More skeletons continue to tumble out of Punjab National Bank’s (PNB) closet. Reuters reported that over the last five years, 8,670 loan frauds in public sector banks resulted in a loss of Rs 61,200 crore. And like Abou Ben Adhem, PNB’s name led all the rest, with 389 cases totalling Rs 6,162 crore. Public sector banks accounted for just 18 percent of the frauds in number, but 83 percent by value.

It might be tempting to treat the Nirav Modi instance as an isolated one, but nothing could be further than the truth. In fact, it highlights the inherent risk of fraud when the balance sheets of two or more banks are connected. Banks lend in syndicates and consortia, the leader of which undertakes the responsibility for due diligence and rigid credit appraisal.

Other lenders in the consortia are happy to go by the leader’s judgement, and that is risky. Different banks have different portfolio structures, and it’s entirely possible that being part of a new consortium may require a diligent credit review. When their balance sheets are connected, the vulnerability to fraud in another institution is also higher. The regulator is worried; it’s high time the banks were too.

The Reserve Bank of India’s (RBI) taxonomy of fraud details three types: deposit related, credit-related and services related. New payment systems, electronic banking and other developments have cut down deposit-related fraud dramatically. But credit-related fraud, especially in the present scenario of ever-rising non-performing assets or NPAs, is a growing danger.

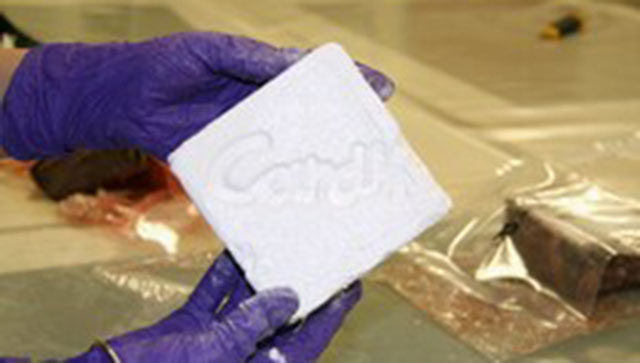

In the last few years, credit-related fraud accounts for two-thirds of all frauds by value. Within this sub-category, the RBI reported in 2014 that documentary credit – letters of credit (LCs) and the now infamous letters of understanding (LoUs) were the principal worry. And cyber frauds represent the third type, or services fraud, but these too are relatively small compared to credit-related fraud.

But let’s return to the correlation between NPAs and fraud, which is the larger question that the Nirav Modi case raises for all banks. At what point does an NPA become a fraud? Bankers have talked about many cases that fit the following type: A bank, or a consortium, sanctions a combination of fund and non-fund based credit company X. In short order, in three years, say company X is declared an NPA.

When the bank conducts an investigation, it discovers potential ‘siphoning off’ funds through connected parties. Most of the LCs were issued in favour of a third party, most likely related to the promoter of company X. Deeper investigation reveal no business activity carried out by the related party.

The exercise also shows a huge sum of money invested in property, and/or shifted to other business ventures. Financial ‘irregularities’ begin to emerge in the financial statements of company X. In keeping with RBI guidelines, company X is declared a ‘wilful defaulter’, but not a fraud, despite the nature of promoter activities. Because a fraud would require higher write-offs and banks are extremely reluctant to do that. Call it willful blindness.

A quick hark-back to the Nirav Modi issue raises another bogey for banks. Now that PNB claims that the staff in the foreign branches of the other two banks, Allahabad Bank and Axis Bank, participated in the fraud, PNB is not liable to meet its commitment to pay them. In other words, the ‘fake’ LoUs are not IoUs. Should PNB continue to insist and persist with its claim, the courts may come into play.

And that adds another dimension to the issue, not to mention complexity to inter-bank relationships. The idea of one public-sector bank potentially taking another public-sector bank to court raises a whole new set of problems for the government that owns both. It may also test the boundaries of contract law and how that figures in documentary credit.

The correlation between NPAs and potential fraud in public sector banks raises all kinds of red-flags, something that the RBI itself has pointed out, in a speech by none other than former deputy governor KC Chakraborty; chairman and managing director of PNB is also on his resume, from 2007-2009. Another red flag is about corporate governance, and yet another about the efficacy of credit appraisals as pointed out by another RBI deputy governor R Gandhi.

The RBI’s latest report on Trend and Progress of Banking in India 2016-17 has a couple of interesting numbers that raise other red flags, at least in terms of due diligence and the care that banks will have to take in dealing with documentary credit.

A review of off-balance sheet items, where LCs and LoUs figure, shows an amount of Rs 3 lakh crore plus of such items as the scale of exposure for the banking system, which includes claims not acknowledged as debt, liability for partly paid investment, bills rediscounted and LCs.

Could we expect renewed scrutiny of all documentary credit undertaken as a risk management and control exercise? It’s possible that there may be clean-ups in other banks, and that is a good thing.

In addition, one more thing is necessary: a review of internal and statutory audits, and auditors. They are part of the external independent control system, and given all the warnings by the central bank others over the last 18 months, it’s only natural that their efficacy be challenged.

The PNB case is a serious wake-up call for public sector banks to look at a number of their systems and operations. History has shown that crisis-like conditions actually make it easy to push through difficult changes, and we are on the cusp of a crisis when it comes to banking system stability. As Walter Bagehot, who became editor-in-chief of The Economist in 1860 pointed out, “Adventure is the life of commerce, but caution is the life of banking.” Now is the time to exercise it the most.

)

)

)

)

)

)

)

)

)