By R Jagannathan

It was billed as redemption day for the economy, with the government and the Reserve Bank of India (RBI) jointly announcing a slew of measures to arrest the decline of the rupee and improve global confidence in the Indian economy’s prospects.

In the end, what we got was six paragraphs from the RBI liberalising external borrowings - something it has been doing for a while now, ever since the rupee has been heading south.

Perhaps the government will dish out its morale-boosters later, perhaps the day’s delay in the exit of Pranab Mukherjee from the finance ministry (he will now quit on Tuesday) has upset the joint government-RBI announcement plan, but the message the market got was that we are only going to get more of the tired old remedies. This is why the Sensex tumbled, and the rupee went weak-kneed at Rs 56.83 around 3.15 pm.

Put together, the measures announced by the RBI add up to potential additional inflows of $18 billion - an extra $10 billion of external commercial borrowings that can be used to repay rupee loans, an additional $5 billion limit for foreign institutional investors (FIIs) to invest in government debt, and a $3 billion limit for FII investment in mutual funds with at least 25 percent exposures to the infrastructure sector.

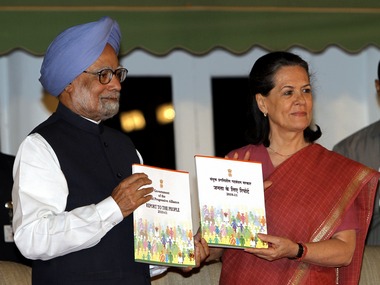

[caption id=“attachment_356399” align=“alignleft” width=“380” caption=“The news the markets, rating agencies, and foreign investors are waiting for relate to reforms - fiscal consolidation and a reduction of subsidies.Reuters”]  [/caption]

Last year, when the rupee was in declining mood, the government had done similar things - to no good effect. In November 2011, it raised FII investment limits in government and corporate bonds by $5 billion each. It also eased the conditions for FII investment in infrastructure bonds to coax more inflows. The markets swallowed in the info and kept pushing the rupee down.

The problem with such measures is that they are necessary to bring in short-term dollar investments to ease the pressure on the rupee, but in the process they build a huge debt pile that India will have to repay at some future date.

Ila Patnaik, writing in The Indian Express, notes this greater dependence on foreign borrowings to finance the current account deficit (gap between external earnings and expenses) and lists the dangers clearly: “Borrowing in foreign currency-denominated loans is dangerous because repayment becomes harder in the event of a big depreciation. When $10 billion has been borrowed and the exchange rate is Rs 50 to the dollar, the repayment of principal is Rs 500 billion. But if the rupee were to depreciate to Rs 75 to the dollar, the repayment would swell up to Rs 750 billion.”

Since the time she wrote, the rupee has fallen from Rs 50 to Rs 57, and analysts are talking about the rupee hitting 60 to the dollar. One wonders how easing debt inflows is any kind of solution to the fundamental problems of the rupee - inflation, huge trade deficits, and low internal and external business confidence in the UPA’s intentions.

It was this signal of intentions that the markets were waiting for. It didn’t come on Monday.

The real solution lies in encouraging either investment in rupee debt, or encouraging foreign equity investment by opening up many more sectors - including insurance, retail, aviation and other sectors - for more liberal investment.

Moreover, the news the markets, rating agencies, and foreign investors are waiting for relate to reforms - fiscal consolidation and a reduction of subsidies.

Borrowing more from FIIs is neither here nor there.

)

)

)

)

)

)

)

)

)