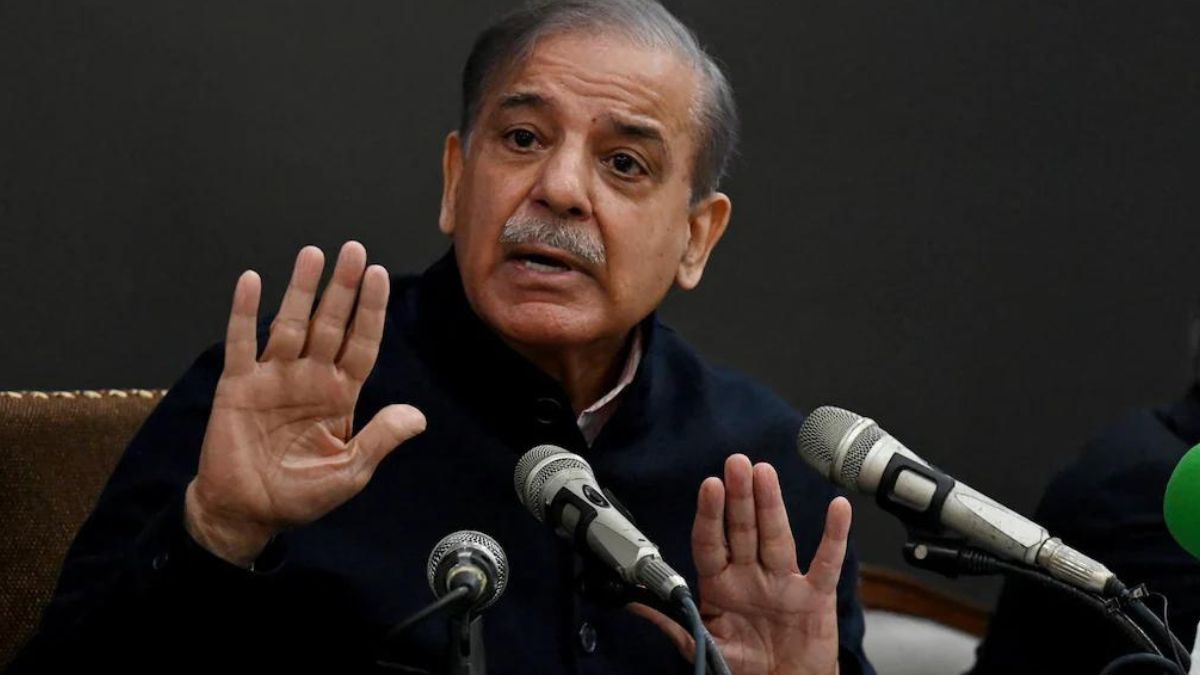

In order to stabilize its unstable economy, Pakistan requires a new loan program from the International Monetary Fund (IMF), according to Prime Minister Shehbaz Sharif’s remarks on Tuesday.

PM Sharif made this statement in Islamabad during a ceremony aimed at motivating the nation’s taxpayers.

According to ARY News, the prime minister stated that the government must sign a new IMF agreement in order to maintain stability.

But he added that the government will concentrate on promoting growth, generating employment, and tackling inflation in addition to the IMF program.

According to Shehbaz Sharif, the federal government will work with the provincial governments to solve issues and create favorable conditions for the private sector. He announced that the exporters had received reimbursements totaling 65 billion rupees, and he pledged that going forward, the refunds will be given on schedule. He remarked that in order to increase industry production, we will also work to provide electricity to them at competitive rates.

He said that the Special Investment Facilitation Council’s (SIFC) platform was created to encourage investment. He declared that the CPEC’s second phase will proceed.

The Prime Minister stated that the FBR will undergo a complete restructuring in relation to tax reforms. He claimed that the tax collection organization will fully digitize next month with the hiring of consultants. He mentioned that we would need to increase the tax base in light of the low tax to GDP ratio.

According to the prime minister, this nation’s heroes are its top exporters and taxpayers. According to ARY News, he declared that the taxpayers and exporters who received today’s prizes would get blue passports.

Impact Shorts

More ShortsFollowing the IMF’s acceptance to a staff-level deal with Islamabad, which would disburse the final USD 1.1 billion tranche under an existing USD 3 billion standby arrangement, if approved by its board, the remarks were made.

Notably, Pakistani authorities have expressed interest in receiving yet another bailout, according to the IMF mission that spent five days in Islamabad during the most recent evaluation of the stand-by program.

On April 11, the standby agreement expires.

Prior to the stand-by agreement, Pakistan was required by the IMF to fulfill certain requirements, such as updating its budget, increasing interest rates, and increasing revenue through higher taxes and higher gas and electricity costs.

Pakistan’s pursuit of a 24th medium-term loan package for a sustained drive towards long-standing structural reforms was confirmed by the International Monetary Fund (IMF).

When announcing the staff-level agreement on the effective conclusion of the current short-term facility, the IMF verified this.

In its final report, the IMF stated that, provided the executive board gave its approval, Pakistan would have access to around USD 1.1 billion—or 828 million special drawing rights (SDR)—by the end of April through the staff-level arrangement.

)

)

)

)

)

)

)

)

)