India’s housing market is losing steam as housing supply is increasing but sales are plummeting.

According to the latest report by property research firm Liases Foras, 146.10 million square feet of inventory ( existing supply of housing units) lay unsold in the Mumbai Metropolitan Region (MMR), which is equal to around 1.35 lakh flats.

However, the average price per sq ft in Mumbai has increased from Rs 5,353 in 2009 to Rs 11,765 in 2013.

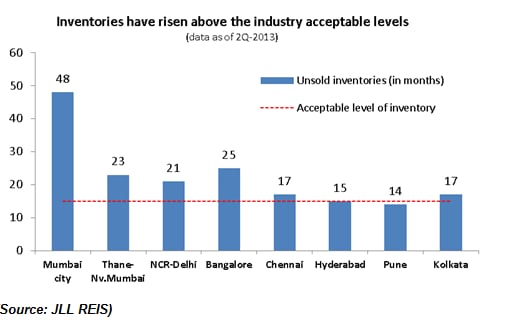

Data from another realty research firm, Jones Lang Lasalle, shows inventory in Mumbai, Bangalore and NCR having risen beyond the industry acceptable levels.

[caption id=“attachment_1111789” align=“aligncenter” width=“520”]  Chart one[/caption]

While Mumbai alone will take at least 48 months to sell off existing inventory, Thane and Navi Mumbai would taken 23 months.The acceptable level of inventory is just 15 months. But given the pace of sales in the last three months, even if builders do not launch other projects in the next 48 months, offloading this existing supply is a tall task.

Real estate transactions in Mumbai alone have dropped 50 percent in the last six months, data from property consulting firm Knight Frank shows. However, developerscontinue to hold on to existing inventory and have refused to offer discounts for fear of starting a market rout.

“Declining affordability and high economic uncertainty are the twin reasons, which would cause property prices in Mumbai to remain subdued, in the near and medium term,” said rating agency Icra in a report.

Capital rates in the city’s real estate market have remained largely firm in the past, supported by limited supply as well as increasing cost pressures.

But with people not coming forward to buy inventories, the sector is facing fears of a slowdown.

Piling up of unsold inventories has put pressure on returns, and this will continue through the year, said industry experts.

And although RBI in June 2013 lowered the risk weightage on loans extended to developers for residential projects to 75 percent from 100 per cent, which could have provided some breather on the interest rate front, the increase in base rate and recent tightening in the liquidity has nullified the impact to a large extent, Icra said.

A look at the share prices of most listed realty firms shows that theyare battling financial stress.

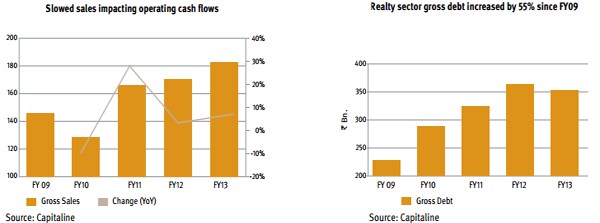

An analysis of 11 listed real estate companies by Knight Frank shows that the financial stress of most builders is at a five-year high as the interest payments have multiplied and gross debt has more than doubled since 2009.

[caption id=“attachment_1111733” align=“aligncenter” width=“600”]  Data provided by Knight Frank[/caption]

“The interest cost as a percentage to sales grew from 12 percent in FY10 to 18 percent in FY12. This, along with the debt repayment obligation, exacerbated the ‘stress score’ to -102 and -95 in FY11 and FY12 respectively,” the report said.

A high stress score implies high strain on the sector’s ability to honour its debt and interest obligations.

Now in FY13 the situation has worsened further.

“Launches and absorption of residential projects in the top seven cities plummeted by 37 percent and 23 percent respectively during the past two years (FY11-FY13), thereby aggravating the structural problems of the sector. The real estate developers have been caught in a trap of ambitious expansion, decelerating sale, hardening interest rate, and weakening cash flow. Unlike the earlier occasions, the sector now has no bailout package and alternate funding options have also dried-up,” said Samanthak Das, head-research, at Knight Frank.

An Economic Times analysis of 25 listed firms shows that 10 companies have lost over 80 percent of their market value, eight over 50-80 percent, and only one company has given positive returns.

And while a correction is imminent, builders are still not coming out with outright discounts.

Take Mumbai’s Lower Parel market, for instance. Builders have resorted to 80:20 payment schemes to increase sales. Special discounts over a particular weekend have also been used to lure buyers.

However, according too Liases Foras’ Kapoor, prices are moderating.

“The new launches are coming at a cheaper rate. Developers have increased the super built up loading. But the notional price impact is making consumers feel that instead of Rs 30,000, the property is being offered at Rs 20,000-21,000.”

Just last week, the New York Times cited the example of Orbit Grand in Lower Parel to illustrate all that is wrong with India’s real estate sector.

“The Orbit Grand, a block-size complex designed to have at least 26 floors of elegant apartments, an extensive array of ground-floor stores and abundant parking for the chauffeured cars of residents and shoppers, was supposed to be a diadem of India’s real estate market. Now it is turning into a symbol of the slumping fortunes of property developers and owners in a once-promising emerging economy. Construction of the Orbit Grand has almost completely stalled at the 10th floor, the tower crane at the site seldom moves and the builder has defaulted on its loan,” t he New York Times said.( Read the full report here).

Orbit is not alone in this struggle.Experts believe that Lodha Developers and Indiabulls are too slugging it out at Lower Parel and Worli. In January, Lodha upped the ante by launching a project - Blue Moon - 40 percent lower than the market rates starting with a price of Rs 3.2 crore for a 2BHK spread across 1,368 sq ft and carpet area of 8,54 sq ft.Indiabulls on the other hand responded by introducing the 20:80 payment scheme for its Sky project in the same vicinity.

However, with the recent RBI curbs on 80:20 schemes, discounts will be the flavour this Diwali due to the builders’ need to sail through the current difficult market conditions.

“A marginal correction in the prices of certain projects aimed at the mid-income segment is not entirely out of question. If it occurs, it would be within a range of 12-18 percent, depending on specific projects and their builders’ holding capacity and financial strength,” said Ashutosh Limaye, Head- Research & REIS, Jones Lang LaSalle India.

In short, this is a buyer’s market. If you have to buy a home, drive a hard bargain and don’t settle for anything less than a 15-20 percent discount on the rate the developer offers you.

)

)

)

)

)

)

)

)

)