“It’s like how one invariably learns how to swim while learning to scuba dive.”

This was how a professor at IIM-Bangalore described the experience of teaching finance to CBI officers, while explaining how it would not just help them in investigations, but would increase their knowledge in general about finance. The Times of India reported on this initiative on Thursday.

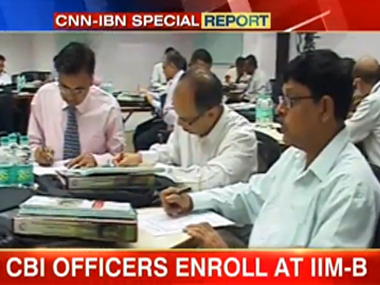

According to the report, 30 CBI investigators took classes on Monday at IIM-B on financial intelligence and analytics. They were given an overview of issues like financial markets, tax havens, accounting analysis and cyber crime.

“Our endeavour is that officers should equip themselves with the latest that is happening in the financial world so that they can understand its implications and nuances,” said CBI director Anil Kumar Sinha in an interview to CNN-IBN .

The course is said to include real-life case studies as well as pointers on what to expect in financial frauds.

The CBI’s desire to sharpen its understanding of money matters appears to be linked to the fact that it has recently sought to become the default investigating agency in large-scale financial frauds.

In April, CNN-IBN reported on a representation made by the agency to the Prime Minister’s office. The CBI is said to have asked for an amendment to the Delhi Special Police Establishment Act, 1946, from which it draws its powers.

Interestingly, not long ago, the CBI was in teaching mode on financial matters, when its academy imparted training to officials of Gujarat’s Anti-Corruption Bureau (ACB). Officers from the rank of Inspector to Deputy Superintendent of Police were said to have been trained to investigate such matters, according to The Indian Express .

Some prominent cases of financial fraud which the country’s premier investigating agency has handled recently include the Satyam case involving Ramalinga Raju, the 2G spectrum scandal and the coal block allocation case among others.

)

)

)

)

)

)

)

)

)