Despite a global slowdown, the rich are getting a lot richer, not just globally but also in India, as the rapid growth in Asia’s emerging markets propels private wealth to record levels, according to a new report by Boston Consulting Group.

India, though it figures at No 15 in terms of millionaires, is still reckoned to have as many as 1,64,000 of them.

Which should be news to Finance Minister P Chidambaram, who said in his last budget that only 42,800 persons in the country admitted to taxable incomes exceeding Rs 1 crore - which is less than one-fifth of what an Indian dollar millionaire would possess (Rs 5.6 crore) by way of wealth at current exchange rates of Rs 56 to the dollar.

The FM clearly has a lot of potential taxpayers to chase, as the BCG report says the total wealth of Indian households has increased from $1.1 trillion in 2007 to $2 trillion in 2012 and is expected to grow to $4.5 trillion in 2017.

“India offers very good long term opportunity to both domestic and global players, given the growth potential, high rate of household savings, and concerted efforts encouraging higher financial savings. However, currently Indian wealth managers face challenges of scale, competitive pricing, business models and ability to attract new customers,” said Ashish Garg, Partner and Director at BCG.

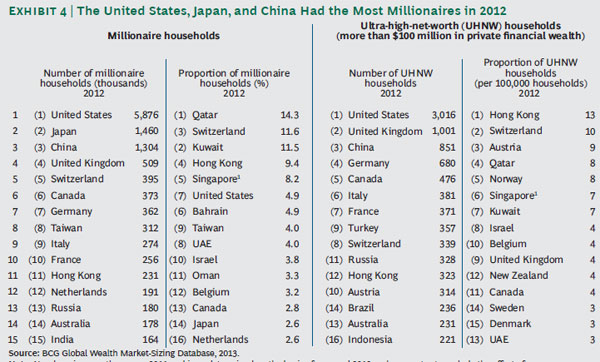

The BCG report said that private wealth grew globally by 7.8 percent in 2012 with the number of millionaires growing to 13.8 million.

The report titled, “Maintaining Momentum in a Complex World: Global Wealth 2013,” shows that the jump in global household wealth to $135.5 trillion is a big jump from 2011, when it rose just 3.6 percent in the aftermath of the financial crisis.

Reading in between the lines, the rise in private wealth suggests the global economy is finally shrugging off the effects of the financial crisis.

A strong rebound in equity markets globally has contributed to the rise in private wealth and increased the rate of savings, the report said.

The Standard and Poor’s 500 Index gained 13 percent last year, helping North America remain the wealthiest region. Strong stock returns, thanks to “supportive monetary policies by central banks”, allowed existing assets to contribute far more than usual to overall growth in markets. The amount of private wealth in equities grew 12.6 percent globally to $45.9 trillion, compared with 3.5 percent growth in bonds and 5.7 percent growth in cash and deposits, the report said.

Put another way, the big gains in wealth came courtesy Ben Bernanke, who has barely paused in his programme to print dollars since 2008 in order to avoid a depressino.

The global liquidity and the increase in savings rate have also benefited emerging markets, with India set to more than double private wealth by 2017.

Meanwhile, Hong Kong has the greatest concentration of billionaires followed by Switzerland, the survey of 140 financial firms showed.

The report has identified several trends in the market landscape with the most prominent being a shift in wealth creation and profit pools towards developing economies. The greatest growth in private wealth has been in the Asia-Pacific region ( excluding Japan) where private wealth grew 13 percent in 2012 to $28 trillion, a 17 percent jump on 2011. The figure is projected to nearly double to $48.1 trillion over the next five years.

In developing economies of BCG’s new world, this newly created wealth accounted for 55.6 percent of the total wealth growth. At $2.5 trillion, the newly created wealth in these economies was also greater in nominal terms than the $1.4 trillion of newly created wealth in the “old world” ( mature economies). “Strong GDP growth in India and China was the principal driver of this expansion, aided by high savings,” the report said.

The report also predicts that China will leapfrog Japan to become the world’s second-wealthiest nation by 2017 and is projected to have more millionaire households than its Asian neighbour by the end of December.

The report also pointed out that despite the growth in private wealth, it has not translated into a proportional growth for wealth managers due to regulatory requirements and clients often choosing products than generate less profit.

“Regardless of their home market or principal region of activity, wealth managers globally still have much in common,” said Daniel Kessler, a coauthor of the report and the global leader of the wealth management topic for BCG.

“All must find ways to gather new assets, generate new revenues, manage costs, maximise IT capability, comply with regulators, and find winning investment solutions that lead to deep and long-standing client relationships. The battle to maintain the momentum they have achieved, amid a very complex industry landscape, will continue to intensify.”

)

)

)

)

)

)

)

)

)