Data News - Page 6

Nifty, Dow close to break-point: US dollar at resistance

The Nifty, Dow and US dollar have reached crucial points from where if the dollar rises, the equity indices could fall

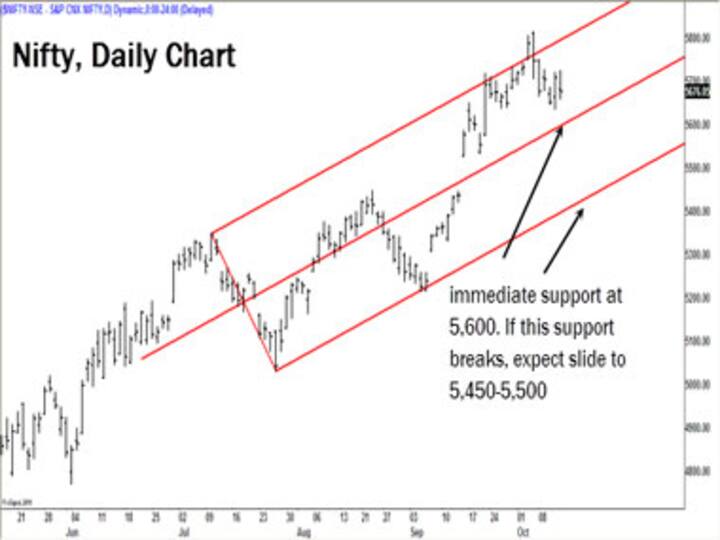

Big Nifty move likely after downside correction

A fall below 5,590 would indicate that a slide to 5,450 is underway; a move past 5,730 would confirm a rise to 6,000.

Nifty in correction mode, but the bulls are still in business

The Nifty is in a minor correction phase. The bullish trend would be in question only if the Nifty falls below 5,450

Why gold bugs should pray for a Mitt Romney victory

The currency presses have debased the dollar, the rupee and every kind of fiat money. Only gold has escaped debasement.

Nifty heads for 6,000; banks stocks gain traction

Frontline banks stocks like SBI, Axis Bank, and ICICI Bank have displayed strong momentum in recent weeks, and this is a good sign<br /><br />

Market mood shifts in favour of mid-caps stocks

The Nifty remains in bullish territory. But the market is moving towards mid-cap stocks like Redington, Corporation Bank, and NIIT Technologies.

Contrarian view: The charts still favour the Nifty bears

The fundamental view on the markets is that reforms will push up the indices. But the technical charts give us cause for pause.

Bull signal: Nifty on course to target 6,000 next

As long as the Nifty trades above the support at 5,400, it would reasonable to expect the Nifty to hit the target of 6,000. The CNX Bank Index too is bullish

Watch the Bank Index - and SBI, NIIT Tech and IDFC

The rebound in the Nifty was driven in part by the sharp surge in the Bank Index. But the latter is still to cross its resistance zone.

Let Nifty prove itself, but it's time to punt on cement stocks

The Nifty's bounce is interesting, but to confirm a rally, it will have to move beyond 5,450; but several cement stocks are ripe for a fling

Nifty enters a bullish zone, and a bounce is expected

The US and European markets may impact Indian equities, but the Nifty has entered a bullish zone which will be the most important reason for the bounce.

Nifty bulls shuffle their feet; rally has no real strength

If the Nifty falls below 5,330, it would be an early sign that a short-term downtrend is underway. It could then slide to the major support at 5,195.

Go easy on Bank Index; but HDFC Bank could be a good punt

The Nifty moved past a small resistance, but the follow-through was not strong. This means one should focus on strong stocks rather than the indices

Bears still not flushed out of Bank Index, so watch out

Neither the Nifty nor the CNX Bank Index are in bull territory. In stocks, Jaiprakash is bearish, while Dishman Pharma has a positive outlook

An ounce of bounce: Nifty seems poised to test 5,300 again

The Nifty is regaining some of its bounce, but the dollar and gold have a mixed outlook. A lot depends on what the moneymen in the US and eurozone do

Chart: If 2-wheelers sales fall, can HUL be far behind?

A recent Goldman Sachs report has pointed out that slowdown in sales of scooters and motorcycles portends negatives for Hindustan Unilever Ltd (HUL), apparently with a quarter's lag.

S&P Nifty steadies with recovery, Bank Index lowers

The S&P CNX Nifty was in line with expectations, the index ruled weak and also tested the support zone of 5,100-5,120 mentioned last week.

Chart: Mutual funds offload stake in IDBI, Titan, Coal India

At a time when foreign investors are bullish on India and have increased their stakes in many companies so far, domestic funds have been net sellers.

Nifty, Bank Index are in bear mode; bank stocks divergent

The risks are now all on the downside for NIfty and the Bank Index. Traders should thus be more focused on specific stocks.

Chart: FIIs increase stake in 32 cos in June quarter

Among Sensex companies, only HDFC, HDFC Bank and Tata Consultancy Services have seen a rise in FII interest.

Nifty will be nervous in results season; not time for big bets

One should expect volatility over the next months as Q1 results are dished out daily. Nifty, the Bank Index and even the rupee will be skittish

Nifty is in will-it-won't-it zone; but many stocks are a buy

The Nifty is still digesting its last big upmove. It has to clear its next resistance for a further rally. But stocks like IDFC, Dr Reddy's, Titan and Voltas are worth a second look

ECB easing leaves markets cold; but India on a different trip

Despite the European monetary easing, the markets did not rise - but India held firm. Does this mean the markets finally know that easing won't work?

Chart: India tops MSCI indices in 2012, will the party last?

Indian equities have risen 13.1 percent followed by the US (8.3 percent) and Poland (6 percent). Brazil, with a fall of 9.5 percent, was the worst performer.

Aviation losses increase in 2012; profitability key to survival

According to data compiled by Firstpost, combined losses of the three listed companies increased to Rs 4,170 crore in 2011-12 from Rs 917 crore the previous year.

Short-term bull view: Nifty on course to hit 5,350

A look at chart patterns in the index heavyweights supports the bullish view. The Nifty and the Bank Index appear to be on a uptrend.

Chart: Brent below $96, lowest since Jan 2011

Oil hit multi-month lows this week on concerns that Spain's soaring bond yields could eventually lead to an international bailout for Madrid, but investors hope any further monetary easing by the US will boost liquidity and support prices.

Govt acts tough with rich PSU, asks to invest more

Many PSUs have been asked to invest their spare cash or park a portion those funds with the government.

Nifty bias is still upwards; but volatility will be a risk too

A news-heavy week lies ahead. But the positive outlook would be under threat only if the Nifty falls below the support level of 4,940.

Stake sale buzz: JP Associates looking to ease debt burden

The Aditya Birla Group (Ultratech) and France's Lafarge are in talks to buy out JP Associates' cement plants in Gujarat and Andhra Pradesh.