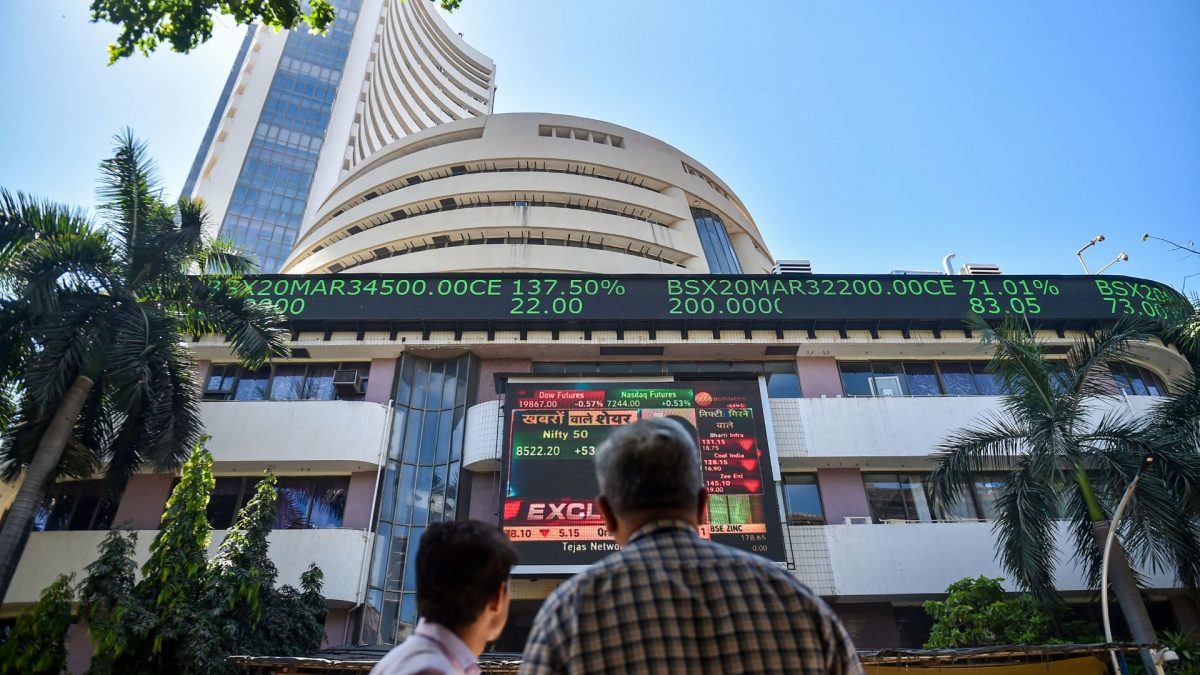

The Indian stock market touched fresh lifetime highs today (November 27).

The benchmark Sensex rose to 85,753.78, while the Nifty was at 26,222.40 around noon. The benchmark index had previously hit its peak of 85,978 in September 2024, while the Nifty had touched 26,277 in the same month. This rally came a day after the market saw a rise with the Sensex climbing over 1,000 points, while the Nifty cleared 26,000.

But why are the Indian markets rising? And what happens next?

Let’s take a closer look

Investor confidence

It seems as if investor confidence is growing. Foreign investors seem to be returning to India, while domestic investors are piling into the market via mutual funds and SIPs.

Kalp Jain, Research Analyst at INVasset PMS, told Moneycontrol, that much of the support for the markets comes from domestic investors. He added that this has tamped down India’s reliance on foreign inflow which has kept India not as vulnerable to global sell-offs.

"A large part of the buying today is coming from domestic investors who aren’t reacting to every global headline. SIP flows are at an all-time high, banks are well-capitalised, and corporate earnings have held up considerably better than most expected. That, combined with steady GDP growth and moderating inflation, gives you a market that can absorb global shocks without losing its footing," Siddharth Maurya, Founder & Managing Director, Vibhavangal Anukulakara, added.

