Despite realty major DLF stressing on luxury home projects to ease its debt burden, the stock is trading near its 3-year low levels. In its latest report brokerage Kim Eng has rated the stock a ‘sell’ citing high debt levels and asset sales that fell below expectations. The brokerage has a target price of Rs 159 per share. The stock is trading at Rs 187 currently.

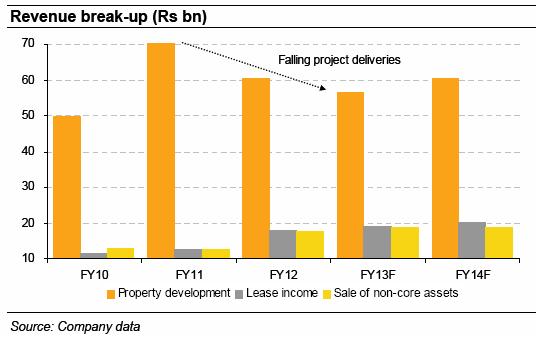

According to the report, the company is expected to face serious construction delays which, in turn, will have a drastic impact on its ability to reduce its huge debt. The company’s net debt has remained unchanged in spite of DLF selling 40 percent additional non-core assets last year. That situation has remained because cash flows from its project development business declined following a drop in project deliveries, the report said.

Another Mint report pointed out that despite DLF’s sheer market size higher volumes have not shored up revenue. " Volume dipped by 2.5% year-on-year (y-o-y), to Rs2,616.8 crore, because a significant portion came from low-value plotted sales. Commercial leasing activity, too, saw some cancellations," it said. Moreover, if the company fails to revive its core business cash flow its fiscal 2014 debt will increase further.

Yet, for the year ending March 2013, DLF is targeting sales of Rs 5,000 crore, a 200 percent jump from last year’s figures. However, according to Kim, given the current economic scenario, that will be extremely difficult to achieve. If it fails to achieve its sales target, there could be more construction delays, which, in turn, will prevent the company from reducing debt.

For the March-ended quarter, the real estate company reported a 39 percent fall in net profit to Rs 212 crore due to higher interest cost and slowing housing sales. Revenues were down by 2 percent at Rs 2,620 crore. It intends to preserve cash by going slow on capital expenditure and land acquisition. With an improvement in approvals, it intends to focus on fresh launches - especially high margin luxury projects.

While DLF is the largest developer in the country, its stock has fallen by 19.5 percent in the last one year.

)

)

)

)

)

)

)

)

)