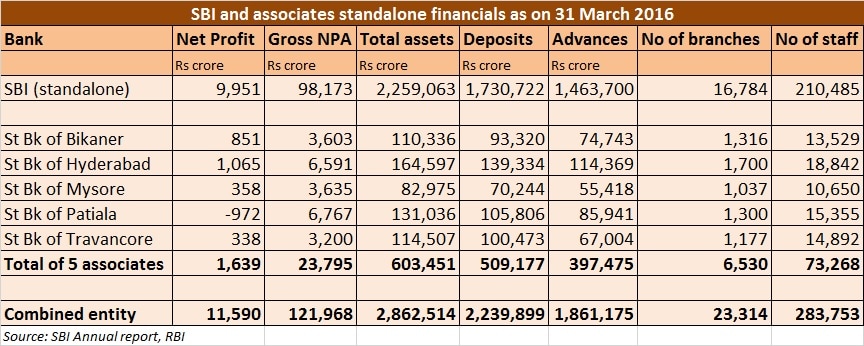

State Bank of India’s (SBI) merger integration with associates is progressing well and all SBI rules, including the Rs 5,000 minimum balance requirement, will be applicable to customers of erstwhile associate banks as well, SBI chairman Arundhati Bhattacharya said in an exclusive interaction with Firstpost on Monday. Bhattacharya, however, said SBI’s minimum balance rule isn’t being understood properly. “No change in rules (on minimum balance). Also it is minimum average balance. Plus, Rs 5,000 is only for 6 metros. It is Rs 3,000 for urban, Rs 2,000 for semi-urban and Rs 1,000 for rural. I think these nuances not being appreciated, neither is media highlighting. If it is average balance, you can have Rs 15,000 for one day and then zero balance for next two days. You won’t be charged,” Bhattacharya said. SBI’s decision to impose Rs 5,000 minimum balance rule had invited criticism from certain quarters. Bhattacharaya said the bank has been seeking the merger with its associate banks “for some time” and there was no political push behind the deal. “There is no (political) push from anywhere. SBI has been seeking it for some time,” Bhattacharya told Firstpost. “It was one of the first suggestions I made on taking office. So, also some of my predecessors (sic),” Bhattacharya said. [caption id=“attachment_2656422” align=“alignleft” width=“380”]  SBI chairman Arundhati Bhattacharya. Reuters[/caption] SBI’s merger with five associate banks–State Bank of Bikaner and Jaipur (SBBJ), State Bank of Mysore (SBM), State Bank of Travancore (SBT), State Bank of Patiala (SBP), and State Bank of Hyderabad (SBH) – came into effect on Saturday. Apart from these, the Bharatiya Mahila Bank, a brainchild of former union finance minister P Chidambaram unfer UPA, too was merged with SBI. Earlier, the bank had merged two of its other associates – State Bank of Saurashtra and State Bank of Indore — in 2008 and 2010, respectively. Trade unions have been vehemently opposing the merger saying this was a political decision by the government and wouldn’t help the bank or employees. Also, the associate banks are doing well on their own and should be allowed to operate independently, said C H Venkatachalam, general secretary of All India Bank Employees Association. “This was a political decision. The political leadership thinks this would create a global bank but actually they are creating a bigger risk,” said Venkatachalam. Post merger, SBI’s asset size should go up to Rs 28.6 lakh crore as on March. SBI will grow in size and will be at least four times bigger than its nearest competitor — HDFC bank – which has assets of Rs 7.4 lakh crore as on March 2016. The third largest bank will be ICICI Bank with asset size of Rs 7.2 lakh crore. Beyond HDFC Bank and ICICI, most other lenders will look too tiny in comparison to State Bank. The combined entity will have over 23,000 branches and two and half lakh employees. It will then be seen in the club of banking giants from developed countries and take part in bigger deals flaunting its size.  SBI gaining global size is a good thing for Indian banking sector in relation to the global industry. But as the trade unions caution, does the decision creates a bigger risk? Because of the huge difference in the asset size and reach of SBI and its nearest competitors, there will be obvious concerns of monopoly by the government-controlled bank. The concerns will be even more given that the government is the promoter of the bank and hence can interfere in SBI’s operations to pursue its populist agenda or to direct lending to specific sectors. In fact, the creation of a monopoly in banking sector is something RBI has warned about in the past. For instance way back in 2013, the then RBI governor, D Subbarao, had highlighted this issue. “Presently, (there is) significant skewness in the size of banks. The second largest bank in the system is almost one-third the size of the biggest bank. This creates a monopolistic situation,’ Subbarao then said. Besides the issue of monopoly, a bigger SBI also mean bigger capital requirement for the bank, the burden of which will ultimately fall on the government exchequer. In the event of a crisis, can a fiscally constrained government manage the capital risks of a giant SBI? On the other hand, SBI-associate merger will indeed give its muscle mass to wrestle with international banks to compete in global business. There were senior bankers who have aggressively supported consolidation, including in SBI group, citing this idea. One of them is K V Kamath, veteran banker and President of New Development Bank. Terming SBI-associate merger as a good step, Kamath said “If you look at the size of our economy, we need a few more large banks. So clearly there is space for consolidation in the public sector and possibly in the private sector also because you need much larger banks to cater to this economy”. Not just Kamath, Uday Kotak, Vice chairman of Kotak Mahindra Bank, too have batted for consolidation in the banking sector. “Globally, in most countries, there are only three to five large banks which dominate. This is how the future will be in our country as well,” Kotak told PTI in a recent interview. SBI-associate consolidation was relatively an easier move to experiment given that there is already synergy between these bank in terms of technology and work culture. But, things may not be this smooth as far as other banks are concerned in the banking sector, particularly in the private sector. The history of most bank mergers in the private sector shows that this was either due to financial distress of the target bank or regulatory compulsions. Interestingly, while on one side consolidation talk is on, Indian banking sector has also witnessed the creation of several small banks (in the form of small finance banks, payment banks and two new commercial banks) in the recent years. The drive to issue new bank licenses was kick started after an announcement by the then union finance minister, Pranab Mukherjee, in the union budget in Feberuary, 2010. Whether the SBI-associate merger will create a more efficient, globally competitive bank for India or will it create a bigger risk for country’s banking sector is something only time will tell.

SBI gaining global size is a good thing for Indian banking sector in relation to the global industry. But as the trade unions caution, does the decision creates a bigger risk?

Advertisement

End of Article

)

)

)

)

)

)

)

)

)