Data News - Page 7

Why Infosys needs to reward its shareholders

There are approximately 14 companies that are sitting on cash excess of more than Rs 2,000 crore, of which five companies are government owned.

LIC still wants a bigger slice of the pie

The PSU wants higher equity headroom to cash in on trading opportunities and book profits.

Nifty will target 5,250; Rupee may continue its rally

The Nifty needs to break past the 5,250-5,300 range to trigger a longer rally.

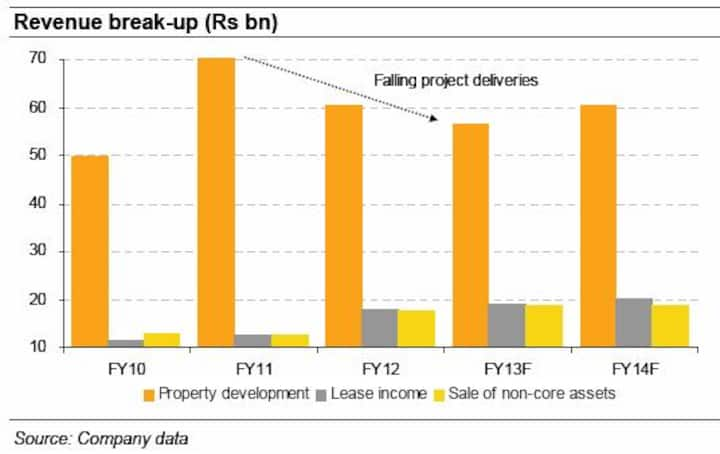

Luxury homes not the answer, DLF's outlook still grim

The company is expected to face serious construction delays which, in turn, will have a drastic impact on its ability to reduce its huge debt.

Nifty still on way down; US$ weak in short-term

As long as the Nifty trades below 5,020, there is no reason to even entertain thoughts of going long. <br /><br />

After spectacular results, is it time to upgrade SBI?

Investors might face some sleepless nights deciding what to do next, but Chaudhury, at least for now, certainly seems more confident about the future.

Don't give up on Tata Motors, Evoque is sure to drive volumes

Though a drop in sales this month was expected, Tata has maintained its guidance for 1,00,000-1,10,000 Evoque volumes for 2013 .

Penny Pop: These stocks zoomed more than 30% in 10 days

Penny stocks (stocks trading at below Rs 10 per share) are always alluring to investors as they offer an easy way to make money in what is usually a short time. Below's a list of penny stocks that generated more than 30 percent since 20 April.

Nifty, Bank Index will continue to be bearish for now

The Nifty has to move past the critical resistance at 5,500 to indicate a resumption of the uptrend.

USD-rupee bulls, watch out; the rupee could revive from 53

The recent weakness of the rupee suggests that it could test the Rs 54.29 low soon. But 53 is the level from where it could rally again

Monkey 1 climbs to the top while Monkey 2 cuts losses

Monkey 1's portfolio of stocks has outperformed both the indices and the broker portfolio at the end of 33 weeks.

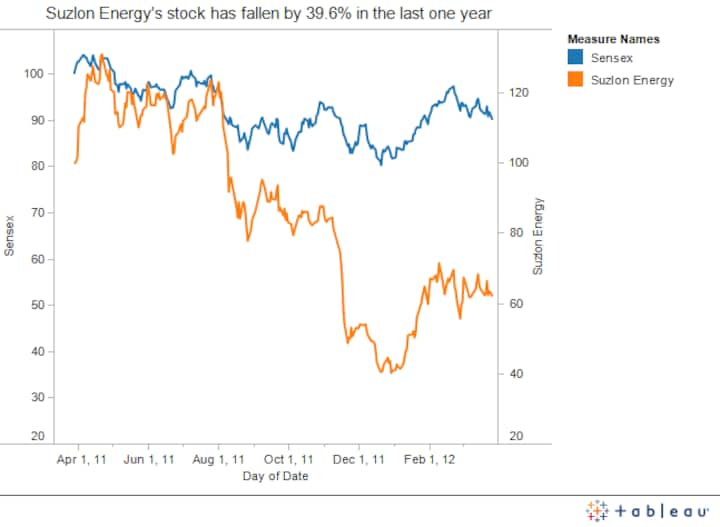

Suzlon inches closer to defaulting on FCCBs payments

The wind energy company has been facing a severe cash crunch brought on by a slump in the market and delayed payments from some big customers.

