Blogs News - Page 15

Will Hindalco and Tata Steel lead a revival of corp bond mkt?

The fact that these two companies could place debt at seemingly fine levels at a time when FIIs are cooling towards Indian bonds has woken up a dormant corporate bond market from its slumber.

Sensex in bearish mode, could lose 1000-1500 points

The chart of the Sensex is forming a bearish chart pattern called the descending triangle. The Nifty too is forming the same pattern.

Did Pranab-da pull a fast one on Voda and P-notes?

How could the Vodafone law change has just been a clarification when it was there on the statue book in 1922, asks one expert.

Don't get too excited about a CRR cut yet

The RBI will cut CRR to improve system liquidity but it will not really help in easing liquidity by much. Here's why

Near-term macro risks remain, but don't sell your stocks yet

It is definitely not the right time to sell and stay out. There is a lot of liquidity being pumped into markets by central banks

Mariwala's ASCENT completes first wave, total turnover nears Rs 9k cr

Over 200 members join Marico boss's entrepreneurship initiative in nine months, 1000 members is next target<br /><br /> <br /><br />

Sure, gold is up, courtesy US Fed. But it's time to go short

The US Fed's decision to keep rates unchanged till 2014 gave gold and silver a boost. But the charts show that both metals are approaching a reversal point.

Why property is not always a healthy investment for you

Extending yourself to buy property to live in may be okay, but those who do so purely as investment could come to grief.

Hawkish RBI helps the govt but not the economy

The question the RBI will now have to ask itself is: "what purpose will a status quo on policy rates achieve?"

As dollar rally flops, equities are reaching selloff points

Equities are nearing a selloff point. This is where one should be shorting them with a stop-loss.

Beware of speculation-driven stocks in this rally

Investors hoping to invest can invest in the index or in fundamentally sound stocks that do not require speculative action for their performance.

After disastrous 2011, Indian equities may have tough 2012 too

The Indian equities market has clearly been a disaster in 2011, turning out to be among the worst performers. But 2012 does not look too bright either

Fear is the key: If dollar rally continues, equity is a goner

The US dollar's rally raises an important question: is risk-aversion back? This does not augur well for equities, but the bears cannot be certain about it for another week or two.

With stronger balance sheet, IndusInd keen on acquisitions

Responsive innovation is the buzzword as Hindujas-controlled bank focuses on new products; gold loans on the anvil<br /><br />

Dear investor, you are on your own; Sebi, RBI cannot help

No regulator can help investors get back lost money - as several scams have shown. It is best for investors to think for themselves and protect themselves.

2012 forecast: Equities weak, look at US dollar and gold

The charts are telling us that equities are still bearish. Which means the US dollar and gold still have some traction.

When everyone else is a bear, it's time to buy shares

Is the pessimism in the stock markets being overdone? The index may well fall further by 25 percent, but it is also time to start buying good stocks.

Dollar rally faces headwinds; may provide strength to equities, commodities

The US Dollar has reached a long term area of resistance which is likely to end the greenback's rally and result in a reversal, or at least a correction.

Dec rallies: Why Santa may take a vacation this year

History has proven that Santa Claus rallies are not guaranteed and it's best not to expect one this month.

Efficiency top priority for India Inc in 2013

Survey shows most companies seek efficiencies over other factors going into new year<br /><br /> <br /><br />

Why RBI should go easy on bank licences

The RBI should hold back on bank licences until the banking sector gets back<br /><br /> on track with balance sheets improving. The government should leave the RBI<br /><br /> on the banking licence issue.

India dealing with Asian crisis its peers felt 15 years ago

The Asian crisis was all about countries taking up short-term external debt to unsustainable proportions leading to a run on their currencies.

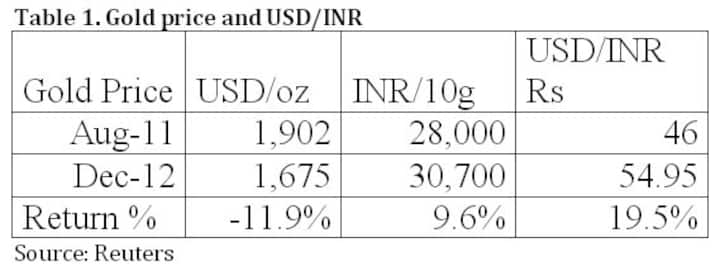

Mr FM, gold isn't the problem, the rupee is. Fix that

The FM is looking at gold as the problem in the current account deficit. The fact is gold prices have fallen, but the rupee has fallen more sharply making gold dearer at home. He has to fix the declining rupee

Why you should be betting against the rupee now

The rupee has been defying gravity despite weak and worsening fundamentals, including the CAD crisis.

One more rate cut likely in March, feel experts

A sharper cut in the repo was warranted, say economists, corporate India <br /><br /> <br /><br />

Parsis are right on top as the finest Indians

Like Carnegie, like Rockefeller, like Gates, like Buffet, the Tatas knew to what end they were creating wealth. To improve society.

Memo to Japan: end failed yen policies, and import more

The Japanese government has failed to keep the yen down to help its export-driven economy. Why hasn't it learnt lessons from 20 years of failed interventions?

This market rally will have legs - and for many reasons

The rally in stocks, bonds and currencies is the result of short-covering, relief and also fundamentals. It may have some stamina.

When will SEBI have its Rajaratnam moment?

In the backdrop of the Raj Rajaratnam conviction, Sebi's stance against Reliance Industries in the ongoing insider trading probe will be closely watched.

Bulls, watch out. Sensex level shows this isn't time to buy

The major indices are at a level where selling holds greater attraction than buying. This is not the time for Sensex bravado.