Data News - Page 10

Q3 earnings: Rupee fall to boost margins at IT companies

Hints of delays in decision making or budget cuts by clients could send investors running out of IT stocks and dampen sentiment for corporate India.

Clients: The secret behind Power Trading Corp's 30% fall

PTC's receivables (money due from clients) have almost doubled to Rs 2,300 crore now from Rs 1,000 crore in the June-ending quarter.

Decoding how digitisation is a positive for cable TV

Mandatory digitisation would better equip the industry to compete with the direct-to-home companies at competitive prices.

Dhanlaxmi Bank: An unlikely hero in a stressed market

The stock was up 15 percent in mi-day trade and has consolidated now, up 8 percent.

Copper trend confirms long term global bear market

The global equity markets are in for a long-term bear market. Trends in copper confirm this. They keys to a medium term revival rest with India and China turning around.

Is US the next Japan? Why the Tea Party is better than Obama

If the US is not to meet the fate of Japan - stagnation and no growth - it will have to abandon its money-fuelling policy and Keynesian predilections and opt for supply side economics.

Why Ranbaxy's gain from Lipitor deal is short-lived

Only if the company sells the generic version of Lipitor, will there be further potential in the stock, everything else is already factored in the current share price.

Dollar sell-off likely, rally in risky assets back on the table

The dollar index, which measures the greenback against six major currencies, has reached a level of resistance between 79.50 and 79.90.

Dollar consolidates, 10-year bonds rally to new high

The US dollar consolidated and the treasuries rallied despite the potential of a US credit downgrade and possible default.

Bulls have upper hand, but don't count your chickens yet

The technical picture of index heavyweights such as Infosys Technologies, State Bank of India and Reliance Industries indicates that the bullish camp seems to have the upper hand. But keep your fingers crossed.

Here's something that will scare the hell out of Jet Airways' investors

Jet Airways reported a steep loss of Rs 714 crore for the September-ended quarter- the sharpest fall ever.

Crude oil's uptrend faces challenge

Increased demand and falling dollar had pushed up crude prices; now, with fears of slowdown, the price is falling drastically and the dollar is rallying.

Stocks may get a short-term fillip from S&P 500 rally

Technically, the Indian markets are in bearish territory. But if the US S&P 500 stages a rally as it enters the demand zone, there could be a sharper - but short-term - rally in India. At the very least, there is a case for not short-selling too much.

Will bear market rally end? Look at US T-bonds, gold

The smart rally last week in 30-year US Treasury indicates that risk-aversion is again rising. This means the recent bear market rally may be teetering on the brink.

The short-term is bleak for stocks; only gold is bullish

The crash in equities the world over impacted the Sensex, too. The chart patterns show that the indices will fall slowly. Gold is still bucking the trend and appears bullish.

Why public sector banks are out of favour for markets

Investors are also showing a clear preference for private sector banks over public sector banks within the sector.

Market has evaded bear grip, mid-caps offer some action

Till the Sensex breaches 18,673, there can't be a bull signal. But investors willing to play the waiting game may accumulate stocks such as Dish TV, Godrej Industries, Pidilite Industries, Petronet LNG, Bhushan Steel or SKF India.<br /><br />

Why weak $ continues to rally, despite strong crude and gold

Despite being hobbled by a weak US economy, the dollar is still capable of a small rally. But fundamentally it is crude oil and gold that are still bullish.

Punters think DCB, Karnataka, LVB, City Union Bank may be next M&A targets

The quick run-up in some private bank shares suggests that some of them may be in line for a takeover in the wake of the Kotak Mahindra-ING Vysya Bank merger

Happy days? Retail inflation is falling with a thud; small signs of industrial recovery

Retail inflation is falling rather quickly due to food and fuel prices. Capital goods growth is also looking good. Now, if only consumer confidence will revive, it would truly be time to call it achche din.

