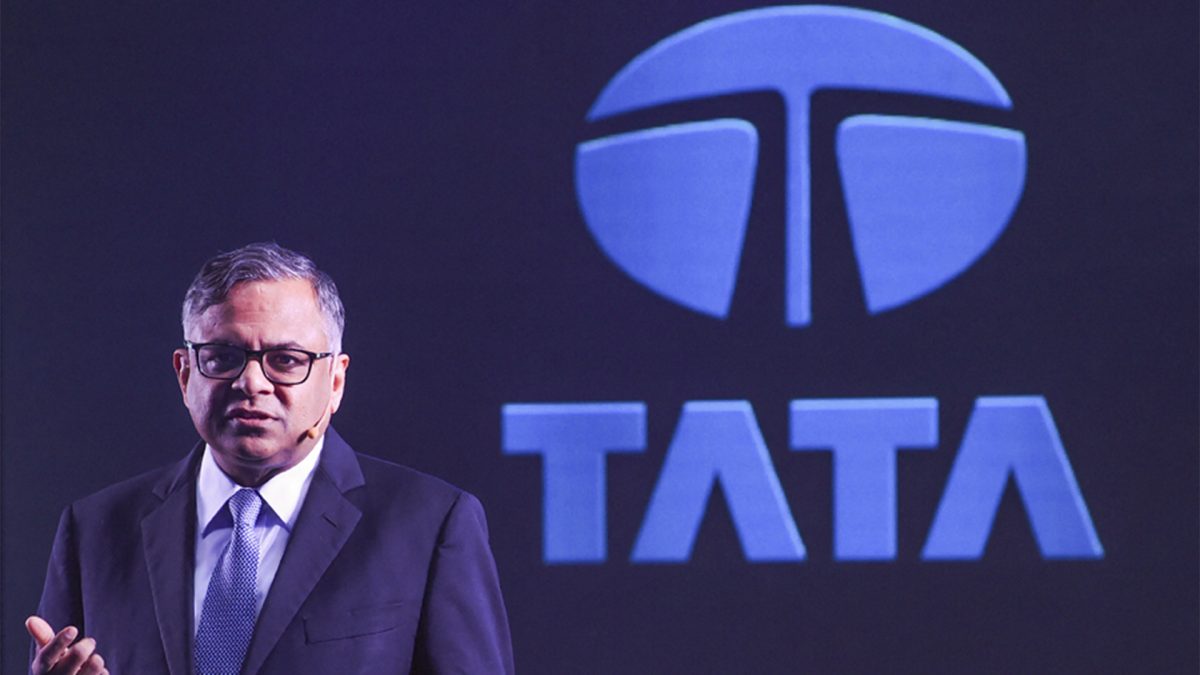

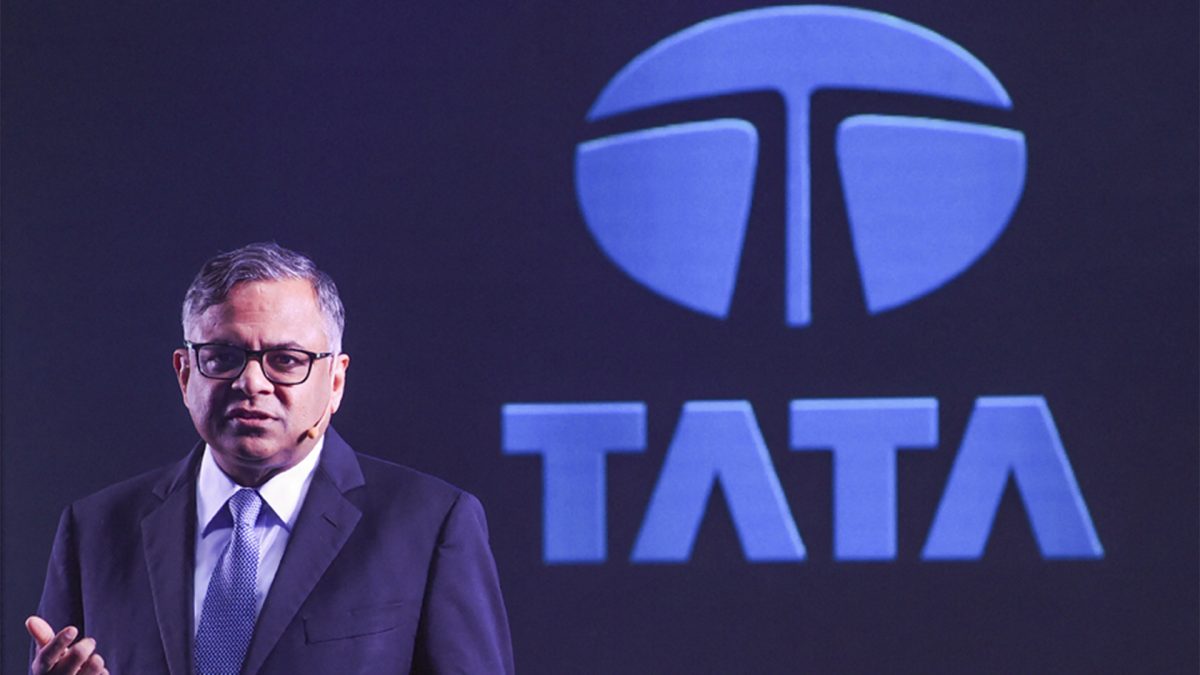

New Delhi: If the government were to indeed bar foreign airlines’ participation in the disinvestment process for Air India, then it can immediately rule out participation of its favourite bidder, the Tatas. Sources close to developments said on Monday that unless the Tatas are allowed to partner with Singapore Airlines in any prospective bid for the ailing Air India, they may choose not to put in a bid at all. Indeed, the much-hyped disinvestment process for the ailing Air India would receive a huge setback if the government bars foreign airlines from participating in the process.

