The first obvious inference from the Gross Domestic Product (GDP) number for the October-December quarter at 7 percent, released on Tuesday, is that the demonetisation hasn’t significantly altered the growth story. At least not to the extent warned by a section of the economists and multilateral agencies including the International Monetary Fund (IMF). But it still tells that the demonetisation would have indeed slowed the growth from 7.9 per cent in 2015-16 to 7.1 percent 2016-17, but the bad news should hopefully end there. Only the final, full year figure will tell the whole story.

Not only the CSO retained its first advance estimate of 7.1 percent growth for the full fiscal year, but it also offered a set of numbers that show business was as usual in the third quarter — a period when a severe, artificial cash crunch hit the cash economy (constituting 78 percent of the overall) for about two months. Prime Minister Narendra Modi had announced his decision to demonetise Rs 500 and Rs 1,000 notes in a televised statement on 8 November, which sucked out 86 percent of the high value currency notes in a stated objective to curb the so-called black money (cash which is not accounted to legitimate income sources or taxed). The withdrawal of currency notes resulted in a cash short supply affecting many businesses.

How should one look at the GDP numbers? It tells us, certainly, that underlying positive growth trends continue — or at least the CSO believes so. According to government statisticians, the economy is not collapsing post the note ban shock-therapy. One shouldn’t be too perturbed debating whose economic growth projections have come right and who all have got it wrong. What is important is to look at the data — the hard numbers — and understand what is really happening on the ground. Here, it is not just enough to look at the GDP numbers alone in isolation, but a set of high-frequency data that would give us the larger picture.

When one does this, it gives an impression that the third-quarter GDP number is largely a pleasant statistical surprise and does not quite add up to certain other vital set of information which should ideally corroborate the headline GDP numbers.

Quick Reads

View AllTo understand this disconnect and the possible reasons, a closer look at certain issues is warranted.

One, the biggest surprise is the manufacturing sector numbers. According to the CSO’s GVA sectoral break-up, the manufacturing sector grew by 8.3 percent in the October-December quarter compared with 6.9 percent in the Q2. Such a jump is perplexing given that the factory output numbers for the last three months has shown a contradicting picture. According to Index of Industrial Production (IIP) data, the manufacturing sector growth contracted in October by 2.4 percent, grew by 5.5 percent in the November and again contracted by 2 percent in December. If one looks at the year-on-year cumulative numbers, there has been actually a negative growth in all these three months.

Two, why the bank credit to the sector doesn’t show a corresponding increase if the sector has actually grown? According to RBI data, bank credit to industry contracted by 4.3 percent in December 2016 in contrast with an increase of 4.9 percent in December 2015. The manufacturing sector, thus, shows a sharp positive jump in the GDP data and opposite trend in the IIP data and bank credit trend. Given that both GDP and IIP data are collated, compiled and released by the CSO and should reflect same trend, how will the agency explain this disconnect?

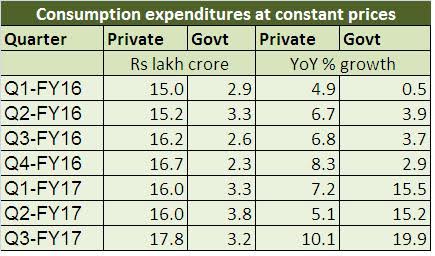

Three, both the private and public consumption numbers are equally confusing. The CSO numbers tell us that the private consumption has picked up sharply in the third quarter. It actually rose by 10.1 percent in the quarter almost doubling from the preceding quarter growth of 5.1 percent. But, if one looks at the trends in consumer spending and consumption, one again gets a contradicting picture. Main among them is the two-wheeler sales numbers and earnings pattern of consumer-focused companies during the period.

According to this report, sales of Bajaj motorcycles declined by over 3 percent in the third quarter, Hero witnessed a negative growth of 13.54 percent while Honda two-wheelers saw a growth of a mere 2 percent. Similarly, if one looks at the trends in the FMCG sector, the story is no different. According to data from market researcher Nielsen (read reports here and here), sales of the industry have gone down by 1-1.5 percent or Rs 3,840 crore in November, compared with October. There has been a 20-40 percent fall in sales of biscuits, salty snacks, toilet soaps, shampoos and washing powders, the data from Nielsen shows. Sales of refined oil, agarbattis, beverages and packaged tea fell about 3-4 percent.

Once again, the IIP data comes handy for reference. The consumer goods, durables and non-durables have done poorly in the December quarter. In fact, in December, growth in consumer durables contracted by 10.3 percent from 9.4 percent in November and 0.6 percent in October. Non-durables declined by 5 percent in December, after contracting 2.9 percent in October and showing a marginal pick up of 2.5 percent in November. Note that December is the month which actually began showing the demonetisation impact. Quite a statistical wonder isn’t it?

Now look at the public spending figures. The CSO estimate on Tuesday shows the government consumption figures have grown sharply in the third quarter, by 19.9 percent as compared with 15.2 percent in the preceding quarter. There has been surely a pick-up in the government spending in the last three quarters but again, the IIP numbers say a different story. According to this data, the capital goods segment, which is an indicator of the investment activity on the ground, has actually contracted 3 percent in December, declined by a massive 27 percent in October though showed an uptick of 15 percent in the November month. To be sure, the base year for both IIP (2004-05) and GDP numbers (2011-12) are different. But such a sharp contrast is surprising.

Four, certain revisions in the CSO’s previous estimates are baffling. The growth in mining and quarrying in the second quarter of fiscal year 2016 has been revised sharply upwards to 13.9 percent from 5 percent earlier. The growth in same segment for the third quarter of FY16 has been revised upwards to 13.3 percent from 7.1 percent. Similarly, in Q1 of FY16, the GDP figure has been revised upwards to 7.8 percent from 7.5 percent, while that of Q2 has been revised upwards to 8.3 percent from 7.6 percent. Revisions in the final numbers are normal from provisional estimates, but to this extent baffling.

Five, one tends to think whether the sorry picture of the informal sector, especially, the job losses and impact on small businesses is totally missing from the GDP data. According to (read a report here) a study by the All India Manufacturers’ Organisation (AIMO), the country’s largest organization of manufactures, in the first 34 days since demonetisation, micro-small scale industries suffered 35 percent job losses and a 50 percent dip in revenue. AIMO, which claims representation of 3 lakh companies also predict a drop in employment of 60 percent and loss in revenue of 55 percent before March 2017. Assessing the impact of the informal sector is crucial since this is where the maximum impact of cash-crunch is reported. This is true for small traders, vegetable vendors, services sector and construction workers. Is the economic impact of note ban on these segments captured in the GDP figures?

The bottomline is this: The 7 percent GDP number in the third quarter is indeed a pleasant surprise, and if it depicts the true picture, offers the much-needed good news to the struggling economy. But, the GDP figure also offers us a statistical puzzle that the government’s statisticians will have to explain, connecting the missing dots.

(Kishor Kadam contributed to this story)

)

)

)

)

)

)

)

)

)