Shares of public sector banks (PSB) are trading at around 50 percent or more discount to those of private sector banks in India. Their valuations may look attractive but the fact remains that a shareholder gets nothing from government banks. It is better to take a loan from a PSB than buying its equity.

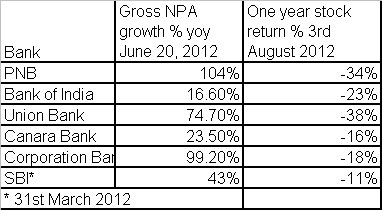

The surge in their bad loans as seen in the first quarter should have their minority shareholders worried. The government, being the majority owner of these banks, too has to pay for this as the values of its holdings go down as well as the dividends. Table 1 shows the percentage rise in gross non-performing assets (NPA) of banks as of end June 2012 and the performance of the stocks over a year’s time.

[caption id=“attachment_410727” align=“alignleft” width=“382”]  Source: Company data, BSE[/caption]

Foreign institutional investors have realised the futility of being a minority shareholder in government-owned companies. Bloomberg data shows that FIIs have pared their holdings in 40 biggest state-owned firms to an average 7.3 percent as of end June, the lowest level since March 2009.

Domestic investors in government-owned firms include Life Insurance Corporation (LIC), the largest insurer in the country, which in turn is owned by the government of India.

In effect, the government, LIC and other state-owned entities are the dominant shareholders in state-owned entities, making minority investor all the more insignificant.

Minority shareholders in PSBs have suffered at the benefit of others. The others include state-run agencies such as state electricity boards (SEBs) that are reeling under heavy losses (estimated at over Rs 200,000 crores).

SEBs sell power at lower prices than they purchase. Many state governments find it difficult to compensate for SEBs losses. It is PSBs who bear these losses, as they provide SEBs loans at the behest of the government.

More than half of the loans restructured in the June quarter were from the power sector, indicating a deep structural problem.

Loans to the agricultural sector, which are usually written off again at the behest of the government, are the next big drag on PSBs. The banks are forced to fund the agricultural sector as targets are set for them (the target for 2012-13 is around Rs 5.75 lakh crores).

They lend directly to the agricultural sector while private sector and foreign banks take an indirect route by buying priority sector bonds or loans.

Weak monsoons in 2012 will deal a body blow to the already NPA ridden PSBs.

PSBs are also the ones to fund the government’s fiscal deficit. As much as 27 percent of their net demand and time liabilities are held in government bonds. This is called statutory liquidity ratio. Though the stipulated SLR is 23 percent, PSBs hold 4 percent in excess. The government looks to their support for its borrowings when fiscal deficit goes above budgeted levels.

Directed lending of PSBs has come down substantially since the late 1990’s when institutions such as IFCI, UTI and IDBI had to be bailed out as directed loans went bad.

However, there is always a lurking fear among investors that many bad loans of the PSBs are due to directed lending.

The government has to seriously relook at the way it acts as the dominant shareholder. If it just wants to continue using state-run firms for its own purposes and not create shareholder value, it may as well delist them.

The government is trying to float more PSUs equity offers to fill in its empty coffers. The fact that the minority shareholder is given a raw deal makes the value of the firms much lower than what they deserve if let to run on their own.

Arjun Parthasarathy is the Editor of www.investorsareidiots.com a web site for investors.

)

)

)

)

)

)

)

)

)