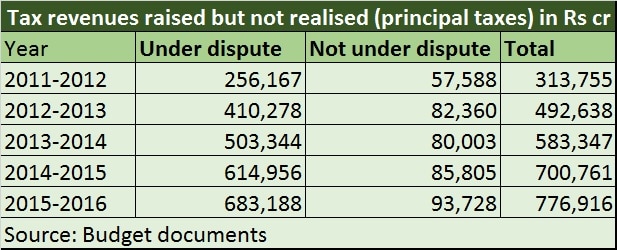

One of the less discussed figures in the Union Budget 2017 is the substantial increase in the tax revenues raised but not realised. Look at last four years, this figure has more than doubled, to be precise by about 147.6 percent. It stood at Rs 7,76,916 crore in 2015-16 compared with Rs 3,13,755 crore in 2011-12. If one compares the 2015-16 figure with that of 2014-15, the figure has increased by about 11 percent. Why is the number important? For any government that seeks to broaden the tax base and increase both direct and indirect tax revenues, finding a way to effectively address the dispute resolution mechanism and reduce the portion of unrealised revenues is critical to boost the revenue base. In India, these figures tell us that governments (both UPA and NDA) have largely failed to crack this puzzle. [caption id=“attachment_3272054” align=“alignleft” width=“380”]  Arun Jaitley presenting Union Budget 2017-18. PTI[/caption] Remember, these are tax collections government should rightfully get but not availed for various reasons — some are disputed, others are simply not paid even without any dispute. To be sure, it is not that the current and previous governments have not taken note of this widening gap. There have been efforts starting with the UPA time to address the disputes and increase tax realisation. But, the data shows that none of those measures have really worked well. If one looks closer, of the total chunk, the tax revenues under dispute has shown a dramatic rise of 167 percent over the 4-year period—from Rs 2.56 lakh crore to Rs 6.83 lakh crore. Of the disputed category, the two major components are corporate tax (Rs 2.92 lakh crore) and personal income tax (Rs 2.86 lakh crore). Even in the category of tax dues ‘not under dispute’ there has been a 63 percent increase over 4 years. Here too, corporate tax dominates the chart with Rs 52,005 crore pending followed by personal income tax, Rs 29,401 crore. If the government manages to realise at least a fraction of these pending dues, this can significantly boost the tax revenues. The 2017 budget, announced by Finance Minister Arun Jaitley, acknowledges the problem of major disparity between the number of taxpayers and those who actually pay the taxes to the state. But, the Budget doesn’t say much on how to deal with this issue.  “India’s tax to GDP ratio is very low, and the proportion of direct tax to indirect tax is not optimal from the view point of social justice. I place before you certain data to indicate that our direct tax collection is not commensurate with the income and consumption pattern of Indian economy,” Jaitley said. Further elaborating this, the FM said as against estimated 4.2 crore persons engaged in organised sector employment, the number of individuals filing return for salary income are only 1.74 crore. As against 5.6 crore informal sector individual enterprises and firms doing small business in India, the number of returns filed by this category are only 1.81 crore. Out of the 13.94 lakh companies registered in India upto 31st March, 2014, 5.97 lakh companies have filed their returns for Assessment Year 2016-17. Going by the Budget, of the 5.97 lakh companies which have filed their returns for assessment year 2016-17 so far, as many as 2.76 lakh companies have shown losses or zero income. 2.85 lakh companies have shown profit before tax of less than Rs 1 crore. 28,667 companies have shown profit between Rs 1 crore to Rs 10 crore, and only 7,781 companies have profit before tax of more than Rs 10 crore. Jaitley argued that situation is not different even for the individual taxpayers. “Among the 3.7 crore individuals who filed the tax returns in 2015-16, 99 lakh show income below the exemption limit of Rs 2.5 lakh p.a., 1.95 crore show income between Rs 2.5 to Rs 5 lakh, 52 lakh show income between Rs 5 to Rs 10 lakhs and only 24 lakh people show income above Rs 10 lakhs, the FM said in the Budget speech. “Of the 76 lakh individual assessees who declare income above Rs 5 lakh, 56 lakh are in the salaried class. The number of people showing income more than Rs 50 lakh in the entire country is only 1.72 lakh. We can contrast this with the fact that in the last five years, more than 1.25 crore cars have been sold, and number of Indian citizens who flew abroad, either for business or tourism, is 2 crore in the year 2015. From all these figures we can conclude that we are largely a tax non-compliant society.” Unleashing the taxmen on corporate and individual taxpayers to harass them and force them pay may not be a successful option, economists have argued, saying this will only encourage further tax evasion. The unrealised tax figures quoted in the table offers evidence. Instead, the government would do well to improve the dispute resolution and incentivise tax payments. The 2017 budget failed to offer any major relief to both individual and corporate tax payers, belying expectations. The reduction in corporate tax rates to 25 percent for those firms with turnover of less than Rs 50 crore wouldn’t help bigger firms—few in number but huge in terms of revenue size. Similarly, one could argue that there wasn’t much for individual taxpayers in the higher income bracket in the Budget. The widening gap in the unrealised tax revenue numbers should be wake-up call to the government to urgently bring about mechanisms to engage with the taxpayer, resolve the disputes and encourage them pay their dues to the state. Harassing the taxpayer, surely, isn’t the way. What is needed is constructive, friendly engagement by offering tax incentives and making the laws simpler and easy for all to comply.

The widening gap in the unrealised tax revenue numbers should be a wake-up call for the government to urgently bring about mechanisms to engage with the taxpayer, resolve the disputes and encourage them pay their dues to the state

Advertisement

End of Article

)

)

)

)

)

)

)

)

)