Data News - Page 5

Nifty may see a counter-trend rally in bearish times

While there is a possibility of an upward move from a short-term perspective, the Nifty has to move past 5,970 to indicate a reversal of the medium-term downtrend.

Nifty, Bank Index are looking down; upmoves may be limited

The Nifty index behaved in line with expectations. Not only did the anticipated pullback materialise, it also met with resistance right at the 5,750-5,775 range mentioned last week

Nifty may see near-term bounce, but view is still bearish

Despite the last minute reversal, the medium term view of the Nifty is still bearish

Will the bull return? Look for cues in US$ and S&P500

The US Dollar index has hit resistance and the Nifty bounced off support last Friday, raising the possibility of a short-term rally in the Indian index.

Copper gives bearish signal; other commodities not supporting rally

Generally copper leads the equity markets but not this time. If the economy is expanding one would expect demand for materials like copper, oil and aluminum to rise too. However, that does not seem to be the case

Technicals: Why short-term outlook for Nifty remains bearish

The swing high at 5,972 is now the reference point for the bullish camp. The Nifty has to get past this swing high to indicate a reversal of the recent downtrend.

Mumbai's Imperial Heights is world's 40th tallest residential building

Mumbai's real estate market is that of extremes. On the one hand, hundreds of skyscrapers are constructed and on the other at least 60 percent of the city's population lives in slums

Why BKC is no longer a favourite among corporates

BKC may have edged out Nariman Point as the No. 1 business destination in Mumbai, but if you were to look at the biggest commercial transactions in the last one year, the complex does not even feature on the list

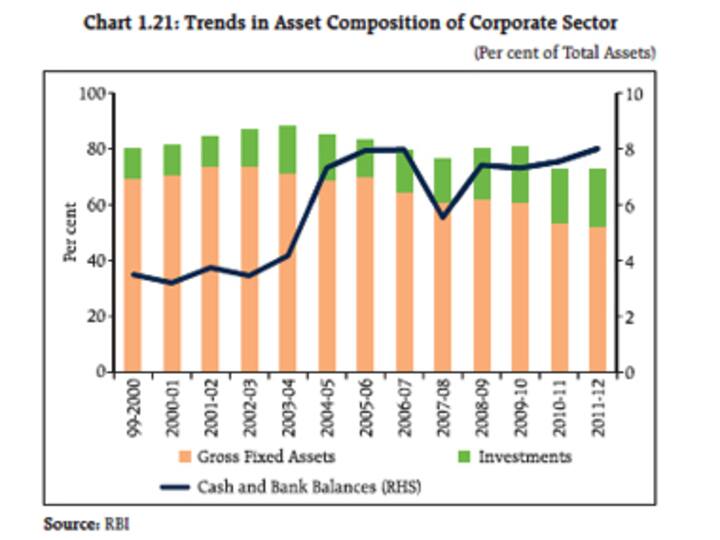

Have money, won't invest: India Inc prefers cash to factories

The RBI notes that companies are investing in financial assets rather than real factories and assets that create jobs. India Inc is clearly not convinced that investing in factories is all that beneficial right now.

This US dollar-rupee chart tells us the market is wary of UPA

The dollar-rupee rate has never been as volatile as its has been under the UPA regime.

What Murthy magic? HCL Tech beats Infosys hands down

Shares of most Indian IT companies have been on the rise in the past few months, due to expectations of a rise in demand in the coming year. Most large and mid-size IT players have hinted at a marginal uptick in spending by clients and a rise in discretionary spending during 2014.<br /><br />

Realty inventories near record high: Buyers should drive hard bargains

There is simply too much inventory available for property builders to not offer discounts. It's time for buyers to drive hard bargains.

Banks may spoil Nifty party; JP Associates a low-risk buy

The bullishness in the Nifty is neither reflected nor supported by the Bank Index.

H1B Visa norms: What's good for IBM is not good for American engineers

As US senate debates the H1B visa regulations, there's a big question its members will have to face: some of the proposals are good for its big tech firms, but are they good for American engineers?

Punters should make small bets till RBI action on 29 Jan

The market is waiting for a clear signal on decisive up or down moves. But the undertone is still bullish, and several stocks look ripe for a punt.

The Bank index will outperform if Nifty hits all-time high

Last week's slide should not scare markets, for the price movement suggests that bulls are still in control.

Sensex inches out: A 500-point rise should be possible

Though there appear to be no constraints to a short-term rally, the market is nearing all-time highs. It is thus time to take a short-term view.

Bank Index going great guns; the target is 13,100

Bank stocks, especially those in the public sector, will be key drivers of the index in the weeks ahead

Two to tango: Nifty ready to rally, Sensex says not yet

Unless the Sensex breaks out we'd be cautious about a market rally. In case the Sensex closes above the 19,800 level, one could go long

Nifty, Bank Index are ready for some major moves

The Nifty and CNX Bank Index are locked between bearish and bullish triggers. This means a major move can be expected shortly

Beyond Nifty heavies, the big gains may be in mid-caps

With a breakout past 5,690, the short-term trend has turned bullish and the rally towards the target of 6,000 appears underway

Nifty, Bank Index still looking at the downside

Considering the short-term uncertainty, Nifty is best avoided from a trading perspective. Compulsive Nifty traders may take the options route to scalp money from the broad range-bound action.

A short-term slide, but Nifty 6,000 is still on the cards

A short-term corrected in the indices does not negate a move to the Nifty 6,000 level. Grasim and Reliance Cap are also in a small downtrend

Bears, take a breather; but keep an eye on US market

The global markets will take their cues in the coming weeks on how the US tackles its fiscal cliff. Its not the time to be bullish or bearish

Chart: Get ready for Nifty's journey towards 6,000

The short-term outlook remains bullish and a rally to the immediate target of 6,000 remains the preferred view.

Chart: Global markets vote down US poll results

A rally in the US markets can be a positive for the Indian markets. Aggressive S&P 500 traders can buy the S&P futures traded on NSE to take advantage of a potential bounce.

Nifty, Bank Index may be poised for next uptrend

The Nifty is still in bull territory, and so is the CNX Bank index. So watch the action closely next week for hints on future direction.

Nifty is two minds: but medium-term is still bullish

The Nifty is still to figure out its direction. It's best to look at stocks that are showing some direction: like Sundaram Finance and M&M