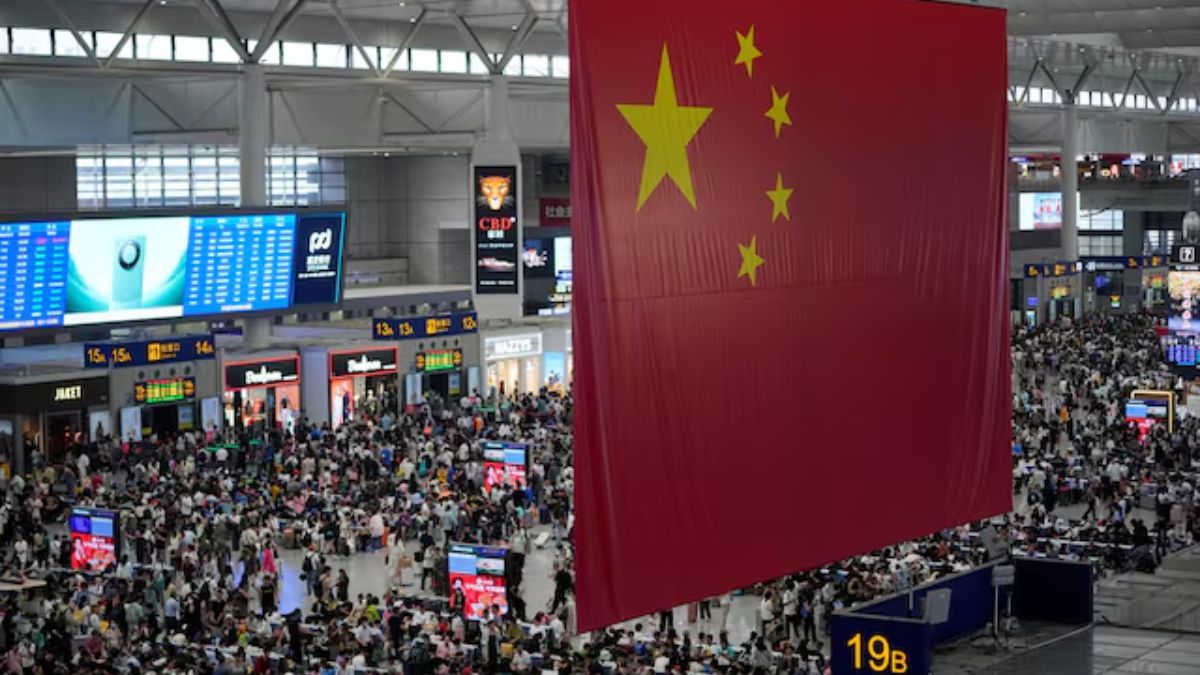

A seasonal boost from Lunar Year spending was expected to bring hope to China’s economy, slowed down by several institutional problems.

However, even though the festive season gave a boost consumer prices, pushing them up in January, it’s nowhere near enough to give hope.

With shifts in US policy under President Donald Trump creating new economic uncertainties, the fear of the Chinese economy not faring well all through 2025 remain. In fact, despite the much awaited inflation uptick, analysts say the country still faces deflationary pressure and weak domestic demand, South China Morning Post reported.

Consumer prices rose 0.5 per cent year-over-year in January, China’s National Bureau of Statistics reported Sunday (February 9), following a 0.1 per cent increase in December. The figure is in line with economists’ expectations, but it also shows how fragile domestic demand remains.

Even the largest increase in prices in over three years was a meagre 0.7 per cent, recorded in the month prior. That too, was only incidental due to holiday spending.

On the other hand, factory prices continued their prolonged decline, with the producer price index (PPI) falling 2.3 per cent in January. That marked the 28th consecutive months of contraction. It was also worse than analysts’ expectations. Those polled by financial data provider Wind had predicted a 2.07 per cent drop.

Since April 2023, near-zero CPI growth has fuelled concerns about deflation. Last month, consumer goods prices inched up just 0.1 per cent year-over-year, while services rose 1.1 per cent. Food prices increased by 0.4 per cent, and non-food prices climbed by 0.5 per cent.

Impact Shorts

More ShortsAmid these weak indicators, most Chinese provinces have lowered their inflation targets for 2025 to around 2 per cent, down from the traditional 3 per cent. Nationally, consumer prices rose just 0.2 per cent in both 2023 and 2024– the smallest annual increases since 2009.

In December, Beijing acknowledged the risk of persistently weak prices, listing “promoting a reasonable rebound in prices” as a key objective.

SCMP reported that Li Chao, chief economist at Zheshang Securities, wrote late in Janaury that the government’s statement signalled a focus on the persistent downward trend in prices.

Yet even as Beijing pushes to revive consumer demand, analysts remain skeptical. Citic Securities forecasts a modest 0.3 per cent rise in consumer prices this year, with factory prices not coming up in green, but only narrowing their decline to 1.4 per cent in 2025. It cautioned that demand-side pressures persist, citing a struggling housing sector and weakening global demand for Chinese exports.

“To see a sustained recovery in PPI and a return to positive growth, more supply-side policies in terms of ‘de-involution’ may be required,” Citic Securities said, calling for government measures to address excessive industrial competition and overcapacity.

For now, China’s economic outlook remains murky, with seasonal spending unable to mask deeper structural challenges.

)

)

)

)

)

)

)

)

)