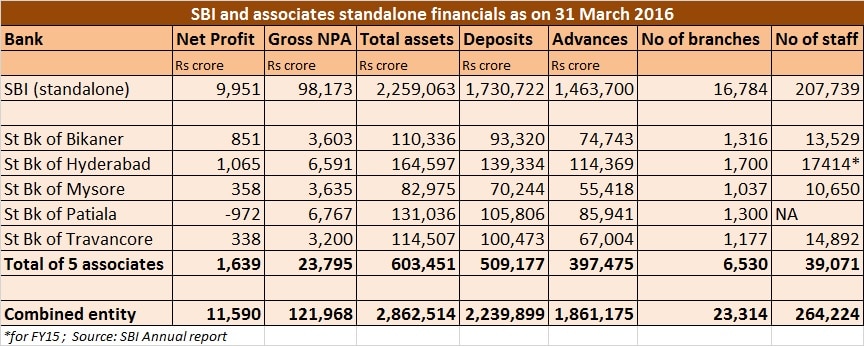

With the cabinet clearing a proposal to merge the five remaining subsidiaries of State Bank of India (SBI) with the parent, the stage is set for the birth of a banking behemoth that’ll possibly finding place amongst the top 50 banks in the world. The five associates are – State Bank of Travancore (SBT), State Bank of Bikaner and Jaipur (SBBJ ), State Bank of Mysore ( SBM ), State Bank of Patiala (SBP) and State Bank of Hyderabad (SBH). SBI merged two of its subsidiaries State Bank of Saurashtra and State Bank of Indore during Bhatt’s time, in 2008 and 2010, respectively. Once this merger happens, SBI’s asset size should go up to Rs 28.6 lakh crore as on March. It will then be seen in the club of banking giants from developed countries and take part in bigger deals flaunting its size. SBI gaining global size is a good thing for Indian banking sector in relation to the global industry. [caption id=“attachment_2558584” align=“alignleft” width=“380”]  Reuters[/caption] But, back home, this would also mean SBI will grow in size at least four times bigger than its nearest competitor—HDFC bank—which has assets of Rs 7.4 lakh crore as on March 2016. The third largest bank will be ICICI with asset size of Rs7.2 lakh crore. Beyond HDFC Bank and ICICI, most other lenders will look too tiny in comparison to State Bank. The combined entity will have over 23,000 branches and two and half lakh employees. The question here is this: Is SBI, often dubbed as the elephant among Indian banks, growing too big in relation to its competitors in the domestic market creating a monopolistic situation and a too-big-to-fail banking institution? Such a big difference in the asset sizes of the largest bank and other competitors have worried the banking regulator in the past. For instance way back in 2013, the then RBI governor, D Subbarao, had highlighted this issue. “Presently, (there is) significant skewness in the size of banks. The second largest bank in the system is almost one-third the size of the biggest bank. This creates a monopolistic situation,’ Subbarao said. The problem has grown even bigger since then. Instead of creating one big giant among several relatively tiny rivals, it is good if we have 3-4 large sized banks so that the spirit of competition will be sustained, experts have suggested in the past.  The concern of policymakers worldwide about ‘oversized’ financial institutions is justified since if something goes wrong with them, this can have serious ramifications on the whole financial system. This is something that prompted the US federal reserve to finalise a rule in November, 2014 that prohibited any financial company from acquiring another, if the resultant entity’s liabilities exceeded 10 percent of the total liabilities of the financial services system. The rule - Section 622 of the Dodd-Frank Wall Street Reform and Consumer Protection Act - says once a particular entity reaches the specified concentration limit, that bank cannot acquire control of another entity. Logically, the new rule intends to shield the US financial system from the foibles of ’too big to fail’ banks, which could then spark a crisis like the one in 2008 following the collapse of Lehman Brothers, which triggered a global financial meltdown. That meltdown showed that when banks become too big, they can bring down the whole financial system when they lend or invest imprudently. True, there is no comparison between US and Indian banking systems in terms of size. But, the concerns apply here as well. In July, 2014, the central bank released a framework to identify domestic systemically important banks (D-SIBs) and later classified both SBI and ICICI as systemically important banks. In SBI’s case, given the enormous size of the bank compared to its domestic peers, there is an obvious concentration risk that is building up. This is what the RBI has to monitor. If anything goes wrong with SBI, it would have repercussions not only for the bank, but the whole financial system. In a worst case scenario, if a major crisis grips the domestic banking system, a fiscally-constrained government may find it difficult to capitalize SBI. Considering its size and appetite, the elephant is not easy to feed. It is a matter of pride for India to have a global sized bank but it brings with itself ominous challenges. (Data support from Kishor Kadam)

If anything goes wrong with SBI, it would have repercussions not only for the bank, but the whole financial system.

Advertisement

End of Article

)

)

)

)

)

)

)

)

)