It is estimated that India has around 90 million elderly people and by 2050, this number is expected to rise to 315 million. Despite this, India ranks India 73rd out of 91 countries in elderly care, according to the Global Age Watch Index (GAWI), developed with the United Nations Fund for Population and Development.

A new report by KPMG and Assocham titled, ‘Old age security: doing the right thing for our elders’, revealed that financial and health problems coupled with living alone are the top three fears of the elderly but lack of incentives for getting into geriatric care is leading to an ever increasing gap between supply and demand for elderly care.

Below are some facts which show India is far behind when it comes to taking care of the elderly.

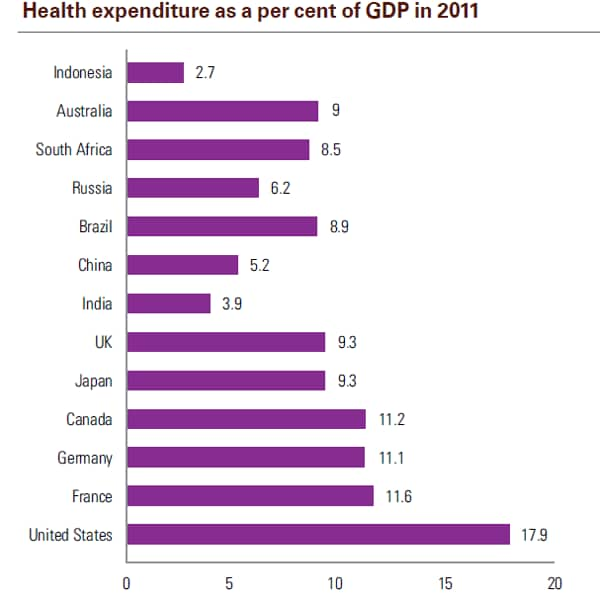

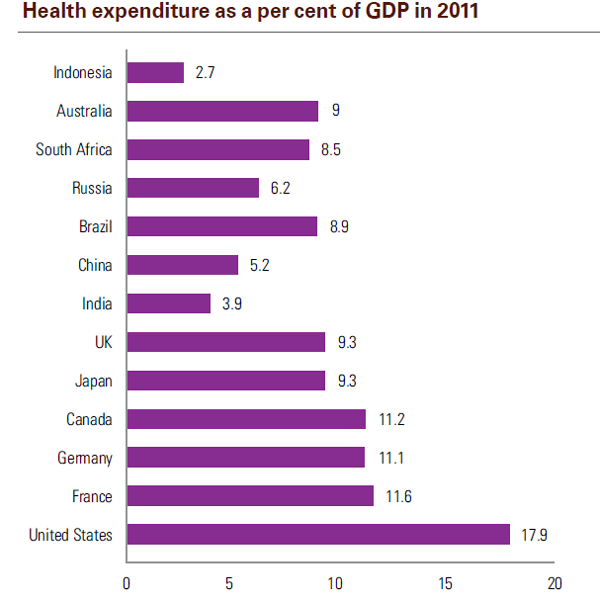

1. I**ndia spends the lowest on healthcare among all the BRICS nations:**Amongst the BRICS nations, the public and private spending on healthcare in India is the lowest-3.9 percent of GDP on healthcare as compared to Brazil and South Africa which spend in the range of 8.5-9 percent.

[caption id=“attachment_1328773” align=“aligncenter” width=“600”]  Data provided by KPMG, citing a World Bank report[/caption]

According to the report, current government expenditure on healthcare is only 1.2 percent of GDP and it is planned to increase it to 2.5 percent by 2017 and 3 percent by 2022.

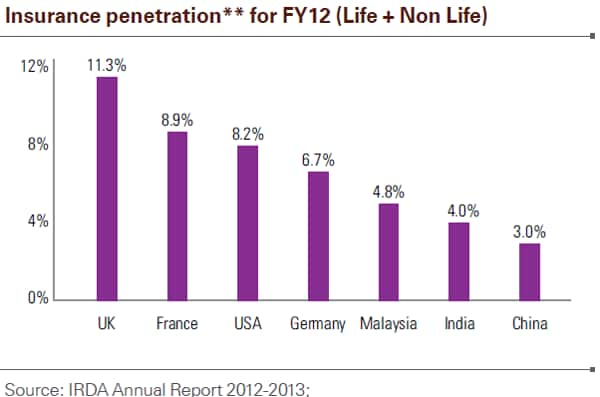

2.Insurance penetration in India is among the lowest in the world: While India has followed in the footsteps of OECD nations such as the US, Mexico, Spain and Austria to offer preferential incentives such as tax deductions and allowances to encourage citizens to buy insurance policies, insurance penetration in India is still very low in India as compared to other global markets. For instance, while insurance penetration ( both life and non-life) for FY12 in UK and France stood at 11.3 percent and 8.9 percent respectively, it was merely 4 percent in India. (This is lowest only to China where insurance penetration stands at 3 percent)

[caption id=“attachment_1328801” align=“aligncenter” width=“600”]  Chart obtained from KPMG-Assocham report[/caption]

