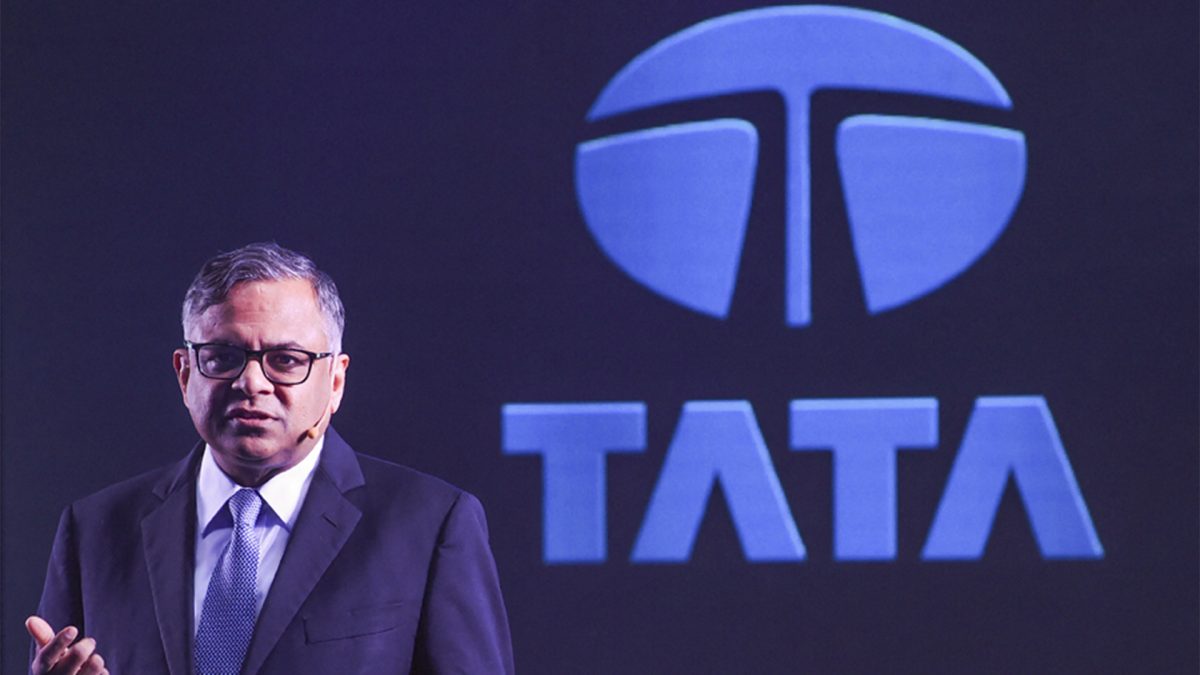

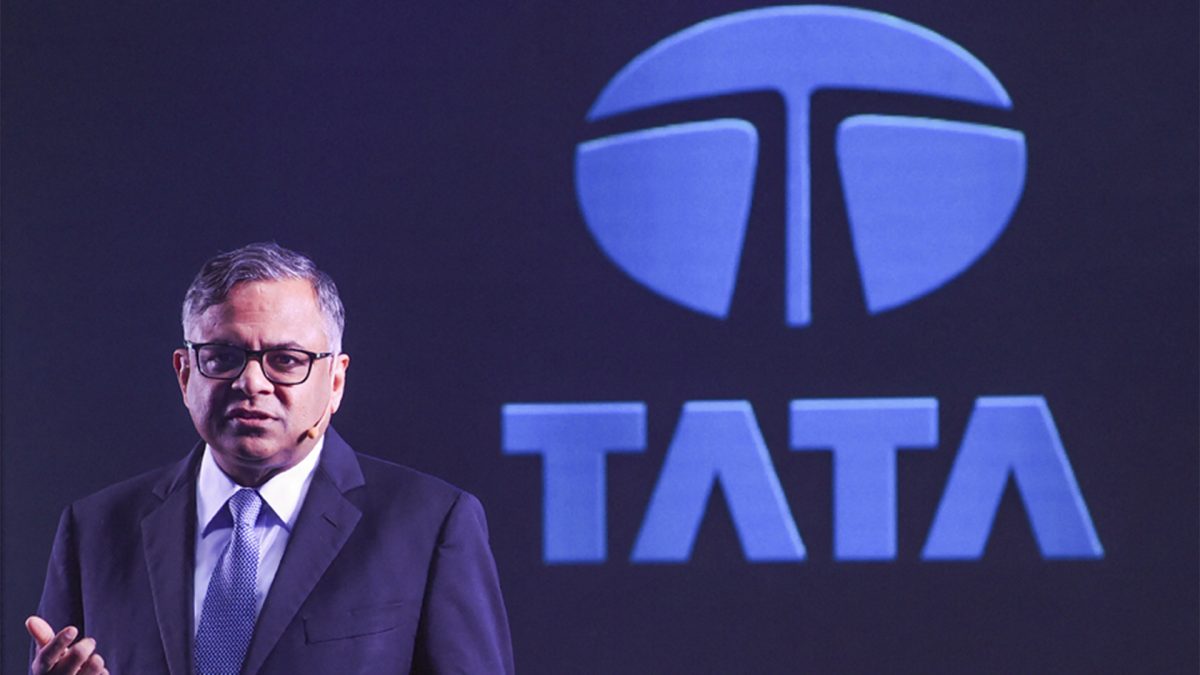

The Tata Group, one of Britain’slargest employers in the manufacturing sector, has warned thegovernment over its commercial tax rates system, saying it ismaking Britain less attractive for the industry.

Joining hands with American auto giant, General Motors,the Indian multinational conglomerate lamented that businessrates are five to 10 times higher in Britain than equivalenttaxes in the rest of Europe.

The two companies are particularly opposed to the factthat plant and machinery fall within the levy while otherkinds of equipment like IT hardware do not.

“Large-scale manufacturers constantly need to invest inupgrading their machinery. But these improvements are takeninto account in revaluations, leading to higher businessrates,” Andy Pickford, Tata Steel’s director of property, told_The Sunday Times._

“A change for the better would be to do away with thisdisincentive to invest by removing manufacturing plant andmachinery from rates assessments,” Pickford said.

Last month, Tata Steel cut 400 jobs at its factory inPort Talbot in south Wales - a move it partly attributed tobusiness rates, as well as high energy prices andenvironmental costs.The company lost around 16 million euro in Europe theyear until March, against a loss of 283 million euro in the

previous year.Business rates contribute around 22 billion pounds to theUK Treasury every year.

However, Chancellor George Osborne had raised hopes of areview in the last year’s autumn statement. But there arefears that any reform could be reduced to tweaking because thetax is so lucrative.Tim Tozer, chairman of GM in Britain, said the currentbusiness rates system is fundamentally flawed and worksagainst manufacturing.

“The system is based on hypothetical rental values wherethere is no rental evidence for large-scale manufacturing.Manufacturing is also further penalised in the current systemwith plant and machinery considered part of the rental value,so investment in manufacturing equipment results in an

increase in business rates,” Tozer said.

The British Retail Consortium is also calling on the mainpolitical parties to include a fundamental overhaul ofbusiness rates in next year’s election manifestos.

PTI

)

)

)

)

)

)

)

)

)