Wondering where to get that MBA from? Try Harvard B-school, it tops the billionaire alumni list

According to the study, Harvard's MBA program has produced nearly three times more billionaire graduates than that of Stanford University

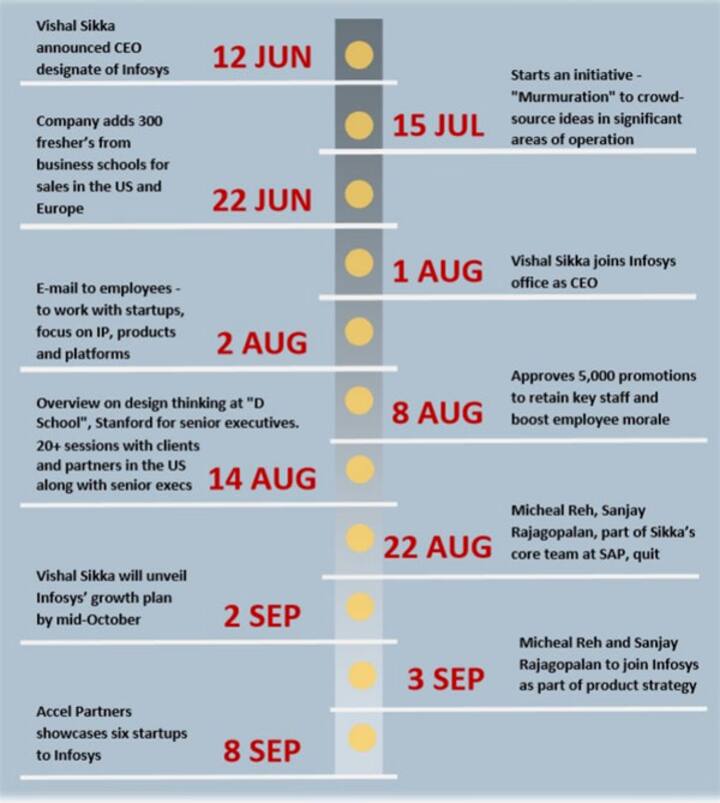

Infosys' stellar Q2 results: How CEO Vishal Sikka plans to transform company

Here's a snapshot of all that Sikka has done since he took over as CEO of Infosys<br />

Modi's savings fall by Rs 40 lakh, Jaitley richest minister with assets worth Rs 72 cr

Did you know that India's finance and defence minister Arun Jaitley is the richest minister with assets totaling Rs 72.10 crore, while Prime Minister Narendra Modi's assets have actually dipped by Rs 40 lakh since his last declaration in April to Rs 1.26 crore reportedly because of the big donation he made tot he cause of the girl child in May.<br />

Why travel stocks are cheering Modi's promise to liberalise visa norms for NRIs

The move is expected to provide the promised push in the tourism sector and travel company stocks were boosted by the news. <br />

Not just Alibaba: Check out the largest US IPOs of all time in one single chart

Chinese e-commerce giant Alibaba priced its initial public offering at $68 a share, enough to make in the largest US IPO in history. The stock will begin trading Friday on the New York Stock Exchange under the symbol, "BABA."<br />

Do companies with more women directors do better? Correlation is not causation

There are simply too many studies that jump to conclusions based on correlations. There are many things you can't infer from a regression analysis

Good news! August car sales figures hint at start of auto sector turnaround

Domestic passenger car sales grew by 15.16 per cent to 1,53,758 units in August this year as compared to 1,33,513 units in the same month of 2013.

Modi's 100-day magic: Equity investor wealth surges Rs 11,381 cr daily

On the 100th day of Narendra Modi's prime ministership, the benchmark Sensex scaled 27000 mark and Nifty 8100 mark -- a pleasant gift for the investors.<br />

At $9.4 bn, HDFC Bank pips Bharti Airtel as India's most valuable brand

Valued at no. 2 position is Indian telecom brand Airtel, with State Bank of India is valued at no 3.

Modi factor: Number of billion dollar babies in Indian markets up 48% in a yr

Investors pumped money into equity assets, betting on the prime ministership of Narendra Modi.