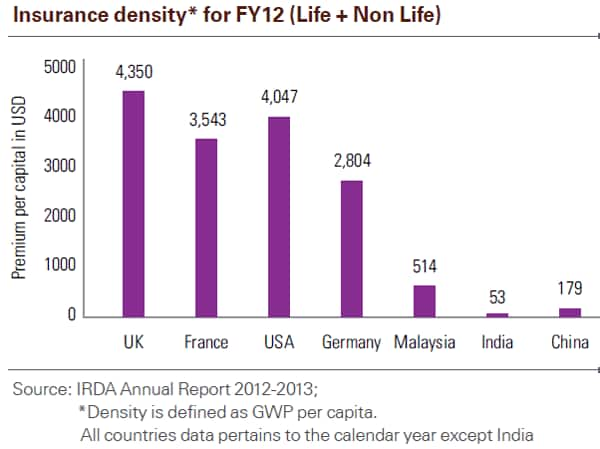

3. Similarly insurance density for India is among the lowest in the world. Currently, a vast population of India does not have any health insurance or any other medical cover even though the government has been discussing policies towards universal coverage.

[caption id=“attachment_1328811” align=“aligncenter” width=“600”]  Chart obtained from KPMG and Assocham report[/caption]

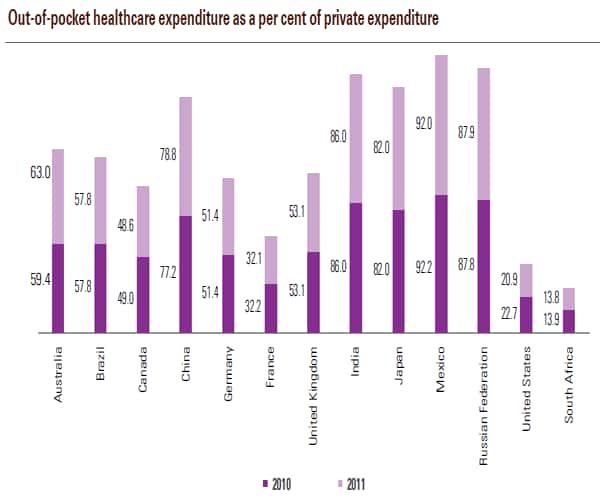

4. Out of pocket expenditure for India is the highest among developing countries:

Considering the fact that insurance penetration and density in India is extremely low at the moment, and government’s policies for healthcare expenditure is not sufficient, out-of-pocket healthcare expenses for individuals is the only way out.

In 2012, India was ranked third in the World Health Organization’s latest list of “countries with highest out-of-pocket expenditure on health” in the south-east Asian region. Evenamong developing countries, India has the highest out-of-pocket expenditure, next only to Mexico and Russia. As in July 2012, the healthcare inflation in India was 15 percent.

[caption id=“attachment_1328821” align=“aligncenter” width=“600”]  Chart obtained from KPMG-Assocham report[/caption]

Recently, the government approved a bill to increase the pension to Rs 500 a month to those over the age of 80. Considering the medical inflation, and out-of-pocket expenditure of individuals on healthcare, this amount may be meagre for individuals whose survival depends on it.

In order to facilitate a universal healthcare system, the KPMG report recommends looking at different segments such as the economically dependent and economically independent in rural and urban areas and also emphasises disease management for this segment by creating a special fund which will pay for the preventive care expenditure.

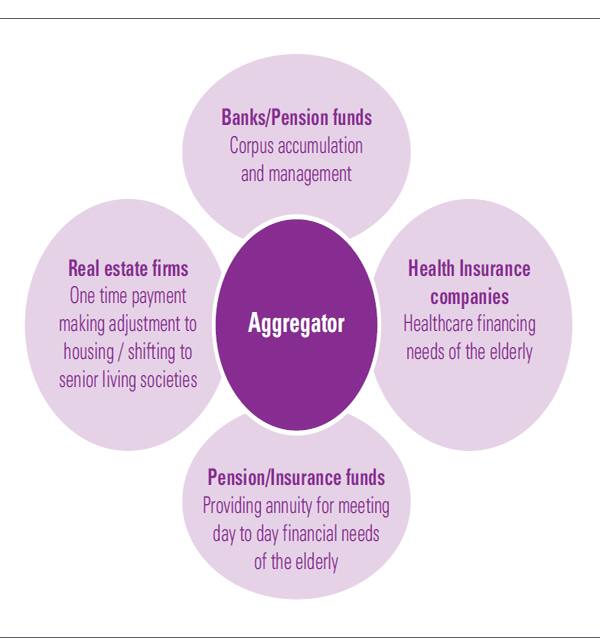

“There are multiple industries which are slowly bringing out products for elderly care such as annuity offerings from life insurance companies, specialised health insurance products, reverse mortgage from banks and specialised housing from real estate players. However, given the limited role being played by each player, there is a need for an aggregator to consolidate all these offerings and to provide a single window solution to the elderly,” the report said.

[caption id=“attachment_1328847” align=“aligncenter” width=“600”]  Source: KPMG in India analysis[/caption]

)

)

)

)

)

)

)

)

)