Nifty's correction is not over; but watch Bank Index closely

Unless the index moves above 5,500, it would be safe to work on the premise that the downward correction is still incomplete.

We need the money: Why govt wants to curb gold imports

The budget proposals to curb gold imports is aimed at correcting the BoP deficit.

These 5 mid-caps can give you 20% & more returns in a year

Brokerage Enam has issued a report on five mid-cap companies that investors can consider for their portfolio.

Who's the sucker now? LIC loses Rs 1,200 cr in ONGC fiasco

Given that ONGC's shares slipped 5 percent since the Union Budget was announced on 16 March, LIC's investment in the oil giant is now worth Rs 10,216 crore.

Nifty's correction is not yet done; rally to 5,700 postponed

The journey towards Nifty 5,700 is postponed and would resume once the short-term downtrend is over.

Nifty correction seems over; next target could be 5,700 level

Long-term investors may hold on to their equity exposures and have a stop-loss at 5,000. Grasim and PFC offer opportunities for short-term punts.

Is rupee's bravado over? Charts say Rs 53 to dollar possible

The dollar-rupee pair is establishing a new playing range between 48.65 and 53.75, which can prove to be fertile trading zone.

Chart: Will foreign investors continue to be bullish on India?

Experts believe results could inhibit the government from taking any bold reform measures and lower the prospects of the economy, which could dampen the appetite of foreign investors.

Market rally volatile but bulls remain undisturbed

The short-term bullish view would not be under threat until the index holds above 5,200. A breach of the major support at 5,000 would cast a shadow in the medium-term bullish view.

Stake sale buzz: Why Hexaware is on a roll today

Hexaware Technologies, a mid-sized IT company has gained almost nine percent in the last two days. Here's why

Broker Alert: With an 8% fall, it's time to dump ABB

Rising input costs, tight liquidity situation, forex volatility and low price realisation as witnessed in some sectors may continue to put pressure on the margins.

Time to raise equity allocation, but watch for Nifty 5,200

As predicted, the Nifty rally is facing a correction. But the rally is still on - and will not be threatened till the index breaks support at 5,200.

Poor Q3 results? With a rally going on, investors don't care

Companies like Tata Steel and Reliance that failed to meet expectations have performed well in the markets while those that met targets have been market laggards.

5 things investors need to know about BSE Greenex

Tata Steel has the biggest weight in the index at 6.7 percent, followed by State Bank of India (6.65 percent), and Larsen and Toubro (6.53 percent).

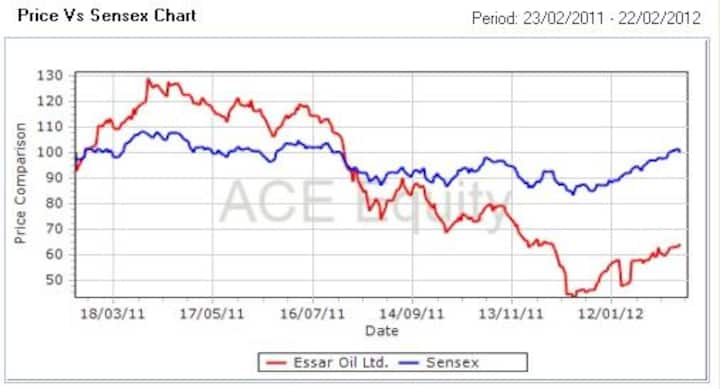

Sales tax dispute turns Essar Oil into 'high risk' bet for Citi

Essar Oil has been downgraded to neutral/high risk by Citi with a revised target price of Rs 69 per share against its earlier price of Rs 120 per share.

Broker power: Why you can still buy Suzlon

There has not only been a huge jump in its order book position, but Suzlon may also be able to repay its FCCBs, a concern that prompted many to downgrade the company.

Nifty is holding strong: Time to raise equity allocations

It's best not to worry about having missed the bus on the current stock rally. You can still enter after the next correction

Secret of the Sensex: Biggest FII turn-on since 2000

The main reason for the sharp 18 percent rise in indices is the Rs 22,000 crore FII money that has entered the country, the highest ever, since Sebi started disclosing the data in 2000.