Mumbai: India is expected to be among the fastest growing major economies this fiscal, geopolitical turbulence notwithstanding, RBI Governor Shaktikanta Das said at last month’s meeting of the rate setting panel MPC while going with the majority to raise the repo rate by 50 basis points to tame inflation. Members of the high-powered panel, however, had different views on the future trajectory of rate hikes to contain price rise, as per minutes of the meeting released on Friday. The Monetary Policy Committee (MPC), which recommends the bi-monthly monetary policy, consists of six members – three from the RBI including the Governor and three external members appointed by the Central government. External member Ashima Goyal had voted for only a 35 basis points (bps) hike in the short-term lending rate (repo), while another government appointed member Jayanth R Varma made a case for a pause in rate hikes in future, showed minutes of the MPC meeting held during September 28-30. Five members of the MPC, including Varma, had voted for a 50 basis points (bps) increase in the repo rate. In his intervention, Governor Das, who heads the rate setting panel, opined that India is expected to be among the fastest growing major economies despite geopolitical turbulence. “While high frequency indicators are showing continued momentum in activity, global factors are putting pressure on external demand. The growth projection of 7.0 per cent for 2022-23, therefore, carries risks which are broadly balanced. Whatever be the unfolding scenario, India is expected to be among the fastest growing major economies in the world,” the minutes quoted him as saying. Going forward, Das said, monetary policy needs to remain watchful and nimble, based on incoming data and evolving conditions. On September 30, the RBI had raised the short-term lending rate for the third consecutive time by 50 bps to take the repo rate to 5.9 per cent. Since May it has cumulatively increased the key interest rate by 190 bps. As per the minutes, Varma opined that a pause was needed after this hike (of September 30) because monetary policy acts with lags. “It may take 3-4 quarters for the policy rate to be transmitted to the real economy, and the peak effect may take as long as 5-6 quarters. If we raise the repo rate to around 6 per cent at this meeting, that would be a cumulative increase of around two percentage points in the space of just four months,” he had said. RBI Executive Director and Member Rajiv Ranjan said in the current macroeconomic mix, while a rate hike in this meeting is imminent, the choice between a 35 to 50 bps is a close call. “Given the growth-inflation dynamics, my vote is for an increase in repo rate by 50 bps and continue with the policy stance of withdrawal of accommodation to ensure that inflation remains within the target going forward, while supporting growth,” he said. Goyal was of the opinion that the MPC has to focus on the six-month to one-year ahead real rate, as this is the horizon where monetary policy will have its greatest impact. She also noted that most analysts were arguing for a 50 basis points rise just to preserve a spread with US policy rates. “This is a fear driven over-reaction,” she said, and added in the past two years spreads of above 300 bps have not brought in debt flows. “If the terminal Fed rate is 5 per cent, will it require we raise ours to 8 per cent? The carry trade is not a stable source of financing. India has earned enough independence to protect itself from policy errors of other nations,” she said. Retail inflation remained above the Reserve Bank’s upper tolerance threshold of 6 per cent for the ninth month in a row in September and was at a five-month high of 7.41 per cent. Shashanka Bhide, another external member, said there were significant uncertainties over the trajectories of growth and inflation. On the growth front, the Covid-19 pandemic related supply side constraints do not appear to be significant. Improvement in private investment and consumption spending would require price stability. The CPI inflation rate has continued to be high – above 6 per cent from January 2022 onwards. “While there are indications of decline in the momentum of price rise, sustaining this decline in momentum is crucial for achieving inflation and growth objectives. To align the inflation expectations with the policy target rate of inflation, further increase in policy rates is necessary at this juncture,” he said. RBI Deputy Governor and MPC Member Michael Debabrata Patra had stressed that monetary policy has to perform the role of nominal anchor for the economy as it charts a new growth trajectory. The focus, he said, should be on being time consistent in aligning inflation with the target. “In this context, front-loading of monetary policy actions can keep inflation expectations firmly anchored and balance demand against supply so that core inflation pressures ease,” Patra said. The RBI, which has been tasked to ensure retail inflation remains at 4 per cent (with margin of 2 per cent on either side), has failed to meet the target for three consecutive quarters, and now will have to submit a report in this regard to the government. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on Facebook, Twitter and Instagram.

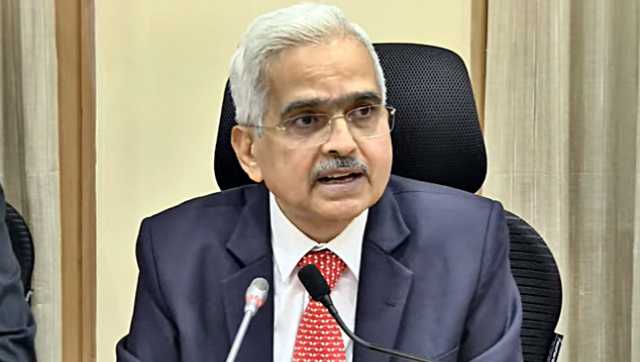

Governor Das, who heads the rate setting panel, opined that India is expected to be among the fastest growing major economies despite geopolitical turbulence

Advertisement

End of Article

)

)

)

)

)

)

)

)

)