Mumbai: BKC may have edged out Nariman Point as the No. 1 business destination in Mumbai, but if you were to look at the biggest commercial transactions in the last one year, the complex does not even feature on the list.

Many corporates put theirinvestment decisions on hold, waiting to see how the economicscenario unfolds, especially in light of the forth-coming nationalelections. As a result companies either did not take up additional real estate space or looked to consolidate at cheaper locations in order to bring down costs.

“Cumulative new leasing of o ffice space in Mumbai in 2013 was 4.76 million square feet, which was 21 percent less than 2012. Absorption decreasedin each subsequent quarter throughout the year, furthercon forming the downtrend, said areport by Colliers International. And rather than BKC, micro markets like Central Mumbai, Navi Mumbai, Andheri East and Western Suburbs together constituted approximately 70% of the total absorption.

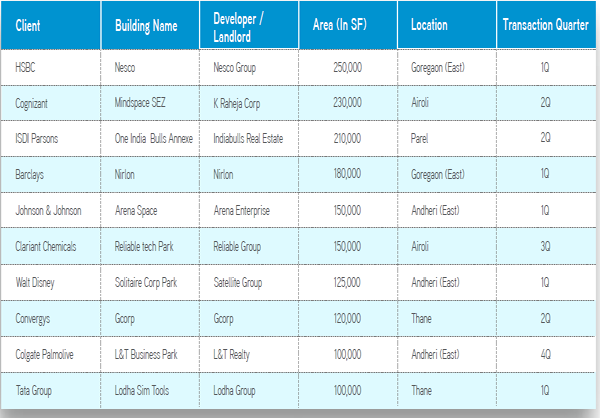

[caption id=“attachment_1336685” align=“aligncenter” width=“600”]  Chart from Colliers International[/caption]

If you look at the above top ten transactions of 2013, BKC does not even feature on the list. Most of the large transactions have either happened in Andheri East or Goregaon East, where rentals are still lower. Little wonder that 70% of the new supply in 2013, which was approximately 3.5 million square feet, was concentrated in Andheri-Kurla and Malad-Goregaon stretch. So basically, the city’s peripherals continueto remain the most preferred location of corporate occupiers due to cost-effectiveness.

According to a report in The Times of India, anestimated 36 lakh sq ft of commercial space is either lying vacant or under construction in the Bandra-Kurla Complex while the average absorption in the area is around 5 lakh square feet annually. The oversupply situation has impacted rentals too. Rentals are now in the range of Rs 240 to Rs 350 a sq ft a month compared with Rs 280 to Rs 400 a sq ft two years back.

Impact Shorts

More ShortsAnother report by real estate consultancy firm CBRE points out that during the fourth quarter of 2013 CBD, Lower Parel, BKC, Kurla (W) and Kalina did not see any new supply additions.

“Going forward, demand is likely to be concentrated mostly in peripheral markets, owing to abundant availability of cost-effective, Grade A office space options. Financial institutions and pharmaceutical firms are likely to drive office space demand in the near term. Owing to large anticipated supply addition, rental and capital values are likely to remain under pressure across most micro-markets of Mumbai in the short to medium term,” said Anshuman Magazine, Chairman and Managing Director, CBRE South Asia Pvt. Ltd.

)

)

)

)

)

)

)

)

)