Share prices fell across markets from Tokyo to London on Thursday as concerns over future growth meant investors now have less appetite for risky assets like equities.

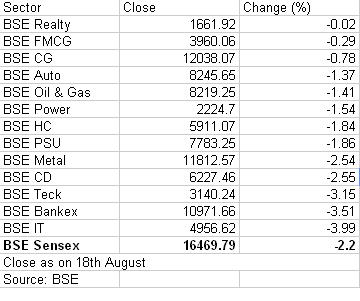

In India, the NSE Nifty touched a 52-week low during the trading day. It recovered from that level to close 2.2 percent below the previous close. The 30-share BSE sensex also fell 2.2 percent. (See table) Indian shares were the worst performers in the Asia-Pacific region.

IT sector shares were the hardest hit as a slowing growth globally could mean poor business environment. The BSE IT sector index fell 4 percent.

The BSE Bankex also fell 3.5 percent. Analysts have raised concerns about rising non-performing assets and an increase in provisioning going forward for public sector banks. This could put further pressure on their profitability.

Foreign institutional investors (FIIs) have pulled out $ 1.5billion so far from Indian equities in the first two weeks of August 2011. They were net buyers in July 2011 by $ 1.5billion. This means the money put in July 2011 was pulled out in two weeks.

Analysts and pundits are factoring in lower earnings growth for Indian companies for the year ending March 2012. A survey of leading economists and analysts by the Reserve Bank of India puts the earnings per share (EPS) growth at 12.2 percent from an earlier estimated 20 percent.

Stephen Roach, non-executive chairman of Morgan Stanley Asia told CNBC-TV18 that that Euro zone crisis is far from over and may see further adjustments in global equity markets. Morgan Stanley has cut global GDP growth forecasts to 3.9 percent in 2-11 and 3.8% in 2012. Roach further warned that both the US and Europe are hovering close to recession.

Foreign securities firm Credit Suisse (CSFB) said in a note this morning that the earnings growth could fall to as low as 8 percent for NSE Nifty companies for March 2012 from the current 17 percent (year ended March 2011).

“We reiterate that we are at the beginning of a period of uncertainty globally, and it is far from the end,” CSFB said.

Inflation remains a key area of concern. The RBI survey of forecasters on macroeconomic indicators expect a further hike in rates up to March 2012. They also expect India to report a higher fiscal deficit than estimated earlier due to increase in the government spending. High government borrowing means more money to be printed. This further adds to the inflationary trend.

“While China’s room for policy manoeuvre is building, India’s remains cramped,” BNP Paribas said in an Asia economics analysis note.

)

)

)

)

)