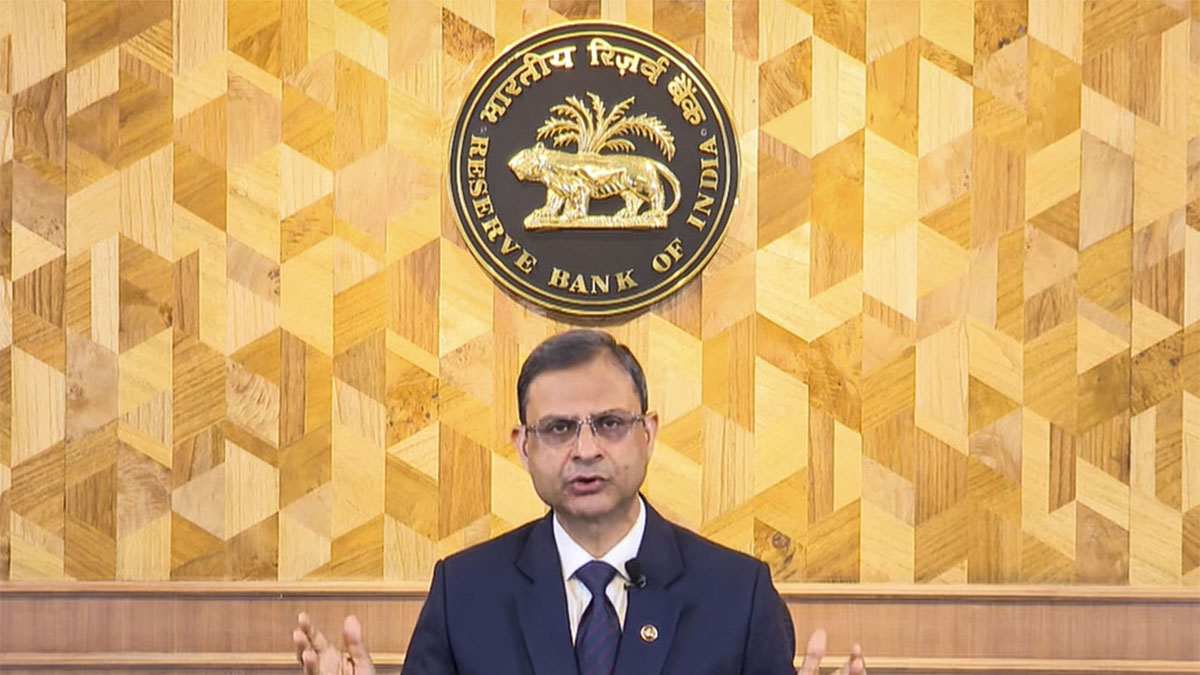

Amid escalating tariff concerns, Reserve Bank of India (RBI) Governor Sanjay Malhotra on Wednesday announced a 25 basis point cut in the policy repo rate during his much-anticipated address.

“After a detailed assessment of the evolving macroeconomic and financial conditions and output, the Monetary Policy Committee (MPC) voted unanimously to reduce the policy repo rate by 25 basis points to 6 per cent with immediate effect,” said Malhotra.

Following the rate cut, the Standing Deposit Facility (SDF) rate under the liquidity adjustment facility has been adjusted to 5.75 per cent, while the Marginal Standing Facility (MSF) rate and the bank rate now stand at 6.25 per cent.

GDP and inflation outlook

Outlining the central bank’s economic forecast, Malhotra said, “Real GDP is now projected for this fiscal at 6.5 per cent.” He further elaborated on the quarterly projections: “Q1 and Q2 are expected to grow at 6.7 per cent, Q3 at 6.6 per cent and Q4 at 6.3 per cent.” On the inflation front, he said, “The outlook for food inflation has turned positive.”

Economic activity and consumption

The RBI Governor pointed to positive signs in the economy. “Manufacturing activity is showing signs of revival,” he said. “Business expectations remain robust and investment activity has gained traction.” He also noted an improvement in consumer sentiment, stating, “Urban consumption is gradually picking up with an uptick in discretionary spending,” indicating a strengthening domestic demand environment.

Global concerns and trade frictions

Turning to the global stage, Malhotra expressed caution. “A slowdown in global growth could entail further softening in commodity and crude oil prices,” he said. “Uncertainty itself dampens growth,” he emphasised, adding that “the dent on global growth due to trade frictions will also impede domestic growth.” Speaking specifically on the impact of tariffs, Malhotra said, “Higher tariffs shall have a negative impact on net exports. There are several known and unknown implications.” He added, “Some of the concerns of the trade frictions are coming true, unsettling the global community.”

Impact Shorts

More Shorts“FY26 has begun on an anxious note,” said Malhotra, underlining the fragile state of the global economy. “Overall, the year has begun on an anxious note for the global economy,” he added. Nevertheless, he reassured that “growth is still on the recovery path,” despite global and domestic headwinds.

The RBI’s Monetary Policy Committee, chaired by Governor Malhotra, commenced its three-day deliberations on the next set of credit policy on Monday. In February, the MPC had cut the repo rate by 25 basis points to 6.25 per cent, marking the first reduction since May 2020 and the first revision in two-and-a-half years.

Experts had widely anticipated another 25 basis point cut on Wednesday, especially in light of moderating inflation and the need to spur growth. These expectations were further heightened by global developments, as PTI reported. Coincidentally, US President Donald Trump announced a hefty 26 per cent reciprocal tariff on Indian goods, effective April 9.

Markets react sharply

Although the RBI delivered a widely anticipated 25 basis point cut in the repo rate, markets reacted sensitively to the downward revision in FY26 GDP growth estimates—from 6.7 per cent to 6.5 per cent—signalling rising concerns over a potential slowdown in economic momentum amid escalating global uncertainties.

Despite the RBI’s supportive tone, the downward revisions added to investor concerns, weighing on already fragile markets.

Earlier on Wednesday, Indian equity markets opened on a weak note following the RBI’s announcement and rising global tensions. The Nifty 50 slipped below the 22,400 level, while the Sensex dropped over 400 points in early trade on April 9.

Adding to the domestic concerns was a sharp deterioration in global sentiment after the US imposed a staggering 104 per cent tariff on Chinese imports, sparking fears of a deeper trade war. The aggressive trade measure triggered a sell-off in global equities and weighed particularly hard on export-linked sectors in India.

Across sectors, all indices ended in the red, except for Nifty FMCG. The worst-hit were IT, pharma and metals, sectors that are typically more vulnerable to global trade disruptions and dollar movements.

The negative sentiment also spilled into the broader markets, with both the Nifty Midcap 100 and Nifty Smallcap 100 falling about 0.6 per cent, mirroring losses in the frontline indices. With the RBI decision now priced in, attention will turn to the evolving US-China tariff battle, global macro signals, and weekly options expiry, all of which are expected to keep volatility elevated in the near term.

)

)

)

)

)

)

)

)

)