By Ranjeet S Mudholkar

Achieving one’s life goals does not happen in one go. That happens over a period of time, spread across different stages. While many people may be aware of the significance of planning their finances, they lack a systematic approach. Goal-based approach is missing in the Indian context.

As per a survey by the National Council for Applied Economic Research (NCAER) and Max New York Life Insurance in 2008 65 percent of all the assets are kept in form of deposits with banks and 23 percent remaining in real assets in India, the focus on goal-based planning is missing. As per a survey by Credit Suisse in 2011, Indians save 16-17 percent of their incomes and items such as mobile phones are also finding place in monthly budget and there is no focus on goals.

The data above calls for a systematic approach towards the achievement of life goals and life stage-based financial planning could be an approach that may be more effective in the scenario.

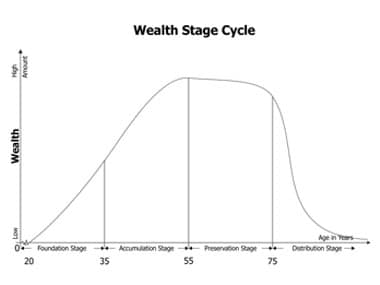

Life stage-based financial planning lends more focus to achievement of goals in a cohesive manner without distorting one’s basic asset allocation across life stages. Broadly, stages can be classified as foundation, accumulation, preservation and distribution.

Under the foundation stage, which is during the early job between 22 and 30 years of age, the most important concern is a sound career and augmentation of income. Individuals should focus on effectively managing cash flows, making judicious use of debt while repaying their educational loan, if any. Normally, 50 percent of net income in this stage should be saved out of which, after creating a buffer equivalent of 3-6 months’ expenses, the rest should be invested in long-term equity assets.

In the accumulation stage, between 30 and 45 years, with the stability of career in place, an individual has additional family responsibilities. A person in this stage should ideally be setting aside one-third of income on household expenses, including contingency fund, another one-third on loan servicing, while the balance to investment vehicles in accordance with short-term and long-term goals including retirement. An emergency fund of 6-8 months of monthly expenses should be in place to take care of temporary exigencies.

In the preservation stage, between 45 and 60 years, as individuals are nearing their retirement age, the most important concern is the preservation of wealth. A few other life goals such as higher education of children and their marriage may force overall asset allocation to tilt more towards liquid assets. The focused attention on accumulating retirement corpus in this stage should dictate risk appetite. The focus should also be on repaying loans as a person approaches retirement. A few years before retirement, the funds should be systematically shifted from risky assets to safe assets in a graded manner.

In the distribution stage, 60 years and beyond, the most important concern is to make the wealth created to marginally outlive. The major part of the corpus, say 85 percent should be invested judiciously in investment instruments to yield an inflation-adjusted annuity. The 10 percent of the corpus may act as emergency fund while 5 percent may remain in equity to benefit from market dynamics. The other concern in this stage is the efficient distribution of the wealth created over the lifetime.

In all the stages as mentioned above maximum benefits provided under Indian Income Tax Act, 1961 like the ones under sections 80C and Section 24 should be availed of to ensure tax efficiency at all times (See table here )

It may be kept in mind that these life stages can only be broadly classified, the emphasis on each life stage may differ from individual to individual. Moreover, with social emancipation and increasing acceptance of new age concepts such as ‘single parenting’ and ’live-in relationships’, the traditional life stages require an altogether distinctive approach from the perspective of investment planning, tax planning, etc. For a holistic advice, however, individuals should better consult a certified financial planner practitioner.

Ranjeet S Mudholkar, is Vice Chairman and Chief Executive Officer, Financial Planning Standards Board India (FPSB India). The views expressed here are personal, and do not necessarily represent that of the organization.

)

)

)

)

)