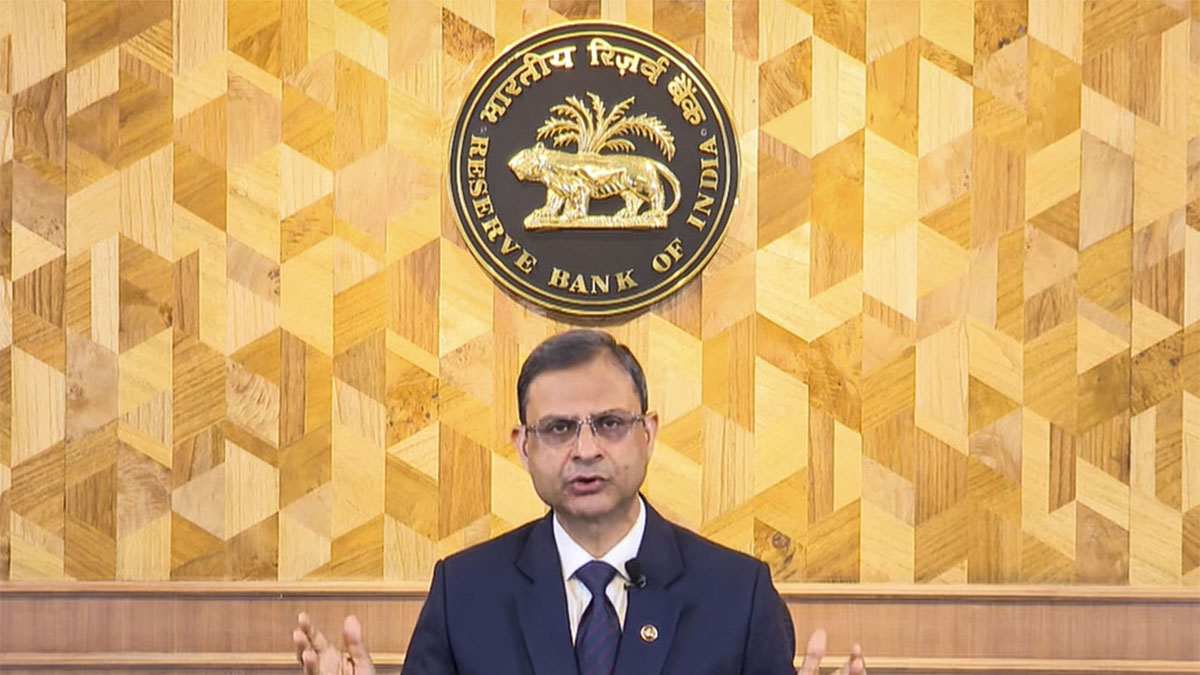

RBI Governor Sanjay Malhotra has announced that the Monetary Policy Committee (MPC) has decided to reduce the repo rate by 50 basis points to 5.5 per cent with immediate effect. This is the third consecutive time that the MPC has cut the repo rate.

“The Monetary Policy Committee met on June 4, 5, 6 to deliberate and decide on the policy repo rate and also the detailed assessment of the evolving macro-economic and financial developments and the economic outlook ahead. The MPC has decided to reduce the policy repo rate by 50 basis points to 5.5 per cent with immediate effect,” said Malhotra.

The repo rate is the interest rate at which the Reserve Bank of India (RBI) lends money to commercial banks. It affects the overall cost of borrowing for consumers and affects the supply of money in the economy.

The repo rate has been presently cut to support growth as inflation has continued to remain below the MPC’s 2-6 per cent target range. In April, the inflation, as measured by the consumer price index (CPI), fell to 3.2 per cent, the lowest since July 2019.

However, Malhotra has indicated that this might be the final repo rate cut for some time.

“After having reduced the policy repo rate by 100 basis points in quick successions since February 2025, the Monetary Policy Committee also felt that under the present circumstances, Monetary Policy is now left with very limited space to support growth, hence, the MPC also decided to change the stance from accommodative to neutral. From here onwards, the MPC will be carefully assessing the incoming data and evolving outlook to chart out the future course of Monetary Policy in order to strike right growth, inflation balance,” said Malhotra.

Impact Shorts

View AllRepo rate is a key tool with the RBI to manage inflation. This is how it is expected to work: When the inflation is high, the RBI increases the rate and, as banks pass on the increased costs to consumers, borrowing becomes expensive and demand falls and low demand eases inflationary pressures in the economy and when the inflation is low, the RBI lowers the rate and, as borrowing gets cheaper for consumers, demand rises and economic activity sees growth.

There are six persons in the MBC, comprising the RBI Governor, the Deputy Governor in charge of the monetary policy, and a nominee of the RBI Central Board. The three members are nominated by the Union government.

As for the economy, Malhotra said that the RBI has retained GDP growth forecast for current fiscal year at 6.5 per cent, but added that geopolitical tensions and weather vagaries pose headwinds.

Malhotra further said that the Indian economy has been progressing well broadly on expected lines despite global uncertainties.

)

)

)

)

)

)

)

)

)