New York: Can Washington come to the rescue of the depositors of failed Silicon Valley Bank ? Is it even politically possible? That was one of the growing questions in Washington on Sunday as policymakers tried to figure out whether the US government — and its taxpayers — should bail out a failed bank that largely served Silicon Valley, with all its wealth and power. Prominent Silicon Valley personalities and executives have been hitting the giant red “PANIC” button, saying that if Washington does not come to the rescue of Silicon Valley bank’s depositors, more bank runs are likely. “The govt has about 48 hours to fix a soon-to-be-irreversible mistake,” Bill Ackman, a prominent Wall Street investor, wrote on Twitter. Ackman has said he does not have any deposits with Silicon Valley Bank but is invested in companies that do.

Some other Silicon Valley personalities have been even more bombastic.

“On Monday 100,000 Americans will be lined up at their regional bank demanding their money — most will not get it,” Jason Calacanis wrote on Twitter. Calacanis, a tech investor, has been close with Elon Musk, who recently took over the social media network. Silicon Valley Bank failed on Friday, as fearful depositors withdrew billions of dollars from the bank in a matter of hours, forcing US banking regulators to urgently close the bank in the middle of the workday to stop the bank run. It’s the second-largest bank failure in history, behind the collapse of Washington Mutual at the height of the 2008 financial crisis. Silicon Valley Bank was a unique creature in the banking world. The 16th-largest bank in the country largely served technology startup companies, venture capital firms, and well-paid technology workers, as its name implies. Because of this, the vast majority of the deposits at Silicon Valley Bank were in business accounts with balances significantly above the insured $250,000 (Rs 2 crore) limit. [caption id=“attachment_12281402” align=“alignnone” width=“640”] Regulators have seized the assets of one of Silicon Valley’s top banks, marking the largest failure of a US financial institution since the height of the financial crisis almost 15 years ago. AP[/caption] Its failure has caused more than $150 billion (Rs 12.28 lakh crore) in deposits to be now locked up in receivership, which means startups and other businesses may not be able to get to their money for a long time. Staff at the Federal Deposit Insurance Corporation — the agency that insures bank deposits under $250,000 — have worked through the weekend looking for a potential buyer for the assets of the failed bank. There have been multiple bidders for assets, but as of Sunday morning, the bank’s corpse remained in the custody of the US government. Despite the panic from Silicon Valley, there are no signs that the bank’s failure could lead to a 2008-like crisis. The nation’s banking system is healthy, holds more capital than it has ever held in its history, and has undergone multiple stress tests that shows the overall system could withstand even a substantial economic recession. Further, it appears that Silicon Valley Bank’s failure appears to be a unique situation where the bank’s executives made poor business decisions by buying bonds just as the Federal Reserve was about to raise interest rates, and the bank was singularly exposed to one particular industry that has seen a severe contraction in the past year. Investors have been looking for banks in similar situations. The stock of First Republic Bank, a bank that serves the wealthy and technology companies, went down nearly a third in two days. PacWest Bank, a California-based bank that caters to small to medium-sized businesses, plunged 38 per cent on Friday. In a sign of how uncertain it is for these medium-sized banks, First Republic Bank sent an email to clients Sunday telling customers that it is well-capitalised and has no liquidity issues that might have an impact on the bank. While highly unusual, it was clear that a bank failure this size was causing worries. Treasury Secretary Janet Yellen as well as the White House, has been “watching closely” the developments; the governor of California has spoken to President Biden; and bills have now been proposed in Congress to up the FDIC (Federal Deposit Insurance Corporation) insurance limit to temporarily protect depositors. “I’ve been working all weekend with our banking regulators to design appropriate policies to address this situation,” Yellen said on Face the Nation on Sunday. But Yellen made it clear in her interview that if Silicon Valley is expecting Washington to come to its rescue, it is mistaken. Asked whether a bailout was on the table, Yellen said, “We’re not going to do that again.” “But we are concerned about depositors, and we’re focused on trying to meet their needs,” she added. [caption id=“attachment_12281442” align=“alignnone” width=“640”]

