and are all set to overtake Mumbai and Delhi.

IT-centric cities like Bangalore, Hyderabad, Pune and to an extent Chennai are now emerging as whole new real estate propositions. IT companies there are expanding their campuses dramatically. Recently, Wipro announced the imminent launch of their new facility and headquarters of approximately 2.5 million square feet in Bangalore. This facility will augment their existing campus, which already employs over 31,000 people. Trends and data points suggest that dynamics in these cities will be very different in the next few years.

With inflation and construction costs moving northwards, the price trends are changing dramatically.

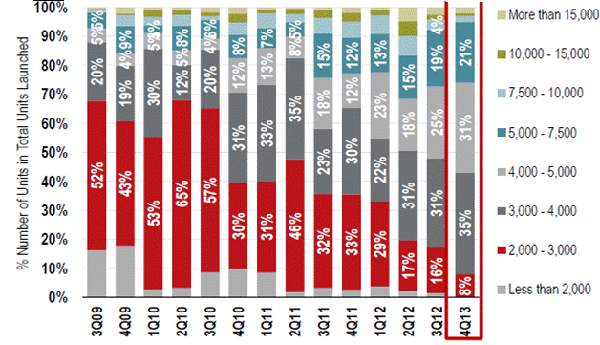

[caption id=“attachment_576187” align=“alignleft” width=“600”]  Image courtesy: Jones LangLaSalle India

[/caption]

The graph clearly indicates that supply trends in real estate have are in a state of flux. The supply of products priced below Rs. 3000 per sq ft is reducing markedly. From 43 percent in Q4 of 2009, supply in this segment will come down to 8 percent in Q4 2013. Meanwhile, supply in the price range of Rs. 5000-10000 per sq ft is expanding.

On the surface, aspirational and affordability levels are driving such trends. However, smart residential property investors will identify the right products priced below Rs 4000 per sq ft in key growth cities as a best option. In cities like Bangalore, Hyderabad, Chennai, Pune and Gurgaon, one can still find good projects in this price segment for long-term investments and appreciation.

The time-related value of money and inflation are two key parameters that one needs to take into consideration. A careful study of the graph above and factors in the growing population, it is easy to see that intelligent investments into residential real estate in India will definitely pay off over the mid-to-long term.

The author is CEO - residential services, Jones Lang LaSalle India.

)

)

)

)

)

)

)

)

)