At the annual review meeting of the finance minister with heads of public sector banks on 6 May, Arun Jaitley said the government will protect from scrutiny of investigative agencies banks that enter into “commercially prudent” settlements to clean up bad loans. The fact that PSUs have run up more than Rs 4 lakh crore of non-performing assets (NPAs) is a crying indictment of the fact that banks have been anything but “commercially prudent” in lending to big corporates. The recent snafu by Bank of Baroda in

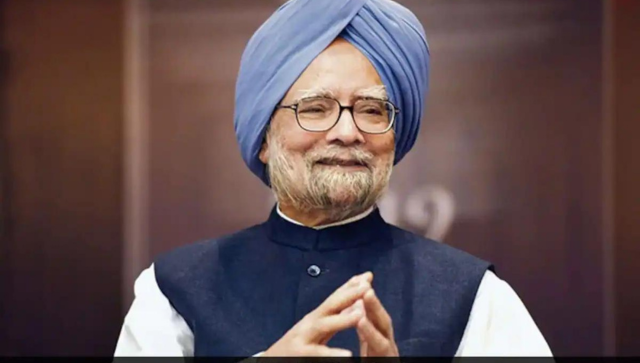

freezing the accounts of Manmohan Singh

, a Uttar Pradesh farmer, for being a “guarantor” for

Vijay Mallya

’s loan, goes to prove that the imprudence in lending is matched and compounded by the shoddy, casual approach in recovering the same bad loans. This case was dismissed as a technical error by BoB. Firstpost dug deep to understand how this ‘technical error’ might have occurred. This series of reports, which attempts to give you a peep into why and how these NPAs are created in the first place, will also demonstrate why the finance minister’s offer of constitutional protection for banks from “commercially prudent” settlements should be extended extremely prudently. On to part 3 of the series:

In two earlier reports in this series, we told you what happened when Bank of Baroda woke up from its deep slumber in December 2015 and decided to recover the Rs 550 crore it had lent to Vijay Mallya.

It froze the account of Manmohan Singh , a Uttar Pradesh farmer with a total bank balance of Rs 5,200 (in two accounts). It also ordered a freeze on the account of Subhash R Gupta , a security guard living in a Mumbai slum redevelopment building. Gupta had all of Rs 93 in his account.

How in the heavens were these two persons linked to a corporate loan of Rs 550 crore was, initially, a matter of mystery and, later, much mirth, highlighted by Firstpost in these reports:

BoB mistook farmer, security guard for Kingfisher directors! and BoB freezes a/c with Rs 93 in quest for Rs 550 crore .

It later turned out that the bank wanted to freeze the accounts of Manmohan Singh Kapur and Subhash R Gupte, two directors on the board of Kingfisher Airlines. Due the “similarity of names” it ended up going after the UP farmer and the Mumbai security guard! The bank quickly reversed the order attributing it to a “technical error”.

The “technical error” did not end there. Even after goofing up on UP farmer and the Mumbai security guard, the bank was not done embarrassing itself.

Firstpost has now identified a third person whose account was ordered seized by BoB. And, shockingly, or should we say, expectedly by now, he turns out to be another regular account holder who had nothing to do with Kingfisher or Vijay Mallya. He is as far away from the glitz-and-glamour world of Mallya as the the other two. He is a vegetable vendor, hawking his wares from a temporary stall near Khar station in Mumbai.

Subhash Ramdulare Gupta’s accounts, too, were ordered frozen because his name is also similar to that of Subhash R Gupte!

Subhash Ramdulare Gupta, stays with his family – 13 persons crammed into a 10 x 10 foot room in this chawl in Jawahar Nagar in Khar East, Mumbai. He operates three accounts – two fixed deposits and one savings – with the Khar branch of BoB. He had no clue that his bank had ordered lien on his life’s savings without as much as a notice to him. He is bamboozled by all the information we try to give him. Vijay Mallya, Subhash R Gupte, Kingfisher, Rs 550 crore loan, everything is Greek and Latin to him. He only manages to say that he will visit his bank and get clarity.