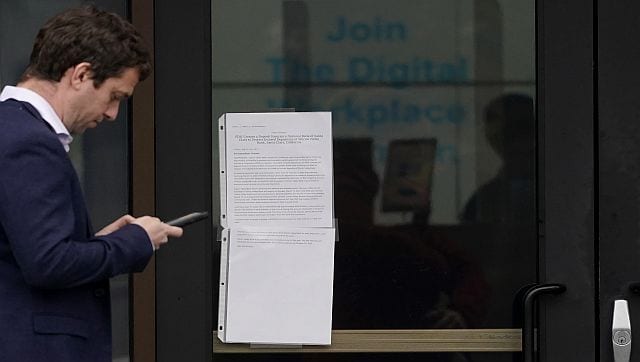

A person walks past a sign posted at an entrance to Silicon Valley Bank in Santa Clara, California. AP[/caption] Senator Mark Warner, D-Virginia, said on ABC’s This Week that it would be a “moral hazard” to potentially bail out Silicon Valley’s uninsured depositors. Moral hazard was a term used often during the 2008 financial crisis for why Washington shouldn’t have bailed out Lehman Brothers. The growing panic narrative among tech industry insiders is many businesses who stored their operating cash at Silicon Valley Bank will be unable to make payroll or pay office expenses in the coming days or weeks of those uninsured deposits are not released. However, the FDIC has said it plans to pay an unspecified “advanced dividend” — i.e., a portion of the uninsured deposits — to depositors this week and said more advances will be paid as assets are sold.

**Also Read: US closes Silicon Valley Bank in biggest collapse since 2008** The ideal situation is the FDIC finds a singular buyer of Silicon Valley Bank’s assets, or maybe two or three buyers. It is just as likely that the bank will be sold off piecemeal over the coming weeks. Insured depositors will have access to their funds on Monday, and any uninsured deposits will be available as the FDIC sells off assets to make depositors whole. Todd Phillips, a consultant and former attorney at the FDIC, said he expects that uninsured depositors will likely get back 85 to 90 per cent of their deposits if the sale of the bank’s assets is done in an orderly manner. He said it was never the intention of Congress to protect business accounts with deposit insurance — that the theory was businesses should be doing their due diligence on banks when storing their cash. Protecting bank accounts to include businesses would require an act of Congress, Phillips said. It’s unclear whether the banking industry would support higher insurance limits as well, since FDIC insurance is paid for by the banks through assessments and higher limits would require higher assessments. Philips added the best thing Washington can do is communicate that the overall banking system is safe and that uninsured depositors will get most of their money back. “Folks in Washington need to be forcefully countering the narrative on Twitter coming from Silicon Valley. If people realise they are going to get 80 to 90 per cent of your deposits back, but it will take a while, it will do a lot to stop a panic,” he said. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on

Facebook,

Twitter and

Instagram.

A person walks past a sign posted at an entrance to Silicon Valley Bank in Santa Clara, California. AP[/caption] Senator Mark Warner, D-Virginia, said on ABC’s This Week that it would be a “moral hazard” to potentially bail out Silicon Valley’s uninsured depositors. Moral hazard was a term used often during the 2008 financial crisis for why Washington shouldn’t have bailed out Lehman Brothers. The growing panic narrative among tech industry insiders is many businesses who stored their operating cash at Silicon Valley Bank will be unable to make payroll or pay office expenses in the coming days or weeks of those uninsured deposits are not released. However, the FDIC has said it plans to pay an unspecified “advanced dividend” — i.e., a portion of the uninsured deposits — to depositors this week and said more advances will be paid as assets are sold.

**Also Read: US closes Silicon Valley Bank in biggest collapse since 2008** The ideal situation is the FDIC finds a singular buyer of Silicon Valley Bank’s assets, or maybe two or three buyers. It is just as likely that the bank will be sold off piecemeal over the coming weeks. Insured depositors will have access to their funds on Monday, and any uninsured deposits will be available as the FDIC sells off assets to make depositors whole. Todd Phillips, a consultant and former attorney at the FDIC, said he expects that uninsured depositors will likely get back 85 to 90 per cent of their deposits if the sale of the bank’s assets is done in an orderly manner. He said it was never the intention of Congress to protect business accounts with deposit insurance — that the theory was businesses should be doing their due diligence on banks when storing their cash. Protecting bank accounts to include businesses would require an act of Congress, Phillips said. It’s unclear whether the banking industry would support higher insurance limits as well, since FDIC insurance is paid for by the banks through assessments and higher limits would require higher assessments. Philips added the best thing Washington can do is communicate that the overall banking system is safe and that uninsured depositors will get most of their money back. “Folks in Washington need to be forcefully countering the narrative on Twitter coming from Silicon Valley. If people realise they are going to get 80 to 90 per cent of your deposits back, but it will take a while, it will do a lot to stop a panic,” he said. Read all the Latest News , Trending News , Cricket News , Bollywood News , India News and Entertainment News here. Follow us on

Facebook,

Twitter and

Instagram.

)

)

)

)

)

)

)

)

)