A major American bank has collapsed and the world has hit the panic button. It’s bringing back memories of the 2008 financial crisis. The downfall of California’s Silicon Valley Bank (SVB), considered a lifeline of tech startups, is the largest failure of a financial institution in over a decade. The move has put nearly $175 billion in customer deposits under the control of the Federal Deposit Insurance Corp. The US treasury secretary Janet Yellen said Sunday that the federal government would not bail out the bank, but is working to help depositors who are concerned about their money. Does this mean SVB customers do not have to worry? What happens next? We take a look. What happened at Silicon Valley Bank?

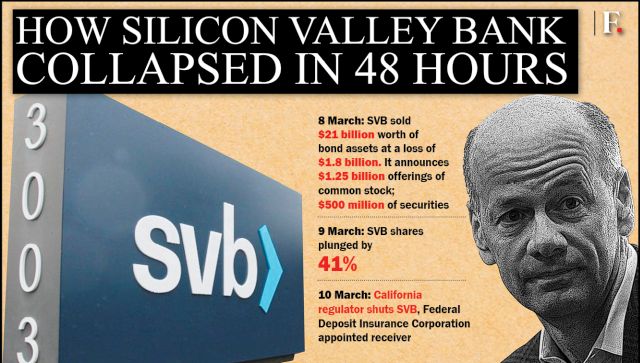

Silicon Valley Bank was hit hard by the downturn in technology stocks over the past year as well as the US Federal Reserve’s aggressive plan to increase interest rates to combat inflation. The bank bought billions of dollars worth of bonds over the past couple of years, using customers’ deposits as a typical bank would normally operate. These investments are typically safe, but the value of those investments fell because they paid lower interest rates than what a comparable bond would pay if issued in today’s higher interest rate environment, according to a report by The Associated Press. That’s not an issue usually, because banks hold onto those for a long time — unless they have to sell them in an emergency. Also read: Why did the Silicon Valley Bank collapse? Will this lead to a repeat of 2008? But Silicon Valley Bank’s customers were largely startups and other tech-centric companies that started becoming needy for cash over the past year. They started withdrawing their deposits. Initially, that wasn’t a huge issue, but the withdrawals started requiring the bank to start selling its assets to meet customer withdrawal requests. Because Silicon Valley Bank customers were businesses and the wealthy, they likely were more fearful of a bank failure since their deposits were over $250,000, which is the government-imposed limit on deposit insurance, the report says. That required selling typically safe bonds at a loss and those losses added up to the point that Silicon Valley Bank became effectively insolvent. The bank tried to raise additional capital through outside investors but was unable to find them, reports AP. [caption id=“attachment_12282492” align=“alignnone” width=“640”] An FDIC sign is posted on a window at a Silicon Valley Bank branch in Wellesley, Massachusetts. US customers with less than $250,000 in the bank can count on insurance provided by the FDIC. AP Photo/Peter Morgan)[/caption] What led to the collapse? On 8 March, SVB sold about $21 billion of securities from its portfolio with a plan to reinvest the proceeds, which will result in an after-tax loss of $1.8 billion for the first quarter. The bank also announced offerings for $1.25 billion of its common stock and $500 million of securities that represent convertible preferred shares, Bloomberg reported. Despite this, the bank witnessed a wave of withdrawals. On 9 March, the bank’s shares plunged by 41 per cent, the biggest decline since 1998. The fall came after SVB sold all of the available-for-sale securities in its portfolio and updated its forecast for the year to include a sharper decline in net interest income, reports Hindustan Times. SVB Financial Group’s CEO Greg Becker advised clients to stay calm amid concern about the lender’s financial position. The regulatory filing at the end of the business day showed that SVB had a negative cash balance of $958 million. [caption id=“attachment_12282462” align=“alignnone” width=“640”]

Graphic: Pranay Bhardwaj[/caption] On 10 March, prominent venture capitalists advised portfolio businesses to withdraw money from the bank. The California regulator shut Silicon Valley Bank and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver, Reuters reported. This day after the shares of the bank were halted after tumbling 66 per cent in premarket trading. The fancy tech-focused bank was brought down by the

oldest issue in banking : a good ol’ run on the bank. Bank regulators had no other choice but to seize Silicon Valley Bank’s assets to protect the assets and deposits still remaining at the bank, according to the report by AP.

Graphic: Pranay Bhardwaj[/caption] On 10 March, prominent venture capitalists advised portfolio businesses to withdraw money from the bank. The California regulator shut Silicon Valley Bank and appointed the Federal Deposit Insurance Corporation (FDIC) as receiver, Reuters reported. This day after the shares of the bank were halted after tumbling 66 per cent in premarket trading. The fancy tech-focused bank was brought down by the

oldest issue in banking : a good ol’ run on the bank. Bank regulators had no other choice but to seize Silicon Valley Bank’s assets to protect the assets and deposits still remaining at the bank, according to the report by AP.