When the government publicly expressed its intent to disinvest Air India for the first time earlier this year, it had approached the Tatas before anyone else to ascertain interest – since Air India was a Tata airline in its earlier avatar and JRD Tata had helmed it to remarkable for years before the government took over. So now, if it indeed rules out foreign airline investment in Air India, the Tatas may well say bye bye.

In the consolidated FDI circular published this afternoon, the Department of Industrial Policy and Promotion (DIPP) has said that foreign airlines are also allowed to invest in the capital of Indian companies, operating scheduled and non-scheduled air transport services, up to the limit of 49 percent of their paid-up capital, subject to some riders. But it has clarified that this part of the policy is not applicable to Air India. While this has been the government’s stated position all along – the FDI circular of 2016 uses the exact same words when dealing with FDI caps in the civil aviation sector – the continued emphasis on keeping Air India out of the purview of any investment by foreign airlines has surprised industry veterans.

They hope that the bar on foreign airlines investing in Air India is lifted, if and when the disinvestment process gets started. But as of now, the statement vis-à-vis Air India shows the government’s aversion to foreign airlines – it could also mean that the government may want to retain majority control even if after it puts the airline through the disinvestment process. Why else would Air India be treated any separately from other Indian airlines even after disinvestment, unless the government continues to exercise control over the airline?

So the two inferences – that foreign airlines cannot bid for Air India’s equity and the government may not relinquish majority control – from Monday’s policy circular show why the disinvestment process for AI has probably already lost steam.

Apart from IndiGo, no other domestic airline or investors has yet publicly expressed interest in the process. And even IndiGo, the largest domestic airline by passengers, has made it clear that its primary interest lies in Air India’s overseas assets. The private airline wants to launch low cost, international long haul operations using the Air India infrastructure.

The source close to developments quoted earlier said there seemed to be no more any urgency within the government to push Air India disinvestment, despite the emphasis the government had earlier laid on this reformist move. This person also indicated that the aversion to foreign airlines may stem from the PMO itself which is believed to have made it clear from day one that the disinvestment process won’t be open to foreign airlines and this condition was included in the Cabinet note on the subject. According to existing government regulations, domestic airlines can accept foreign direct investments of up to 49 percent from a foreign airline.

Besides the hurdle of foreign airline participation in Air India’s disinvestment, many other obstacles abound too. For one, the government may have to write off a significant portion of the airline’s debt pile, in a bid to make it attractive for prospective suitors. The total debt on the airline’s books is Rs 48,887 crore as on 31 March this year, which is bigger than India’s health budget this fiscal.

Should the government be writing off such a large amount, when this money and the separate equity infusion into this loss making airline could have instead been used for larger public good? Well, one view is that such a one-time write off will stave off future investments into the bleeding airline. Another, and a diametrically opposite point of view, is: why should the airline be privatised if the government has already decided to swallow the bitter pill and write off a significant portion of the debt? Shouldn’t induction of professionals on the airline’s board help turn it around, instead of the government ceding control through disinvestment?

Not just a large hair cut, the government may also have to hive off real estate and other land assets besides loss making subsidiaries into a separate entity - not every investor would be interested in these. Also, operations like the ground handling subsidiary may not be of interest to an airline bidder. These assets would have be set off against the aircraft-related debt to unlock value .

Anyway, fresh data presented in Parliament last month showed Air India’s annual debt servicing obligations alone come to about Rs 6,000 crore, which is 50 percent more than previously thought. This translates to about Rs 500 crore each month in interest payments or about Rs 16.5 crore each day of the year. IndiGo has already said it does not plan to take on the airline’s debt. One doubts if other serious bidders would, either.

Of the total debt, about Rs 32,000 crore is due to working capital requirements. This is specifically the portion aviation analysts have said needs to be written off before any serious buyers will come forward for the loss laden Air India. Remember, Air India had piled up losses totaling Rs 41,380.45 crore by March end last year, according to the government’s own figures. So should even the working capital part of the Air India debt pile should be written off? If the government does do this, wouldn’t this set a precedent for future disinvestment of loss making PSUs? Why should the tax payer first pump money into the loss making Air India and then also fund a one-time write off of debt which was anyway a consequence of poor management and piling losses of the national carrier?

It seems buyers – not many have evinced interest openly till now – may not find the airline particularly lucrative if the entire working capital portion or a significant part of it is waived off. The debt writeoff seems to be virtually a pre-condition to the sale of the airline. If disinvestment had to proceed in any meaningful manner, the government must take a significant haircut.

Air India comprises the main airline company and five subsidiaries. Along with debt write off, the government must also bundle the profit making subsidiaries to make the sale more attractive, seems to be the collective view.

)

)

)

)

)

)

)

)

)