Of course, the bank reversed these orders when it became clear that it had set itself up for ridicule, confusing directors of an airline with a farmer, a security guard and a vegetable vendor. (Gupta has not suffered any financial loss unlike the UP farmer who defaulted on his loan payments because his account was shut down for nearly five months.)

The bank wants us to believe that it’s a simple technical error and move on. But even if we were to believe the bank – it does seem like a great mix up – it’s impossible to move on, without a clear, transparent answer to one basic question: What caused the mix up?

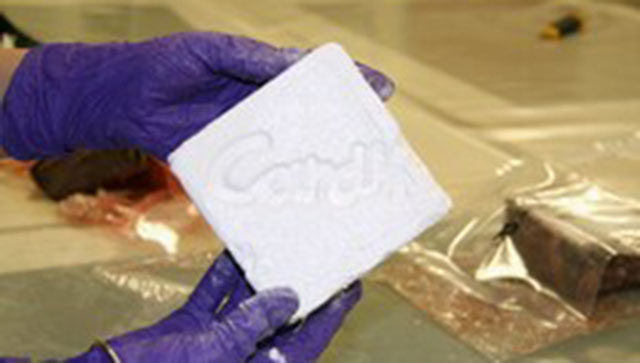

Take the case of Subhash Ramdulare Gupta, the vegetable vendor, for example. In the freeze-list put out by the Nariman Point regional office of BoB, Ramdulare’s name crops up at three places, item nos 6, 7 & 8 (visual below):

His name appears thrice (once as Subhash Ramdulare Gupta and twice as Subhash R Gupta) with three different account numbers, meaning the bank had no clue that all the accounts belonged to the same person. This raises the question of how loosely the know-your-customer norms are enforced.

There’s an even more fundamental and troubling question. The bank has said it wanted to seize the accounts of Manmohan Singh Kapur and SubhashR Gupte but due to “similarity of names” it ended up shuttering the wrong accounts.

In the case of Manmohan Singh Kapur only the account of Manmohan Singh the farmer was frozen. But in the case of Subhash R Gupte, the accounts held by two persons – Subhash R Gupta, the security guard and Subhash Ramdulare Gupta, the vegetable vendor – were ordered frozen. The obvious question that stares you in the face is, why?

Freezing the account of one of the Guptas can be explained as a technical error. But once the name of Subhash R Gupta, the vegetable vendor, was put on the freeze-list at items 6, 7 & 8, where was the need to then add another Subhash R Gupta, the security guard, at item no 9?

That the bank thought that these two Guptas – technically four because Ramdulare had three accounts – were Subhash R Gupte, one of the guarantors to a Rs 550 crore loan, is bad enough. But that the bank did not know that these two Guptas were two different persons is appalling. It’s a strange situation where the bank had one “defaulter” (Subhash R Gupte) but four persons to penalize!

There’s only one explanation to all this confusion at the bank. It was shooting in the dark. All it knew was it had to freeze the accounts of the guarantors to the Kingfisher loan, but it had no freaking idea who they were or how to go about making them accountable for a Rs 550 crore loan to Vijay Mallya.

That’s the scary part of this apparent comic act of BoB. As Paulo Coelho has famously said: “When you repeat a mistake, it is not a mistake anymore: it is a decision.”

And these “mistakes” of BoB take us right back to one decision the bank made. The decision to lend Rs 550 crore to Vijay Mallya and the process and procedure followed. More on that in the fourth part of the series coming up soon.

Here are the links to the previous parts of the series:

Vijay Mallya’s loan: BoB mistook farmer, security guard for Kingfisher directors! Vijay Mallya loan part 2: BoB freezes a/c with Rs 93 in quest for Rs 550 crore!

)

)

)

)

)

)

)

)

)