What happens to SVB customers? The FDIC said that SVB would reopen on Monday morning under the control of the newly created Deposit Insurance National Bank of Santa Clara. Insured depositors with up to $250,000 in their accounts will be able to access their money, reports NBC News. Anyone who has over $250,000 in their accounts is required to call a toll-free number. However, a majority of deposits are not insured but it is unlikely they will lose all the money. FIDC will pay uninsured depositors an advanced dividend in a week. They will also be given a receivership certificate for the remaining amount of their uninsured funds. [caption id=“attachment_12282472” align=“alignnone” width=“640”] People walk past a Silicon Valley Bank sign at the company’s headquarters in Santa Clara, California. The bank funded several tech startups, providing banking services and funding companies that were considered too risky for traditional lenders. AP[/caption] As of 31 December 2022, SVB’s total assets stood at $209.0 billion and its total deposits were approximately around $175.4 billion. About 89 per cent of the bank’s total deposits are uninsured, according to FDIC data. FDIC said that as it sells “the assets of Silicon Valley Bank, future dividend payments may be made to uninsured depositors”. Customers who had loans are expected to make their payments as usual. Also read: Explained: How the collapse of Silicon Valley Bank caused chaos and can it be contained? Who are SVB’s big clients? American streaming technology Roku held approximately $487 million of its $1.9 billion in cash at Silicon Valley Bank. This is close to 26 per cent of the company’s cash and cash equivalents, reports CNN. The company’s deposits are largely uninsured, but Roku said it had enough cash and cash flow operations to “meet its working capital, capital expenditures, and material cash requirements from known contractual obligations for the next twelve months and beyond.” [caption id=“attachment_12282522” align=“alignnone” width=“640”]

American streaming technology company Roku which has deposits in SVB said that it has enough existing cash flow to meet working capital needs. AP[/caption] Video game company Roblox, Rocket Lab USA, and video hosting platform Vimeo had accounts in the bank. Roblox said the collapse will not affect everyday operations and Vimeo’s accounts balance is less than $250,000, which means it will be insured by the FDIC. But some companies have been affected immediately. Etsy, the e-commerce company selling handmade and vintage items, has been forced to delay vendor contract payments, Axios reported. SVB was a prominent lender to tech startups such as Pinterest Inc, Shopify Inc, and CrowdStrike Holdings Inc. It financed start-ups like Shopify and Beyond Meat. The bank has also invested in around 21 Indian startups but the exact investment amount is not clear. Bluestone, Carwale, and Loyalty Rewardz have raised funds from the bank, according to Traxcn data. The list also includes Paytm, Paytm Mall and One97 Communications. But SVB has not made any significant investments in Indian startups after 2011. Paytm founder Vijay Shekhar Sharma confirmed that the bank is no longer a shareholder in the company. According to the report in The Economic Times, the situation is particularly dire for startups backed by the Silicon Valley accelerator Y Combinator (YC), with at least 40 YC-backed Indian startups having between $250,000 to $1 million each in deposits with SVB, and over 20 of them having deposits of over $1 million each. But larger YC-backed companies in India such as Razorpay, Meesho and Zepto have no exposure to SVB. Early-stage and mid-stage startups will be impacted by the bank’s collapse. What are the options before regulators? While a bailout has been ruled out regulators are looking at other options. “We are concerned about depositors and are focused on trying to meet their needs,” Janet Yellen said on CBS’ “Face the Nation.” “This is really a decision for the FDIC, as it decides on what the best course is to resolve this firm.” One option could be to use the FDIC’s systemic risk exception tool to backstop the uninsured deposits at SVB. Under the Dodd-Frank Act, that move would need to be made in concert with the Treasury Secretary and the Federal Reserve, reports CNBC. [caption id=“attachment_12282572” align=“alignnone” width=“640”]

US treasury secretary Janet Yellen said Sunday that a bailout of SVB is not on the table. AP[/caption] Regulators were also considering creating a special investment vehicle that would backstop uninsured deposits at other banks, which could keep the bank run from spreading in the coming week, Bloomberg reports. The other possibility is if another bank decides to buy SBV. During the 2008 financial crisis, JP Morgan Chase absorbed Washington Mutual. The FDIC is running an auction process for SVB, the report says. For now, HSBC has acquired SVB’s UK unit for £1. SVB UK had loans of around £5.5 billion and deposits of around £6.7 billion as on 10 March 2023. “The best outcome is an acquisition of SVB,” Senator Mark Warner, a member of the Senate Committee on Banking, Housing, and Human Affairs, told ABC’s “This Week”. With inputs from agencies Read all the Latest News , Trending News ,

Cricket News , Bollywood News , India News and Entertainment News here. Follow us on

Facebook,

Twitter and

Instagram.

US treasury secretary Janet Yellen said Sunday that a bailout of SVB is not on the table. AP[/caption] Regulators were also considering creating a special investment vehicle that would backstop uninsured deposits at other banks, which could keep the bank run from spreading in the coming week, Bloomberg reports. The other possibility is if another bank decides to buy SBV. During the 2008 financial crisis, JP Morgan Chase absorbed Washington Mutual. The FDIC is running an auction process for SVB, the report says. For now, HSBC has acquired SVB’s UK unit for £1. SVB UK had loans of around £5.5 billion and deposits of around £6.7 billion as on 10 March 2023. “The best outcome is an acquisition of SVB,” Senator Mark Warner, a member of the Senate Committee on Banking, Housing, and Human Affairs, told ABC’s “This Week”. With inputs from agencies Read all the Latest News , Trending News ,

Cricket News , Bollywood News , India News and Entertainment News here. Follow us on

Facebook,

Twitter and

Instagram.

)

)

)

)

)

)

)

)