US President Donald Trump’s tariffs have roiled world markets. However, the data shows that investor confidence in India remains at a record high.

Trump has announced a 50 per cent tariff on India for its continued trade relationship with Russia in the backdrop of the two countries negotiating a free trade agreement (FTA).

New Delhi has hit back at Washington, accusing it and the West of hypocrisy for their dealings with Moscow and said that it will not compromise on the national interest.

But what do we know? What does the data show?

Let’s take a closer look

Markets rebound, SIPs on rise

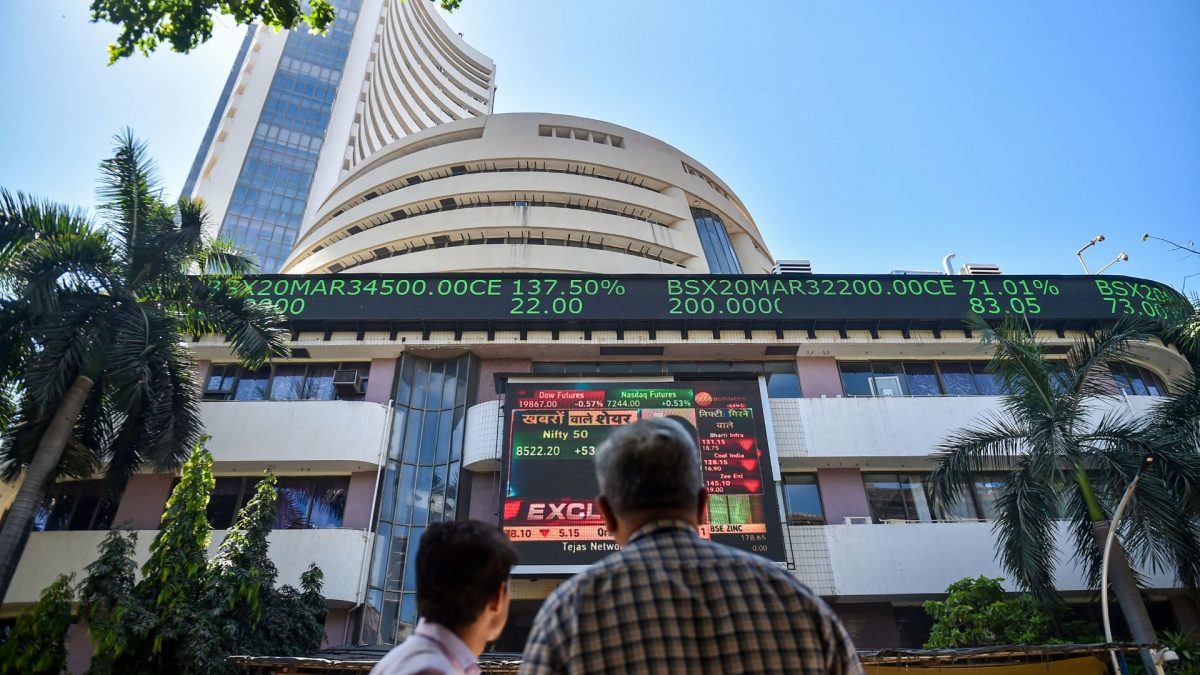

The Indian stock markets have rebounded from Trump’s tariff announcement last week, which left many stunned and shaken.

India’s key equity indices on Monday rallied around 1 per cent. The BSE Sensex gained 746 points to close above the 80,000 mark with buying in oil, auto and banking shares amid fresh foreign fund inflows. Meanwhile, the 50-share NSE Nifty jumped by 221.75 points or 0.91 per cent to 24,585.05 .

The Sensex had dropped 765.47 points or 0.95 per cent to settle at 79,857.79 on Friday and the NSE Nifty had dropped 232.85 points or 0.95 per cent to 24,363.30. This came after Trump’s tariffs, which took effect on Thursday, shook markets. The FIIs also witnessed an exodus to the tune of Rs 4,997.19 crore on Thursday.

Small investors don’t seem perturbed by the Trump tariffs. Systematic Investment Plan (SIP) contributions touched a record high of Rs 28,464 crore in July – up four per cent from Rs 27,268.79 crore in June.

This, according to data from the Association of Mutual Funds in India (Amfi) on Monday. The number of new SIPs also reached 6.86 million in July. That number was at 6.19 million in June and 5.91 million May.

The number of contributing SIP accounts increased from 86.4 million in June 2025 to 91.1 million in July 2025.

SIPs allow citizens to put fixed amounts of money in mutual funds at certain intervals. This encouraged investors to observe fiscal discipline as well as them gives them the long-term advantages of rupee-cost averaging (DCA). It also allows investors to build wealth over a longer period of time. They also tend to be popular with lay investors rather than the more informed lot.

Meanwhile, monthly equity flows scaled the Rs 42,000 crore mark in July while the industry assets under management (AUM) crossed Rs 75 lakh crore in the same month, data from Amfi showed.

Amfi chief Venkat N Chalasani said the development was a reflection of sustained investor confidence and disciplined participation.

“The total Assets under Management grew by 1.3 per cent to Rs 75.36 Lakh Crores, despite pressures from a strong US dollar and persistent foreign fund outflows. This is a testament to sustained investor confidence and disciplined participation,” Chalasani said.

“Equity mutual funds recorded their highest-ever monthly inflow of Rs 42,702 crore, with DIIs maintaining strong support. SIP contributions hit a new record of Rs 28,464 crore, and contributing accounts grew 5.4 per cent to 9.11 crore — clear evidence of disciplined investing even amid volatility”.

What do experts say?

Experts say SIPs could go past the Rs 30,000 crore mark soon.

“SIP numbers…could reach the ₹30,000-crore monthly milestone soon. This reflects growing investor maturity, rising financial awareness, greater digital access, and sustained market confidence. The resilience of the Indian markets, despite global uncertainties, is remarkable. Using corrections as opportunities is wise, but in the long run, systematic investing remains the most powerful approach,” Suranjana Borthakhur, head of distribution & strategic alliances, Mirae Asset Investment Managers (India), told Fortune India.

They say SIPs are a key factor in stabilising the market.

“The steady growth in SIP inflows brings significant reassurance, as it helps reduce market volatility. We also view rising SIP investments as an early indicator of job creation and economic strength. The record-high monthly SIP inflow of ₹28,464 crore reflects a positive outlook for India’s economy,” said Jyoti Prakash, managing partner–equity and PMS, AlphaaMoney, added.

Aditya Birla CEO A Balasubramanian said the record inflow into equities and all-time high SIP contribution show the deep commitment and trust shown by the investors in mutual funds.

India’s future is bright

Surveys abroad show that the future looks even brighter for India. A recent survey by Bank of America shows that US fund managers are growing more bullish on emerging markets (EM).

Over a third of fund managers, 37 per cent, say they are now overweight on EM stocks. That’s the highest number since February 2023. This shift is driven by concerns over elevated US stock valuations and optimism about China’s economic rebound.

Nearly half of investors, 49 per cent, say that EM equities are increasingly thought of as undervalued or cheap – the highest number in a year. Meanwhile, a massive 91 per cent of respondents think US equities are overvalued – mainly big tech firms, which they think have become the “most crowded trade”.

With inputs from agencies

)

)

)

)

)

)

)

)

)