Blogs News - Page 22

Why Kingfisher Airlines is right in asking for a bailout

India bailed out many sectors hit hard by the 2008 crisis. If the government does not bail out Kingfisher, it should have a clear-cut policy of not bailing out any company that is in trouble.

2008 won't end till we know if Laura can pay

We will never really escape the ghosts of the 2008 recession until we start honestly answering the most basic questions.

Will India go the Argentina way toward populist decline?

Neither India nor China can take their growth and political transformations for granted. China may fail to build good institutions, and India may yet fall victim to the lure of mindless populism.

There's a lot the ECB can learn from the RBI

The ECB can save the euro by managing eurozone debt, not by buying its bonds but by making sure each government acts responsibly, just the way RBI is doing with the 28 states.

MTNL, BSNL, Air India: Why govt is bad owner of business

The way government runs businesses into the ground, one wonders why they even bother trying to run them. But privatisation through strategic sales to one buyer may not be a good option. Best to sell public sector shares in bits through transparent stock exchange sales

Debt's big losers: realty, oil, aviation and power firms

Companies with high debt levels are going to be in trouble as banks turn wary. This is also true of government and govt-owned companies.

RBI is shooting itself in the foot over inflation

Sustained and persistent inflation is not an act of god. It is made by mistakes in macroeconomic policy. It can and should be contained by solving these problems of macroeconomic policy.

Why the Buddha never smiled

As we mark the 13th anniversary of Operation Shakti, in which India conducted five nuclear test explosions, and the 37th anniversary of Smiling Buddha, when Indira's India first went nuclear with a test explosion at Pokharan, we find ourselves in the gutter with a bloody nose and several stinking questions.

In Afghanistan, India Inc learns to hang together

Sometime in August this year, some of the largest mining and steel companies around the world will make final bids for the exploration rights to the 1.8 billion tonne Hajigak iron ore mines in the war-torn Bamiyan province in Afghanistan. India's steel first have to collaborate to beat the globo-majors in the mining business<br /><br /> <br /><br />

Consumers and the new addiction: customisation

The consumer today is addicted to customisation. Everything needs to be personal and unique to the consumer. And brands all around the world are noticing this trend.

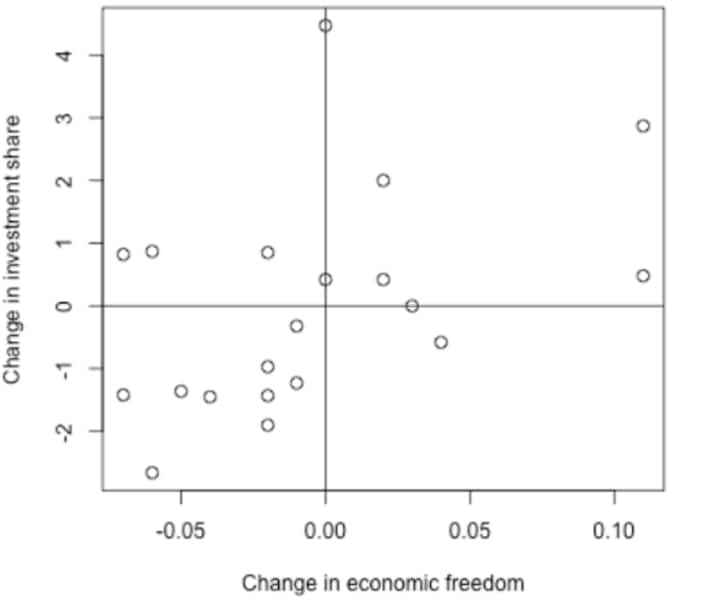

India's economic freedom

Well -functioning countries today are grounded in the yin and yang of political and economic freedom. Liberals suggested that it is important to measure economic freedom across countries and across time.More economic freedom is associated with greater wealth, lower poverty and higher growth.

US agri biz outshines S&P 500. Where do we stand?

Indian Agro companies are getting serious about technological innovation, the Department of Biotechnology is playing venture capitalist

Raising rates will bring down inflation: Here's why

If the RBI's anti-inflationary stand had been credible, it would work better than trying to be all things to all people

Post office, PPF rates set to rise, but not by too much

Faced with a resource crunch, the finance ministry is moving to raise post office deposit rates and PPF rates. But will senior citizens lose out?

Why should finance minister put fresh equity in SBI?

Government-owned banks like SBI should not think it is their right to equity when they need it. They need to do more to plough back retained earnings.

Why didn't Apple just call it the iPhone 5? Here's why

Freakonomics argues that Apple's decision to name the latest iPhone as 4s is bad marketing. It would have done better as iPhone 5. Would it, really?

If your MF isn't profitable, how will it make money for you?

Most asset management companies are not at all profitable. If they can't make money even for themselves, how are they supposed to do that for you?

Who did SBI in? Govt must look in the mirror for answer

Instead of decrying Moody's downgrade of State Bank of India and India, the government should look for a different villain - and look in the mirror

Only result of US Fed's 'Twist' will be a sprained ankle

The US Fed has tried every trick in the book and outside it to dig the US economy out of the ditch. Nothing is working. It's latest Twist is unlikely to fare any better.

The rupee will stay weak in the range of Rs 48-52 against dollar

Thanks to global risk-aversion and the US Fed's 21 September decisions, the dollar continues to remain strong. The rupee will remain weak till the risk-aversion remains

Some interesting readings from the Web

Ajay Shah recommends interesting reads from the media and elsewhere.

What's the secret behind Jhunjhunwala's Pipavav foray?

The structure of the deal makes it look as though Pipavav was more keen to have Jhunjhunwala on board to endorse its stock, which has been having a poor run for some time now.

India needs lower taxes, supply side miracle - not rate hikes

The RBI's rate hikes will not work ultimately. What India needs is a supply side miracle and tax cuts that will stimulate the economy and increase investment.

Logic calls for rate hike, but can RBI bowl from both ends?

The RBI will be damned if it does, damned if it doesn't. But it can't avoid a rate hike unless the finance ministry starts doing its bit to contain inflation.

Why 16 Sep is not a date for investors to worry about

The RBI's next policy review is on 16 September. Chances are it will go slow on rate hikes, if not call for a pause. No matter what it does, investors should bet on the long term.

Will bear market rally end? Look at US T-bonds, gold

The smart rally last week in 30-year US Treasury indicates that risk-aversion is again rising. This means the recent bear market rally may be teetering on the brink.

After Murthy's exit, Infy will have to rediscover risk-taking

As Narayana Murthy bid adieu to Infosys, what is surprising is the kind of risks he took in the early stages of the company's growth. His successors need to rediscover that original risk-taking ability.

New trend: Investors are cutting the US dollar to size

Some of the traditional asset-class relationships have broken down. Usually, when the equity markets fall, the dollar rallies. But this has not happened this time. The world has started looking beyond the US dollar

Making sense of the Sensex: Why 2011 may not be 2008

The weak flows of foreign portfolio flows this year and the relatively sedate valuations of Indian stocks may make 2011 less like 2008 for investors.