Nvidia is now selling its H20 Artificial Intelligence (AI) chips to China again.

The tech giant, which last week briefly touched a market cap of $4 trillion, has been allowed to do so by the Donald Trump administration.

Nvidia has said that it hopes to resume deliveries soon. It also announced a new chip for China which is “fully compliant”.

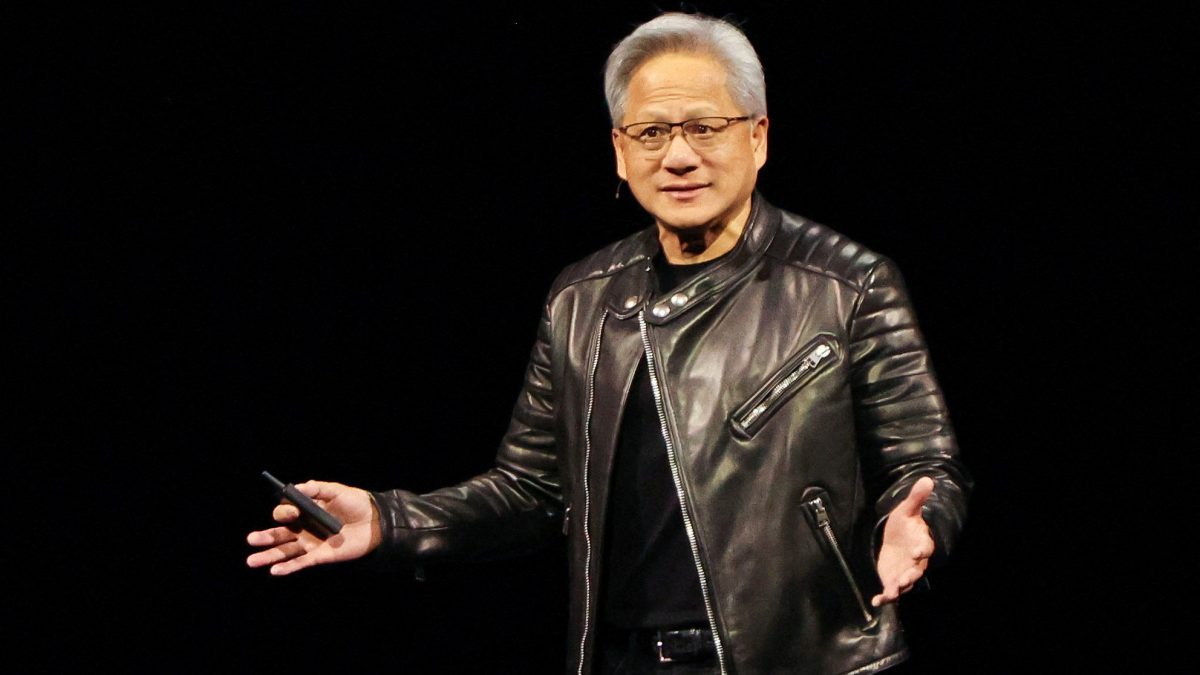

The development came after a meeting between Nvidia chief Jensen Huang and Donald Trump at the White House.

But what happened? Why was it barred from selling chips to China? Why has it resumed doing so?

Let’s take a closer look

What happened?

Nvidia has been allowed to resume the sale of H20 chips to China.

“The US government has assured Nvidia that licences will be granted, and Nvidia hopes to start deliveries soon,” the company wrote online.

“Today, I’m announcing that the US government has approved for us filing licences to start shipping H20s,” Huang told reporters in China.

“It’s so innovative and dynamic here in China that it’s really important that American companies are able to compete and serve the market here in China,” he said.

Huang is currently on a visit to China where he will meet top government officials and tech industry leaders.

The development comes months after the Chinese firm DeepSeek shook Silicon Valley and Wall Street by announcing it had developed an AI model for a pittance compared to tech giants such as Microsoft and Apple.

China, while not directly commenting on the development on Tuesday, said it opposes “weaponisation” of technology and trade issues disrupting “the stability of the industrial supply chain.”

