Investing News - Page 9

How to increase savings by plugging leaks

Investing in wrong financial products is a very high source of leakage from your savings. Insurance policies are the worst form of leakages as costs can be as high as 50% if you are not careful.

Your realty investment just got riskier

Throwing money at a piece of real estate where there is no price correction despite the ruckus created by crony capitalism revelations is foolhardy.

Mamata's resignation will further spike markets

The Centre does not have money to bail out West Bengal, where will Mamata go? The government knows this and markets too are sensing it. Expect more rallies going forward.

Irda is about to give LIC, govt a free ticket to imprudence

The insurance regulator is planning to allow all insurers to hold more than the prudential limit of 10 percent in any one company. This is just to help LIC and the government

Everyone benefits from state banks except shareholders

The government is trying to float more PSUs equity offers to fill in its empty coffers. The fact that the minority shareholder is given a raw deal makes the value of the firms much lower than what they deserve if let to run on their own.

How not to rescue the rupee: The UPA misses a chance

The joint Govt-RBI announcement to rescue the rupee and reverse negativity has been botched with the RBI alone coming out with steps.

Why the rupee is marching to its own gloomy beat

The rupee is in a decline of its own making. But the stock markets seem to be holding up. What is the reason for this divergence?

After taxman and intel snoops, Sebi wants to tap your phone

Sebi is now seeking rights to tap phones to track down insider traders. There is no no lack of agencies listening in to your conversations

Investors watch out! Cash is your best hedge right now

Investors will by now have realized that investing in equity is not a hedge against inflation (rising inflation has actually hit equities hard in India over the last four years). Equity investing is based on much more complex fundamentals rather than positioning against rising prices in an economy.

MCX, Ajay Shah and the response to sharp criticism

MCX is targeting a free-market economist for his veiled criticism of the exchange. It's not on.

Sensex Q4 PAT seen growing 15%, ex-SBI growth just 7%

Pre-results study reckons financials will report robust earnings growth, capital goods stagnant<br /><br /> <br /><br />

Dr Subbarao, easy money isn't the answer. Stand firm

The nature of banking usually ends up increasing money supply, but the devil here is deficit financing of the government by the Reserve Bank. Unless the Reserve Bank can say no to the government, it will be difficult to control money supply.

Why Subbarao told the finmin to take a walk

The latest policy is the clearest signal yet from the RBI that rates can't fall further without a lot of effort from the finance ministry

Why the RBI must cut interest rates

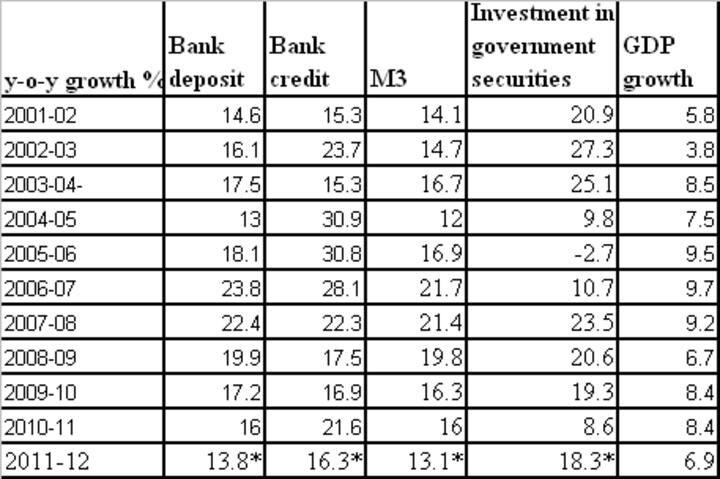

Banks, by passing on lower interest rates to borrowers, can increase demand for credit leading to a multiplier effect. The multiplier effect helps raise deposit as well as broad money growth.

2012 is the year of the dollar: it's a mixed bag for India

This year could be good for the US dollar for various reasons. This means the rupee will be under pressure.

Infrastructure spending not the best way to boost growth

Without reforms, infrastructure spending only leads to large-scale corruption where businessmen, bureaucrats and politicians amass untold wealth at the cost of the country.

Real estate is a no-no in the current slowdown scenario

Property prices have held up better in this slowdown that other asset classes. This means property has nowhere to go but down in this climate

Why Facebook fell flat on its face after Nasdaq listing

The Facebook listing, which saw huge trading but not much price strength, shows that the jury is out on its business model

Tale of ant and grasshopper: Lessons for Europe, India

In India, the ant is represented by the people who work hard and save money for the future. The government, on the other hand, is the grasshopper that lives off the savings of the hard-working Indian

Why Indians will keep buying gold even at higher prices

Rise in gold prices is a catch-22 situation. Rising gold prices will increase gold imports despite a duty hike and higher gold imports will push up the CAD further, which will weaken the rupee, and the falling rupee will lead to a rise in gold prices.

2012 will be a year of austerity for India - so be prepared

Debt reduction and lower consumption will be the watchwords for India. This is good for the markets in the long run. Look for a revival by the second half of 2012.

PSUs are not for shareholders, so why invest in them?

Minority shareholders do not figure in the government's scheme of things except to buy out a part of its ownership when the government disinvests a small stake.

Here's currency and bond market response to EU: 'Yawn'

The European Union's decision to reduce deficits is not really a solution to the eurozone crisis. The stock markets may be happy, but the bond and currency markets know better

Should you bet on equities or commodities in medium term?

Trend of outperformance of equities led by knowledge stocks will continue going forward given the positive outlook for the US economy, as well as given the weak growth outlook for China and India

There goes your big rate cut hope: manufacturing slowed in March

PMI index shows activity slowed in March, inflation risks remain high<br /><br />

FM's deficit math is going wrong; rate cut hopes recede

Oil prices and currency depreciation may spoil Pranab Mukherjee's fiscal deficit arithmetic.

Major currencies near strong reversal points against rupee

The euro, dollar and British pound near strong reversal points against the rupee, which can stop and reverse the continuous depreciation of the Indian currency. Only there seems to be no stopping the rally of the Japanese yen.

Rupee weakness is overdone; it will only move up from here

All the negatives are built in to the current value of the rupee and the currency should look to trend up from here as markets weed out the negatives and look for positives that are still out there.

Sensex will take cue from US dollar after euro package

The euro bailout will get its first taste of market sentiment over the weekend. The currency to watch is the US dollar

The Bank Nifty may be about to stage a comeback

If interest rates are close to peaking, the Bank Nifty should be close to bottoming out.