ByAshutosh Limaye

Dubai, which is touted to be the most popular and world-class property investment destination in the Middle East, has started to witness a recovery in its property market post the financial crisis.

In 2012, real estate prices recovered for the first time, growing 10 percent year on year, according to the Dubai Land Development (DLD) authority’s data and as quoted in various regional media. Real estate transactions in Dubai had increased by 8 percent to 154 million dirhams in 2012.

Not surprisingly, this recovery is backed by huge investments by expatriates, particularly from India. Non-resident Indians (NRIs) are comfortably among the top five investor communities in the region. With their natural affinity towards India, and against the depreciation of the Indian rupee against the US dollar, could the NRI community’s real estate investment decisions be changing in favour of the Indian market?

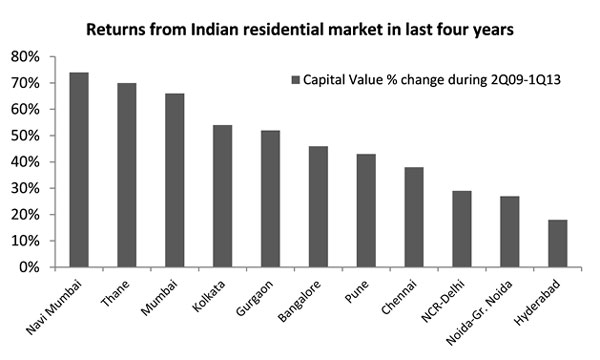

For Indian real estate, general perception among buyers/ investors is that prices have increased dramatically over the last few years. Immediately, following the Lehman collapse, Indian property prices witnessed significant increases - averaging 40-42 percent across all major markets. (See chart below)

[caption id=“attachment_939111” align=“aligncenter” width=“600”] Source: Jones Lang LaSalle India’s Real Estate Intelligence[/caption]

Even in cities such as Mumbai, where capital values are already high, returns stood at 66 percent during the same period. As against this, DLD data for Dubai suggests property prices witnessed a 65 percent slump in the four-year period prior to 2012, thereby justifying the question whether a 10 percent rally in 2012 is actually all that significant

More recently, the Indian rupee (INR) has seen 12 percent depreciation against the US dollar since the start of May until June 2013, thereby forcing its value down against all other currencies pegged to the US dollar - including the UAE Dirham (AED). As a consequence, the rupee has also depreciated against the AED by 12 percent during the same period.

A simple back-of-envelope calculation suggests that if a Dubai-based NRI invests AED 10 million in Indian real estate now (INR/AED at 16.4), and assuming only conservative returns of 15 percent from Indian real estate in the near term, the investor could expect repatriated returns of over 27 percent assuming that the INR returns to its pre-May mean of 14.8/AED (see diagram).

[caption id=“attachment_939117” align=“aligncenter” width=“380”] Chart: Jones Lang LaSalle India’s Real Estate Intelligence[/caption]

It could be argued that expatriate Indians may be favouring Dubai over Indian real estate on the basis of socio-economic and other factors.

[caption id=“attachment_939125” align=“alignleft” width=“400”] Chart: Jones Lang LaSalle India’s Real Estate Intelligence[/caption]

According to media sources, Indian investors were buying properties in Dubai as it offers relative political stability, world class infrastructure, tax benefits, attractive prices and geographical proximity. Also, Dubai’s economy has been recovering since last two years, growing by 4.4 percent and 3.4 percent in 2012 and 2011, respectively.

However, a recent survey conducted by Sumansa Exhibitions, organisers of the successful annual event called the India Property show in the UAE, portrays a different picture. The survey possibly reveals that NRIs place a higher intrinsic value on property owned in India over that of property owned in Dubai or elsewhere.

Apart from strict visa rules in the Middle East region, there are certain regulatory obstacles in buying a property in the Emirates. These are also other critical factors that can help sustain NRI interest in Indian property market, includingthe higher economic growth in India;improving infrastructure and renewed political focus on timelines for new infrastructure initiatives; rising demand for commercial space in the market (leading to job creation); social infrastructure; and price trends.

Putting these findings into perspective, the recent fall in the Indian rupee could potentially act as a trigger for the NRI community in the Middle East to switch focus towards properties back in India.

Ashutosh Limaye is Head - Research & REIS, Jones Lang LaSalle India

)

)

)

)

)

)

)

)

)