So, why was Nvidia barred from selling these chips to China?

A brief look at H20 chips

First, take a brief look at the H20 chips.

These chips means they are not as powerful as Nvidia’s top-of-the-line models.

They are essentially as what is known as “second-tier”.

The H20 chips were designed by Nvidia specifically for the China market and to get around export controls on AI chips imposed by the previous Joe Biden administration.

The Biden administration had imposed this export ban amid a growing battle with China over Artificial Intelligence.

The administration cited national security issues as behind the move.

Both countries are desperate to outdo each other in the field of AI.

Nvidia in May 2024 had announced it was writing off H20 chips were billions of dollars – a huge blow to the company’s bottom line.

“It doesn’t really fit anywhere else without a lot of expensive tweaking,” Arash Azadegan, a professor of supply chain management at Rutgers Business School, told Fortune.

In February, major Chinese firms such as Alibaba, ByteDance, and Tencent purchased these chips from Nvidia.

This came a month after DeepSeek’s announcement which caused chaos in Silicon Valley and dealt a severe blow to the value of AI firms on Wall Street.

Experts said these companies likely made the call thinking they could replicate DeepSeek’s efforts with these H20 chips.

Trump administration bans H20 chip exports, reverses its decision

However, the Commerce Department of the Trump administration in April 2025 had disallowed Nvidia from sending even sending these “second-tier” to China.

This came as the two countries were increasingly at odds over tariffs.

Trump in April had unveiled his ‘Liberation Day’ tariffs on dozens of countries including China.

Beijing hit back at Trump and unveiled its own tariffs against America.

Experts had predicted an even greater blow to Nvidia’s bottom line if the Trump administration did not reverse its decision.

Nvidia said the decision would cost the company between $5 billion and $15 billion.

So, what happened?

Like many before, Huang went directly to the source of his problem – meeting Trump at the White House.

Huang is said to have made his case directly to the US president.

He is said to have argued that sales to China would help keep American companies ahead in the global AI race.

However, Huang is likely more concerned about Nvidia’s bottom line.

China comprised about 13 per cent of the company’s sales and generated around $17 billion for the firm in the latest fiscal year.

Huang has also spoken about the importance of the Chinese market to Nvidia.

The Chinese market is massive, dynamic, and highly innovative, and it’s also home to many AI researchers," Huang told Chinese state broadcaster CCTV on Tuesday.

“Therefore, it is indeed crucial for American companies to establish roots in the Chinese market.”

But others are far more cautious about China’s ambitions.

“It’s very hard to disentangle China’s AI ambitions for the commercial space from the military space,” an ex-US Commerce Department official told Washington Post.

“Jensen has been very clear that he doesn’t see a military nexus to what he sells”, the former official added. But “there was plenty of open source and classified intelligence showing that the PLA was working quite hard to get its hands on these chips”.

They also remain sceptical about Nvidia’s value to China in the long run.

“China is in a weird position because they continue to be dependent on Nvidia and its product lines to sustain near-term growth in China’s AI industry,” Ryan Fedasiuk, a former tech policy adviser in the U.S. State Department’s Office of China Coordination, told the newspaper.

“But I think it should be clear to Nvidia that the company is dispensable in China. China is actively pouring hundreds of billions of dollars into an effort to dispense with Nvidia in its market”.

Nvidia has also announced the development of a new AI chip designed specifically for China, called the RTX Pro GPU.

The company described the model as “fully compliant” with US export controls and suitable for digital twin AI applications in sectors such as smart factories and logistics.

In May, Reuters reported Nvidia was preparing to launch a new AI chip, based on the RTX Pro 6000D, in China at a significantly lower price point than the H20.

The graphics processing unit would be part of Nvidia’s latest generation Blackwell-architecture AI processors and was expected to be priced well below the H20 due to its weaker specifications and simpler manufacturing requirements.

It remains unknown if this decision by Trump has any link to trade talks between the US and China. Both countries have backed off their threats. The White House has expressed optimism after China said it would resume sending rare earth materials to the US.

With inputs from agencies

)

)

)

)

)

)

)

)

)