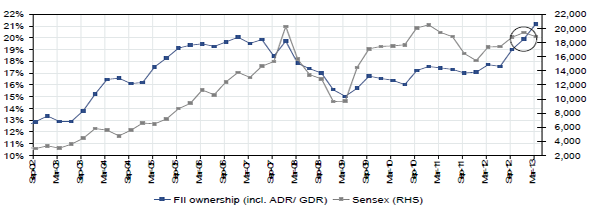

Indian markets have been soaring for the past two weeks thanks to the flood of global liquidity. Currently, foreigners are the most dominant shareholders in the country’s equity markets with an 18.6 percent stake.

In fact, in the March quarter, FII inflows hit an all time high, but the equity markets actually fell 3 percent due to record selling by domestic investors. In April too, India remained amongst the most preferred emerging market for theseventh consecutive month for FIIs.Domestic institutional investors were, however, sellers of equities aggregating $ 497 million in April.

[caption id=“attachment_762631” align=“alignleft” width=“600”] Source: Bloomberg, CMIE and Citi Research[/caption]

[caption id=“attachment_762653” align=“alignleft” width=“568”] Over the last quarter, FIIs increased their holdings of Indian equities, while DIIs

reduced ownership marginally. Source: CMIE, JP Morgan[/caption]

JP Morgan views this trend as risky for the Indian markets.

“Latest available data indicates that FII’s overweight position on India is at a six year high. From a technical perspective this position highlights the vulnerability of India to a global risk off trade. The vulnerability extends to the currency as well - the large CAD is being funded mainly by capital flows and 2) underscores the need for the Government to ensure growth revival,” it said in its latest report.

Even brokerage Citi agrees that FIIs pouring in money does not mean it is a bull market just yet.

While it has retained its year-end target of 20,800 for the Sensex , it has cautioned that it is not a bull market yet despite heavy purchases by foreign institutional investors.

According to Citi, participation by domestic investors holds the key to a sustained uptrend. This is borne out by the fact that equity benchmarks declined 3 percent in the January-March quarter even as FIIs were buying heavily.

“While foreign flows have been very strong, FII portfolio stance seems to have turned more conservative, with higher allocations to energy, telecom and health care, and lower allocations to the stronger performing/larger financials and IT,” the Citi note to clients Wednesday said.

According to Citi, participation by domestic investors holds the key to a sustained uptrend. This is borne out by the fact that equity benchmarks declined 3 percent in the January-March quarter even as FIIs were buying heavily.

)

)

)

)

)

)

)

)

)