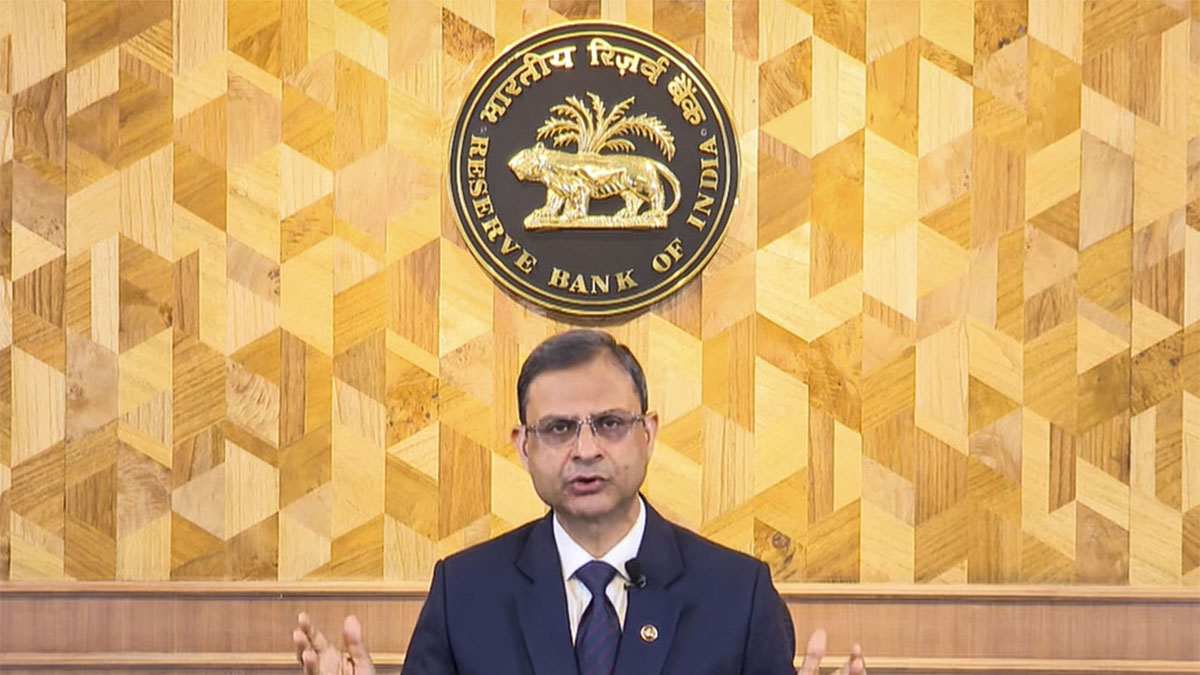

As the Reserve Bank of India’s Monetary Policy Committee (MPC) gets ready to announce its interest rate decision on April 9, 2025, Governor Sanjay Malhotra faces an important moment for the economy. Around the world, challenges are growing — like a rising trade conflict with US, worries about a possible global recession and ongoing concerns about high inflation.

So, this decision is not just about changing interest rates (repo rates), but also about helping India move safely through a very uncertain global situation. Malhotra’s big task is to support economic growth in the short term while also making sure the country stays financially stable in the long run.

Tariff troubles for India

At the centre of the RBI’s current challenge is the trade conflict, especially the recent move by the United States to put a high 26 per cent tariff on Indian goods. According to Bajaj Broking Research, as reported by News18, this single action could reduce India’s GDP growth by 20 to 40 basis points in the financial year 2025-26. This means growth could fall from 6.7 per cent to around 6.1 per cent.

Now, Governor Malhotra has to decide if cutting interest rates will be enough to boost demand within India and help balance out the impact from outside. So far, in his short time as RBI Governor, Malhotra has focussed more on supporting growth than his predecessor. He already lowered the repo rate by 25 basis points in February 2025 and added over $80 billion to the financial system. As per The Economic Times, many traders and experts believe he will do something similar this week — another 25 basis point cut to bring the repo rate to 6 per cent. But if the US keeps making its trade policies tougher, India might need bigger rate cuts or even major changes in its trade and industry policies.

Recession clouds on the global horizon

Tariffs are just one part of the bigger economic problem. There’s also a real risk of a global recession, especially as US deals with high interest rates and the possibility of its economy slowing down. If the US — the world’s biggest economy — slows down, it could affect the flow of money around the world, change commodity prices and hurt investor confidence everywhere.

Impact Shorts

More ShortsAs reported by News18, this kind of global uncertainty could reduce the positive impact of any rate cuts within India. If US interest rates stay high, investors might pull their money out of India, which could weaken the Indian rupee. A weaker rupee makes imports more expensive, even though lower interest rates are supposed to make borrowing cheaper and boost the economy. Narinder Wadhwa from SKI Capital warns that while a weaker rupee can help exporters, it also raises the cost of importing things like energy and raw materials — which can push inflation back up.

Because of this, Malhotra faces a tough choice. Lowering interest rates could support spending and investment within India, but it might also increase economic risks, especially if global markets become more unstable. There’s also the worry of a bigger trade war, like in past times when countries raised tariffs and reduced trade, which could hurt global demand and India’s export-driven sectors. So, the RBI has to stay flexible and ready to adjust its policies, not just based on what’s happening in India, but also on changes in the global economy.

Inflation: A persistent worry

Even though there has been some recent relief, inflation is still a concern. Retail inflation — also called the Consumer Price Index (CPI) — dropped to 3.61 per cent in February 2025, which is the lowest it’s been in seven months. This drop mainly happened because food prices went down. However, the RBI expects average CPI inflation for the financial year 2025-26 to be around 4.2 per cent. Since this is mostly above the 4 per cent midpoint of the RBI’s target, inflation is still something to watch.

This mixed situation makes it harder for the RBI to decide what to do. On one side, inflation is within the allowed range of 2 per cent to 6 per cent and the low number in February gives the Monetary Policy Committee (MPC) some space to act. But on the other side, inflation hasn’t gone away. A hotter-than-usual summer could hurt crop production and make food prices go up again. Also, if the rupee loses value — because of investors pulling money out of India or due to more interest rate cuts — the cost of imported goods like oil and other essentials could rise, leading to more inflation.

As mentioned by The Economic Times, the RBI might slightly reduce its inflation forecast since global inflation is cooling down, especially because of too much supply in countries like China. Past experience shows that inflation can come back quickly if there’s a sudden problem inside or outside the country. For Malhotra, the real challenge is not just understanding the current data but also preparing for possible future problems — which is harder now because of the uncertain global situation.

Liquidity dynamics

Along with inflation and growth, another big challenge for the RBI is managing liquidity — which means making sure there’s enough money flowing in the financial system. In the past few months, the RBI has taken strong steps to add liquidity by using tools like buying government bonds, doing forex swaps and offering loans to banks through variable rate repos. These efforts have helped solve one of the worst liquidity shortages in the system, and now the banking sector has extra liquidity.

The RBI’s April 9 decision isn’t just about how much the rate is cut — it’s also about showing how the RBI plans to handle a shaky global economy. With a tariff war, recession risks and inflation concerns, the RBI indeed needs to think ahead and not just react.

)

)

)

)

)

)

)

)

)