Nvidia has joined the India Deep Tech Alliance (IDTA).

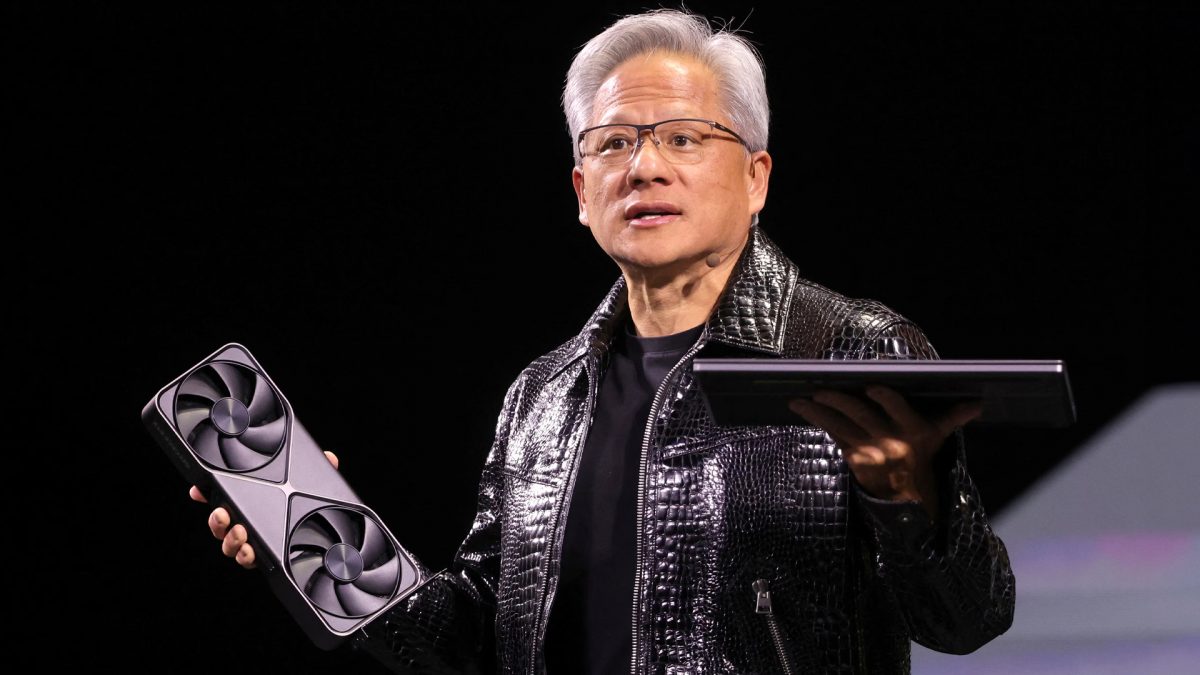

The tech firm, which previously and briefly crossed a market cap of $5 trillion (Rs 443.25 lakh crore), remains the world’s most valuable company. Helmed by CEO Jensen Huang, the world’s leading chipmaker has joined the group as a founding member and strategic technical adviser.

Nvidia has joined firms such as Activate AI, Chiratae Ventures, InfoEdge Ventures, Kalaari Capital, Singularity Holdings VC, and YourNest Venture Capital.

The development comes days after India’s government established a $12 billion (Rs 1 lakh crore) Research, Development, and Innovation (RDI) Scheme to fund investment in technology, which was approved by the Union Cabinet in July. Prime Minister Narendra Modi on Monday announced that India will host the AI Impact Summit in February 2026.

But what do we know about the IDTA? And what role will Nvidia play exactly?

Let’s take a closer look.

What we know

The IDTA was launched in September at the Semicon India event organised by the India Semiconductor Mission (ISM) and Semiconductors and Electronics Ecosystem (Semi) in New Delhi.

The two-day event, comprising representatives from four dozen nations, witnessed over 30,000 people attending and was flagged off by Prime Minister Shri Narendra Modi. Union Minister Shri Ashwini Vaishnaw and Minister of State Jitin Prasada also attended.

The IDTA is essentially an industry-led consortium of investors, corporates, technology partners, and ecosystem stakeholders, both from India and the US, that are looking to fund ‘deep tech startups’ in this country. Th e IDTA had earlier announced it had a commitment of $1 billion (Rs 8,865 crore) to invest in companies working in industries such as space, semiconductors, artificial intelligence, and robotics.

Accel, Blume Ventures, Celesta Capital, Gaja Capital, Ideaspring Capital, Premji Invest, Tenacity Ventures, and Venture Catalysts were among those announced as the backers of the IDTA. Celesta has invested in startups including space-tech firm Agnikul Cosmos and drone maker IdeaForge.

The consortium has now announced that it has garnered another $850 million (Rs 7,500 crore) in commitments from its newest members. The IDTA is not a government group. It seeks to offer a counterpart to the efforts of the government rather than provide a substitute for it.

What role will Nvidia play exactly?

As a founding member and strategic adviser to the group, Nvidia will provide technical guidance, training, and policy input to help Indian deep-tech startups adopt its AI and computing tools.

Nvidia wants to “provide guidance on AI systems, developer enablement, and responsible deployment, and to collaborate with policymakers, investors, and entrepreneurs,” Vishal Dhupar, Nvidia’s Managing Director of South Asia, was quoted as saying by CNBC.

Nvidia, like other members of the group, will voluntarily invest capital in deep-tech startups based in India over the next decade. IDTA members will also provide mentorship to the leaders of these companies and provide them with networking opportunities. Members of the group will also coordinate with the Indian government over the RDI Scheme and explore investing and collaborating with Indian firms.

Sriram Viswanathan, Founding Managing Partner at Celesta Capital, has said the increasing government support means that “there’s no better time for India to look at deep tech”. The IDTA also has no ‘central fund’ to draw from. Each company can invest its own sum in an Indian startup. “There’s no real pooling of capital. It’s voluntary,” Viswanathan said, comparing the group to industry body Nasscom.

“Their (Nvidia’s) joining as a strategic adviser is extremely valuable for us as investors and for startups, as they bring trends and insights from the cutting edge of technology,” IDTA Executive Council member and Celesta Capital Managing Partner Sriram Viswanathan told Inc42.com.

Deep tech startups and India

Deep tech startup funding in India surged 78 per cent to $1.6 billion (Rs 14,184 crore) last year, but still accounted for only about one-fifth of the $7.4 billion (Rs 65,501 crore) raised overall, according to a Nasscom report. An Indian minister’s call in April for startups to emulate China by focusing on high-end technology rather than grocery deliveries had drawn backlash from entrepreneurs, who said the government needed to do more to support innovation.

AI firms are focusing more and more on India. OpenAI has made ChatGPT Pro free for Indians to use for one year. Meanwhile, Google has announced it will invest $15 billion (1.33 lakh crore) to build an AI hub in Visakhapatnam. Experts have said deep-tech investment is vital to build core technologies such as chips and artificial intelligence that secure economic and strategic independence.

The importance of Nvidia, which hit the $4 trillion (Rs 354.6 lakh crore) mark just a few months ago, joining the group cannot be understated. Experts like Matt Britzman, Senior Equity Analyst at Hargreaves Lansdown, which holds shares in the company, have said that the company has gone “from chipmaker to industry creator.”

Since the launch of ChatGPT in 2022, Nvidia’s shares have climbed twelvefold as the AI frenzy propelled the S&P 500 to record highs, igniting a debate on whether frothy tech valuations could lead to the next big bubble.

With inputs from agencies

)

)

)

)

)

)

)

)

)