Positive global markets

Indian markets have also benefited from the largely positive global markets. The Dow Jones Industrial Average on Wednesday increased 314.67 points or 0.67 per cent, to 47,427.12, the S&P 500 climbed 46.73 points, or 0.69 per cent to 6,812.61 and the Nasdaq Composite rose 189.10 points, or 0.82 per cent to 23,214.69.

US markets are closed today due to Thanksgiving. The pan-European increased 1.09 per cent to record its biggest daily percentage gain in two weeks. Meanwhile, Japan’s Nikkei 225 rose 1.2 per cent to 50,167.10, while Hong Kong’s Hang Seng index rose 0.1 per cent to 25,952.42, and the Shanghai Composite index climbed 0.3 per cent to 3,875.26.

"One of the key drivers behind today’s rally is the strength in global markets. Asian indices traded firmly higher, while Wall Street ended on a positive note overnight. This improved global risk sentiment provided support to Indian equities and encouraged fresh buying at lower levels," Pravesh Gour, a senior analyst at Swastika Investmart, told Mint.

Corporate earnings rebound

The performance of the corporate firms must also be taken into consideration. Some argue that companies are more reasonably valued and their stocks more fundamentally sound than earlier.

Ravi Singh of Master Capital Services added, “Indian corporates displayed strong performance in Q2 results with several sectors delivering double-digit profitability growth numbers. Further, sectors like auto, banking, discretionary goods and FMCG have gained from improved outlook, aided by a series of favourable measures. Confluence of favourable measures and domestic resistance has set the stage for sustained growth in the coming quarters”.

Early signs of an earnings recovery in the September quarter and expectations of further improvement in the second half of FY26 have created a constructive market view, Amit Premchandani, fund manager at UTI Mutual Fund, added.

Consolidation in the benchmarks over the past 14–15 months has bridged the gap between earnings and valuations, creating attractive entry points, Aditya Sood, fund manager at InCred Asset Management, said. The Nifty now trades at 22.3x–22.7x 12-month forward price-to-earnings, down from 23x–25x seen 14 months ago, as per the data.

An earnings slump last year forced a sharp valuation correction that brought down multiples to 18.5x–19x in early 2025, the data showed.

Fall in crude

The decrease in prices of crude oil has tamped down on inflation. The price of oil fell last week after reports of a peace plan between Russia and Ukraine made the rounds. This raised expectation that Russian supply of crude oil would resume to much of the world, which has been cut off from it since the beginning of the Ukraine war.

The price of Brent crude oil on Thursday was $62.47 (Rs 5,574.06) per barrel, a decline of nearly 15 per cent since the beginning of 2025. This came days after the US and Ukraine held ‘highly productive’ talks in Geneva. It also comes after JP Morgan and a report predicted that the price of crude oil could decline by half by 2027 due to a glut in market supply.

Goldman Sachs has predicted that the price of crude oil will decline to $53 (Rs 4,727.31) per barrel by next year. This is important for India, which imports around 85 per cent of its entire domestic oil needs. This also helps reduce the deficit in India’s current account – the difference between the value of what we import and export.

The decline in oil prices has also had the knock-on effect of lowering costs for companies, increasing consumer spending and spurring further positivity.

Rate cut in US, RBI to follow suit?

Markets all over the world gained on the expectation that the US Federal Reserve would cut rates in its December 10 meeting. US President Donald Trump has made no secret of the fact that he wants interest rates lowered, even threatening to fire Federal Reserve chief Jerome Powell.

Experts think a rate cut is now in the offing. “While the press conference played out somewhat differently than we expected, we have not changed our Fed forecast and continue to see a December cut as quite likely,” David Mericle, chief US economist, was quoted as saying by Indian Express.

In India, there is hope that the Reserve Bank would follow suit.

“An important positive trigger is renewed optimism around a possible interest rate cut by the US Federal Reserve. Recent softer US economic data has strengthened expectations that the Fed could begin easing monetary policy in the coming months. Lower interest rates in the US generally improve liquidity conditions and increase the attractiveness of emerging markets such as India, prompting risk-on sentiment across equities,” Gour told Mint.

With inputs from agencies

)

)

)

)

)

)

)

)

)