US President Donald Trump declared his campaign against China in June 2016 and after gaining the presidency blamed China for unfair trade practices and currency manipulations. Trump thereafter raised the issue of China’s entry into the World Trade Organisation (WTO) and blamed his predecessors (Barack Obama and George Bush) for having failed to resolve the issue. The US officials have been accusing the Chinese spies and hackers for stealing sensitive and military information through intellectual property theft to their advantage.

In January 2018, the US imposed the first phase of tariffs on Chinese solar panels at 30 percent (later reduced it to 15 percent), followed by 25 percent tariffs on steel and 10 percent tariffs on aluminium which were imposed in March 2018. China responded with retaliatory tariffs and the war formally began in April 2018.

The second round of tariffs was imposed in August 2018, subsequent to which both nations initiated formal trade talks. The situation worsened further after both countries failed to reach at an agreement till May 2019 after the 11th round of talks.

The last round of US-China trade talks failed on a few sticky points such as China’s demand to remove all tariffs, adhere to the preliminary agreed figure to import goods from the US and no compromise on its dignity over the US demand to pass a law in China to encourage trade.

So far, the US has already imposed tariffs on $250 billion worth of Chinese goods and threatened to impose further tariffs on the remaining $325 billion. China has also implemented retaliatory tariffs on US’s $110 billion worth of goods and threatened the US with further qualitative measures to restrict the American business operations in China.

China plays a major role in the US economy and both are heavily dependent on each other for a majority of goods and services. China is the leading trade partner and is responsible for more than 20 percent of the total US imports, which amount to $539 billion worth of Chinese goods (in 2018); the US has a trade deficit of $419 billion with China.

The US trade deficit with China rose to the highest levels in the current decade; had the US not taken concrete steps, the deficit could have surged even further. The gross public debt of the US is nearly 105 percent of the gross domestic product (GDP) currently, rising sharply from 68 percent at the start of the 2008 recession. At the prevailing interest rates, a widening trade deficit along with higher gross national debt results in increased interest servicing costs.

The US-China trade deal is affecting both nations. Consumer and industrial activity in both countries slowed in the past six months. A worsening trade situation in both the nations is likely to cost 0.5 percent and 0.1 percent to the Chinese and the US GDP respectively. In a recent release, Chinese retail sales growth dropped to 7.2 percent year-on-year (YOY) in April 2019, which was the slowest in the last 16 years. Growth in industrial production also slowed to 5.4 percent, which was much below the market expectations of 6.5 percent.

The tariff war will lead to a slump in manufacturing activity and the world economy may go into a recession, as both countries jointly (i.e. US & China) represent 40 percent of the world’s GDP. The US and China may go for a currency devaluation to promote their exports, which may further lead to a fresh currency war afterward. The global equities will see some correction unless the US and China take corrective measures.

The US requires finished products to meet their domestic demand, while on the other hand, Chinese demand revolves around the US electrical equipment, vehicle parts and agricultural products. China has increased the soybeans growing area by 10 percent this year in order to reduce its dependence on imported soybean from the US. In 2018, China imported 88.03 million tonnes of soybean, which was nearly 8 percent lower from the previous year, according to a China Agricultural Sector Development report published in May 2019. The trade war can see emerging nations such as Brazil, Korea and Vietnam taking up a relatively bigger portion of the US imports.

On the contrary, India does not gain much headroom in this situation. India is the ninth largest trading partner with the US; in 2018, it exported goods worth nearly $83.2 billion to the US and imported around $58.9 billion of it with a trade surplus of $24.2 billion. India and China have a unique basket of goods and services to offer to the US which cannot be compensated or replaced easily.

Considering the current situation, we do not expect a satisfactory deal for both nations but believe there is a low probability of a full-blown trade war. The US and China may reach a significant deal with a few tariffs on both sides to keep a tab on the growing US trade deficit. The US will also be under pressure from farmers and is likely to lose some agricultural exports in the absence of any deal.

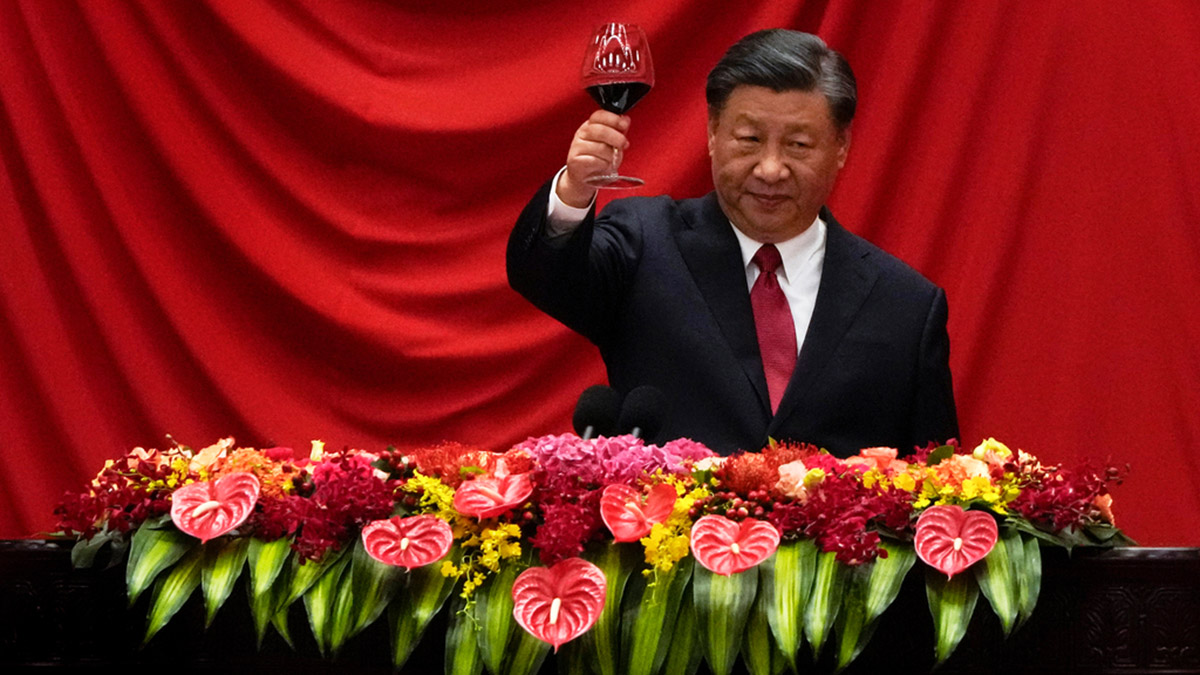

Even China wishes for a meaningful agreement to compensate for its economic slowdown. The next few months will be critical in deciding the fate of the US-China trade deal. We have high expectations from the next G20 Economic Summit, which would be held in Japan on 28 and 29 June. Trump will be meeting his Chinese counterpart President Xi Jinping, and hopefully an outcome shall be reached shortly.

(The writer is chairman, ABANS group of companies)

)

)

)

)

)

)

)

)

)