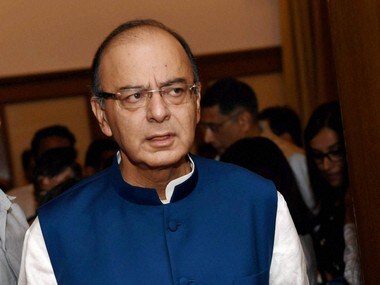

The government on Tuesday launched a website on ‘Operation Clean Money’ in a bid to bring illegal wealth on books, moving a step ahead in its battle against black money. According to the government, the operation clean money portal will give details of high risk areas like petrol pumps and jewellers to help increase awareness about tax compliance. A tax payer can also go to the website and take a pledge of paying taxes and this will aid in ensuring voluntary compliance. For the uninitiated, Operation Clean Money was the programme launched by the government on 31 January after the government’s demonetisation period ended on 30 December, 2016. It was launched to e-verify large cash deposits made during 9 November-30 December, 2016. According to the government, as many as 17.92 lakh people were identified for unexplained deposits post demonetisation and the income tax department has identified one lakh suspected tax avoidance cases. [caption id=“attachment_3371888” align=“alignleft” width=“380”]  Finance Minister Arun Jaitley. PTI[/caption] The website has been launched to help create awareness about black money and also to help those those who want to come clean on demonetisation cash deposits. According to the government press release, there are three salient features for the portal: 1) It seeks to provide comprehensive information at one place consisting of step-by-step guides, frequently asked questions, user guides, quick reference guides and training toolkits related to verification process of deposits made during the demonetisation and other issues. 2) It also helps enable citizen engagement to increase tax compliance. “Citizens would be able to support the Operation Clean Money by taking pledge, contribute by engaging and educating fellow citizens, and share their experiences and provide feedback,” the release said. 3) It will enable transparent tax administration by sharing status reports on (including sanitised cases and explanation of verification issues) and thematic analysis reports (e.g. taxpayer segment analysis of cash deposit data), the press release said. The website has detailed FAQs on e-verification and e-filing of tax returns. Those who want to know how to go about the processes, just need to click the ‘I am a citizen’ link on the portal. There are other links for reporting entities and also tax professionals, detailing their responsibilities and processes. However, according to a report in NDTV, the government will not name and shame the tax defaulters or those who have disclosed their deposits during the demonetisation period. “Naming can be a problem. A transaction initially may look suspect. Naming will mean condemning a person publicly even before he or she has been given a chance to clarify,” a government source has been quoted as saying in the report.

Operation Clean Money website seeks to provide detailed information on how to come clean in case of cash deposits made during demonetisation

Advertisement

End of Article

)

)

)

)

)

)

)

)

)