The first GDP data release after the demonetisation of the Rs 500 and Rs 1,000 notes showed that the economy may have weathered the impact of the unexpected note ban and the cash squeeze as the growth during October-December stood at 7 percent.

The rise in the GDP has come as a surprise as the print is much higher than the estimates by various polls.

A CNBC-TV18 poll of economists had estimated the economic growth at 6.1 percent. A Reuters poll saw economists estimating the growth falling to a near three-year low due to the slowdown in demand following the ban of high-value currency notes.

Modi’s announcement on 8 November ordering the removal of 500-rupee and 1,000-rupee notes took out around 86 percent of the currency in circulation, putting activity on the skids in a predominantly cash-reliant economy. Several economists were uncertain about the full impact of the currency ban.

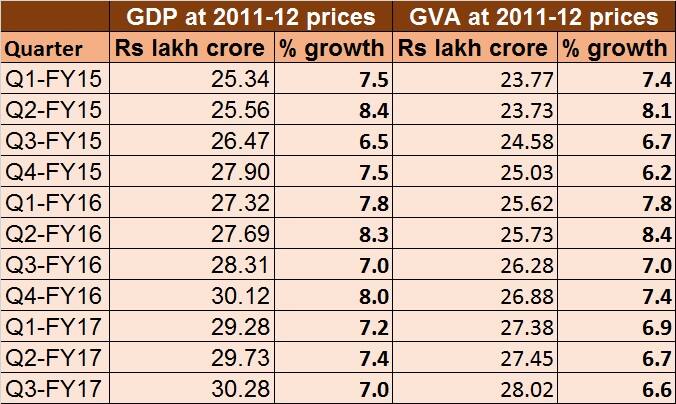

In July-September, the GDP growth stood at 7.4 percent (revised) and in the year ago period 7 percent (revised).

The agriculture sector growth in the third quarter stood at 6 percent compared with 3.8 percent (revised) in the previous quarter and (-)2.2 percent (revised) on year.

The third quarter GVA stood at 6.6 percent, also better than expected. This is against 6.7 percent (revised) in the previous quarter and 7 percent (revised) a year ago. For the full year 2016-17, GDP has been seen at 7.1 percent.

The mining sector output during the quarter stood at 7.5 percent as against a contraction of 1.3 percent in the previous quarter and a rise of 13.3 percent a year ago.

The services sector growth, meanwhile, stood at 6.8 percent as against 8.2 percent on quarter and 9.4 percent on year.

Industries growth stood at 6.6 percent compared with 4.6 percent in the previous quarter and 9.5 percent a year ago.

When asked whether the impact of note ban has been captured in the numbers released, chief statistician TCA Anant said at the press conference: “I don’t know what you mean by not captured. I can only tell you what the third quarter number shows. We have only the advanced filings of corporates. More numbers will be coming in the future. These are the numbers we have now. You may interpret the way you want.”

However, economists were surprised and doubted whether the numbers are indeed reflecting the pain of demonetisation.

Aneesh Srivastava, chief investment office, IDBI Federal Life Insurance Co, said that he was “totally surprised”.

“This is much higher than expectations. Perhaps this data is not capturing the impact of demonetisation. I am totally surprised and stunned to see this number. This is totally ahead of our expectations and I believe that, with a lag, we will see an impact on GDP numbers,” he told Reuters.

A slew of revisions to earlier GDP numbers only added to the confusion. For one, the government has revised upward the GDP data for first quarter 2015-16 from 7.5 percent to 7.8 percent, second quarter GDP to 8.3 percent from 7.6 percent, first quarter FY17 GDP to 7.2 percent from 7.1 percent, and second quarter number to 7.4 percent from 7.3 percent. The only number that got revised downward was that of third quarter of last financial year from 7.2 percent to 7 percent.

Data inputs from Kishor Kadam

)

)

)

)

)