Data News - Page 4

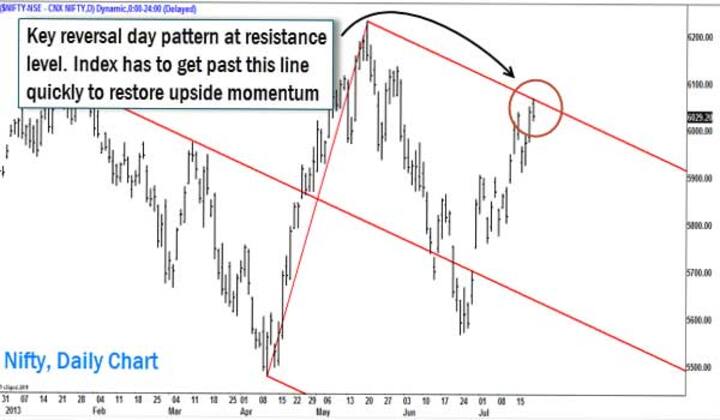

This chart shows why Nifty could get into a downside correction from here

A move past 6,093 would indicate that the worst may probably be over for the index.

Bank Index holds key to Nifty as IT, pharma weaken

Early signs of a crack are visible in the pharma and IT sectors. If the Bank Index fails to lend support, the damage to the Nifty could be quite sharp

Nifty trend is southwards, and banks are leading the fall

The IT index is the only bright spot in the market scenario, with banks and FMCG too showing signs of weakness<br /><br />

Further Nifty rise hinges on banks, energy; TechM outlook positive

Looking at the technical picture in Reliance Industries and ONGC, there appears to be a strong case for the Nifty to at least remain afloat if not seek higher levels<br /><br />

Nifty, Bank Index sending contrary signals - so watch out

The Nifty still has to contend with stiffer resistance at 6,135. The key levels to watch are 5,900 on the lower side and 6,135 on the higher side.

Chart: Sensex nears resistance, Nifty has room to rally

After the initial panic that the Federal Reserve will wind down the monetary spigots, the central bank officials walked back on the statement saying that they were in no hurry.

As equities dance, bonds threaten to stop the music

It is important to keep a close eye on the bond markets while trading equities. Equities are the teenagers of the market, while bonds are the grandads.

Nifty has run up too quickly; so don't chase momentum

It makes little sense to chase price and buy at prevailing levels. Any correction may be used to build long positions in sound large-cap stocks in software and banking.

Don't count on Nifty bounce; index is in resistance zone

The momentum in the Nifty over the last two days gives bulls an edge, but traders should not be so confident about market direction

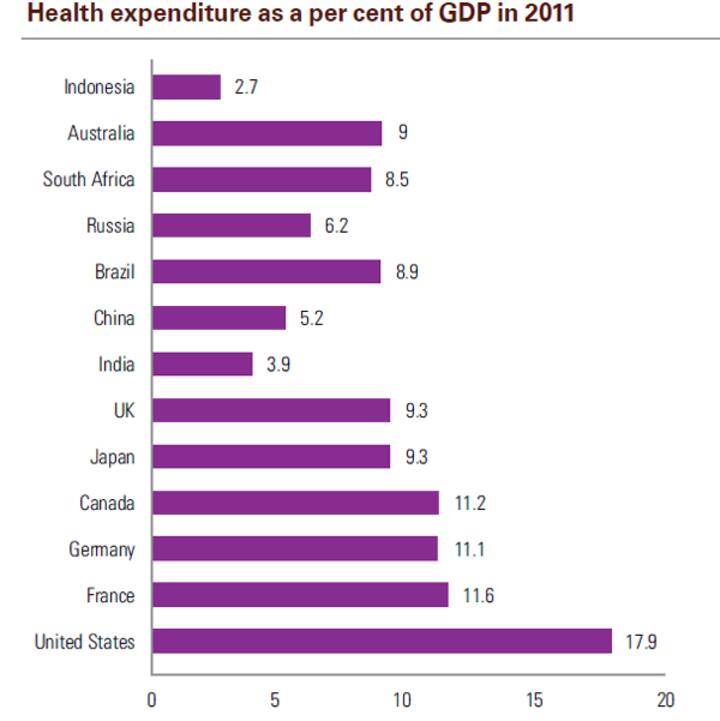

These 4 charts show India doesn't give a damn about the old

Insurance penetration in India is among the lowest in the world:

More jobs? Forget IT, look at healthcare instead

Between 2004-05 and 2011-12, education, health and recreation services added even more employment than the fast growing financial, real estate, business and IT services sector.

Nifty fall has not hurt bullishness; short-term uptrend in Maruti

Investors may use any weakness to build long positions in the Nifty as well as high quality large cap stocks.

Nifty short-term outlook looks green, HDFC rallies back

A fall below the 12 July low of 5,496.95 would result in a bearish sequence of lower highs and lower lows.

Demand zone in S&P 500 stops global bear and rescues Nifty for now

The S&P 500 needs to break out of it's resistance zone, for Nifty to go higher. However, a policy boost from the Reserve Bank of India could also push the Nifty higher.

Why 55-60 to the dollar may be the new normal for rupee

A drop in the US dollar index does not seem to help the rupee; this shows that the Indian currency seems to be marching to its own gloomy beat.

