What will be there for the salaried class in Finance Minister Arun Jaitley’s Budget? Will he bring in acche din for them in the form of changes in the I-T slabs and standard deduction? While expectations in the tax payers remains high, the recommendations of the Institute of Chartered Accountants of India (ICAI) to the Finance ministry mention exactly what they would like to hear.

In its pre-Budget recommendations to the, ICAI has suggested that income up to Rs 3 lakh should be made tax-free. “Keeping in view the inflationary trends in the economy and the imperative to leave more disposable income in the hands of individual taxpayers, especially in the lower income bracket, it’s recommended that full exemption from tax (nil rate) should be raised to Rs 3 lakh from Rs 2.5 lakh,” the ICAI has stated. The premier accounting body has also suggested that for income of Rs 3 to 10 lakh, it should be 10 percent. (Refer below mentioned table)

Changes in Income Tax slabs recommended:

| Tax Rate | Proposed Slab(Lakhs) | Present Slab(Lakhs) |

|---|---|---|

| Nil | 0-3 | 0-2.5 |

| 10% | 3-10 | 2.5 to 5 |

| 20% | 10-20 | 5-10 |

| 30% | Beyond 20 | Beyond 10 |

The salaried class:

The salaried class, which forms a major chunk of taxpayers, can expect achche din, if the government restores the provision of standard deduction, which was given to employees to compensate for the expenses incurred by them for which no separate deduction is allowable under the I-T Act.

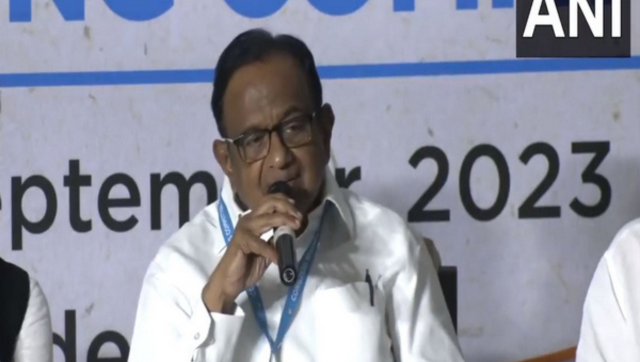

“Former FM P Chidambaram discontinued this standard deduction with effect from April 1, 2006. It’ll be good news for salaried class, if restored in Budget 2015-16,” said Chartered Accountant Abhishek Aneja.

Earlier, 40 percent of salary or Rs 30,000 whichever is lower was allowed as a deduction to taxpayers having salary income up to Rs 5 lakh and Rs 20,000 was allowed as deduction to persons having salary above Rs 5 lakh.

One tax change that can give major relief to the salaried class is taking out the deduction of repayment of principal amount of housing loan from the existing limit of Rs 1.5 lakh available under section 80C and providing a separate deduction for the same, since the present limit gets majorly utilised on account of LIC, PF contributions leaving little or no benefit to the tax payers on account of repayment of housing loans.

“This has been a major demand from the salaried class. Such a move will also bring relief to housing finance and real estate industry and will create demand for fresh loans,” Aneja pointed out.

Investment Limit:

In order to meet the investment targets, the FM may reintroduce the deduction available for investment in infrastructure bonds or certain specific investment products/ mutual funds focused on infrastructure sector. Last year’s budget increased the deduction in specified investments under Section 80C of the I-T Act, which included investments in Provident Fund, Public Provident Fund, National Savings Certificates, etc. The limit was increased from Rs 1 lakh per annum to Rs 1.50 lakh per annum, which may further be enhanced to a slab of Rs 1.5 lakh to Rs 2 lakh per annum.

Filing norms for better tax compliance:

The ICAI has recommended online filing of Form 60, 61, 15G and 15H. While, Form 15G/H is a form of declaration that is generally submitted by the taxpayers to banks so that there is no deduction of tax on interest paid by the bank, whereas, Form 60/61 is submitted by persons who do not have PAN and they enter into specific transactions/ purchase specified good where quoting of PAN has been made compulsory.

“This will improve better tax compliance and will help the department in identifying multiple forms submitted by a person and tracking tax evasion,” ICAI said. The body has strongly suggested for a single Income Tax Return (ITR) form to replace multiple ITR forms for simplification, besides verifications of all ITRs by chartered accountants.

On Black Money:

Getting back the black money to India had been one of the biggest poll plank of the BJP during the General Election 2014. The NDA government faced enough criticism, when it said that names of all accountholders in black money case could not be revealed. Keeping this issue in mind, the FM may announce some measures to monitor unaccounted assets and curb black money generation.

The Institute of Cost Accountants of India has recommended voluntary investment in declared bonds (issued by the government) with a minimum lock-in period of 10 years and promote savings and investments in specified government securities.

“These measures would help in getting funds which the government can utilize for infrastructure development. The government can impose one-time tax of 30 percent at the time of redemption,” said Dr A S Durga Prasad, president, Institute of Cost Accountants of India.

“We’re expecting that the FM through direct and indirect tax measures, and faster tax refund processing would facilitate capital formation and sustainable economic growth in social sectors as well as investment promotion,” added Dr Prasad.

)

)

)

)

)