Special to Firstpost

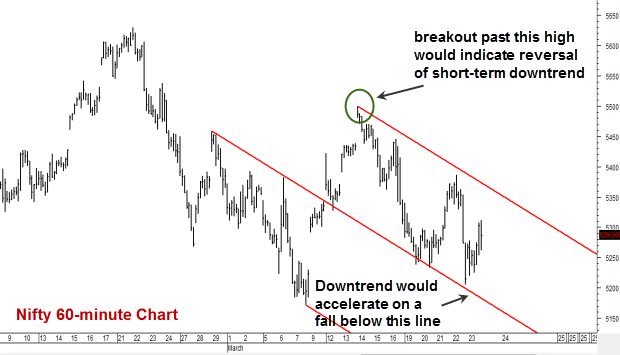

S&P CNX Nifty (5,278.20): The index did a whole lot of nothing during the week gone by. The sharp rally on Wednesday was eclipsed by a selloff on Thursday. The price action during the week has not warranted a change in the technical view featured last week.

Unless the index moves above 5,500, it would be safe to work on the premise that the downward correction is still incomplete. A fall below the 7 March low of 5,171 would lend momentum to the downtrend and also strengthen the case for a slide to the target of 5,050 mentioned last week.

While the continuation of the short-term downward correction is the favoured view, it however does not vitiate the medium-term uptrend. The index is likely to resume the uptrend once the ongoing correction is over.

CNX Bank Index (10,294.55): Similar to the Nifty, this index too was confined to a narrow trading range during the just concluded week. The index has to move past the immediate resistance at 10,950 and there would be a strong case for a test of the short-term support at 9900.

Considering that this index is likely to play a pivotal role in bolstering the next leg of the uptrend in the broad market indices, any price weakness may be used to enhance exposures in the banking sector.

Long-term investors may adopt a SIP-like approach to select banking stocks such as Union Bank of India, Axis Bank, Andhra Bank and Syndicate Bank. Take exposures via exchange traded funds. Sectoral mutual funds are a viable option as well.

Andhra Bank (Rs 126.40): After a sharp run-up, the stock has been consolidating in recent weeks. The price action last Friday indicates that the stock has resumed its prior uptrend. Long position may be considered with a stop-loss at Rs 113, for a target of Rs 150,

A breakout past Rs 150 could trigger a rally to the major resistance at Rs 165. Those willing to play the waiting game may accumulate the stock on dips, for an eventual target of Rs 165.

VIP Industries (Rs 102.80): The stock has been in a major downward correction since 21 September 2011. The price action since the 12 December 2011 low of Rs 73.40 indicates that the stock is in a short-term uptrend. A rally to the short-term resistance at Rs 130 appears likely.

The stock may be bought with a stop-loss at Rs 92, for a target of Rs 130. A breakout past the resistance at Rs 130 could push the stock to the major resistance at Rs 142.

(The views and recommendations featured in this column are based on a technical analysis of historical price action. There is a risk of loss in trading. The author may have positions and trading interest in the instruments featured in the column.)

)

)

)

)

)

)

)

)

)