Southward Ho? Nifty, SBI and Titan in bear territory

The Nifty is below the swing low of 5,930. This has resulted in lower highs and lower lows, which strengthens the case for a slide to 5,650-5,700

Chidu, Pranab have left a debt time-bomb for next govt

In the years starting 2014-15, the repayment burden of government debt will show a sharp spike upwards. The next government will have little fiscal breathing space.

Nifty, Bank Index are now staring down, so are PNB, Hindalco

A crack in the Bank Index in the recent trading week was instrumental in bringing down the Nifty. Watch out for a further correction.

Holding the 56.11 support level is crucial for the rupee

The rupee's weakness despite zero interest rates in the US is worrying. What is the US Fed stops printing money and the dollar strengthens further?

Chart: Nifty bulls are here, banks safest bet

ong term investors may use any weakness to buy fundamentally sound stocks from the banking space. A fall below the recent swing low at 12,188 would indicate reversal of the bullish view.

Nifty can reach all time high if Jan 2011 high is cleared

It is very likely that the Indian markets will follow the US markets at least to make it to its past all time highs

Graph: Check out the change in RBI policy rates in 2013

Here's a look at how repo rates moved in this financial year:

Not the time to short the Nifty; 6K is the new floor

Nifty is currently at levels where there is no technical justification to consider fresh long or short positions. Unless the Nifty falls below the 6,000 mark, there is no reason to even consider short positions.

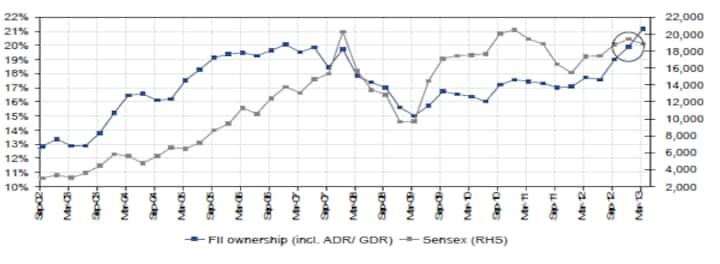

Chart: Markets top 20k but here's why it's not a bull run

Why foreign ownership is risky for Indian markets

Nifty is running weak; SBI, ICICI and Axis are vulnerable

The Bank Index has helped pull the Nifty down. There is reason to think the trend is down in the short run, and pivotal banks stocks are under threat

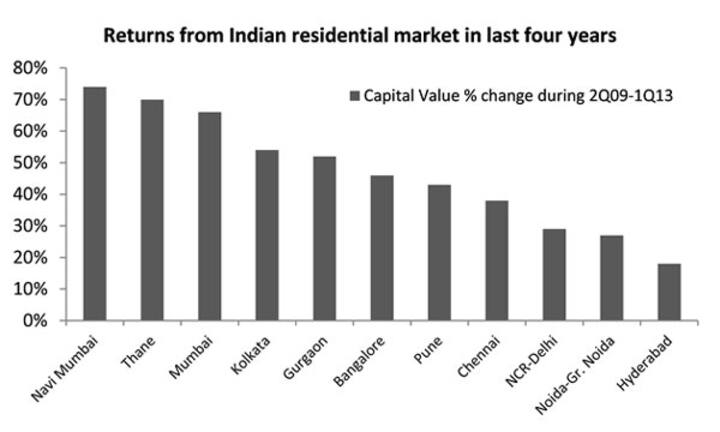

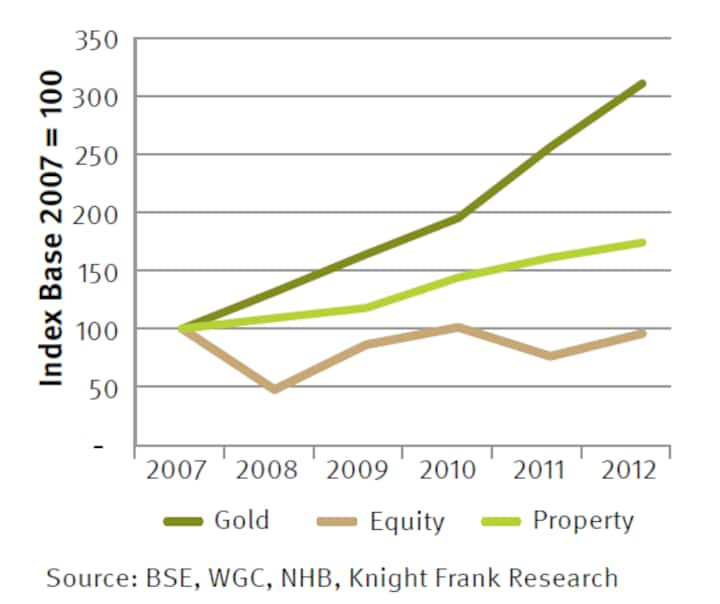

Why property investment is a better bet than equity

According to the latest study by real estate research firm, Knight Frank, property investment has yielded 74 percent returns, while investment in equity, as measured by Sensex, has lost money

Chart: Is the worst over for Nifty?

While the index is headed towards multiple resistance levels, there are no signs of weakness as yet.

Technicals: Gold catches bounce; decline is no big deal

Gold caught a bounce this week as it hit a support zone driven by sell recommendations by leading investment firms. I