China’s manufacturing activity grew at its fastest pace in a year in March, offering a rare sign of optimism for the world’s second-largest economy amid mounting pressure from a deepening trade conflict with the United States.

The official purchasing managers’ index (PMI) rose to 50.5 in March from 50.2 in February, reaching its highest level since March 2024. A reading above 50 indicates expansion.

The non-manufacturing PMI, which covers the services and construction sectors, also improved to 50.8 from 50.4.

China maintains optimistic outlook

The increase in factory activity was driven by a rebound in new orders, indicating that recent fiscal measures are beginning to lift domestic demand. Some analysts say the improvement is partly due to foreign buyers rushing to make purchases ahead of potential new US trade restrictions.

Despite the growing pressure, China has kept its economic growth target for the year unchanged at “around 5 per cent.” The government is relying on increased fiscal spending, debt issuance and further monetary easing to stabilise the $18 trillion economy. More emphasis is also being placed on boosting domestic consumption as exports come under threat.

The new orders sub-index climbed to 51.8, its strongest reading in 12 months. While new export orders remained in decline, the pace of contraction slowed and came close to the neutral 50 mark.

Performance among small and medium-sized enterprises improved in March, according to Zhao Qinghe, a senior official at the National Bureau of Statistics, although larger firms reported more challenges than they did in February.

Concerns over economy remain

But the boost may prove short-lived. US President Donald Trump is expected to announce a new wave of “reciprocal” tariffs on Wednesday (April 2), aimed at correcting what he sees as persistent trade imbalances with China. Trump has already imposed a 20 per cent cumulative tariff on all Chinese imports since returning to the White House in January. He has accused Beijing of failing to stop the flow of chemicals used to make fentanyl into the United States.

Concerns about the sustainability of the recovery persist. The wider economy has had an uneven start to the year. While retail sales have shown tentative signs of recovery, deflationary pressures and a rise in unemployment are weighing heavily.

Impact Shorts

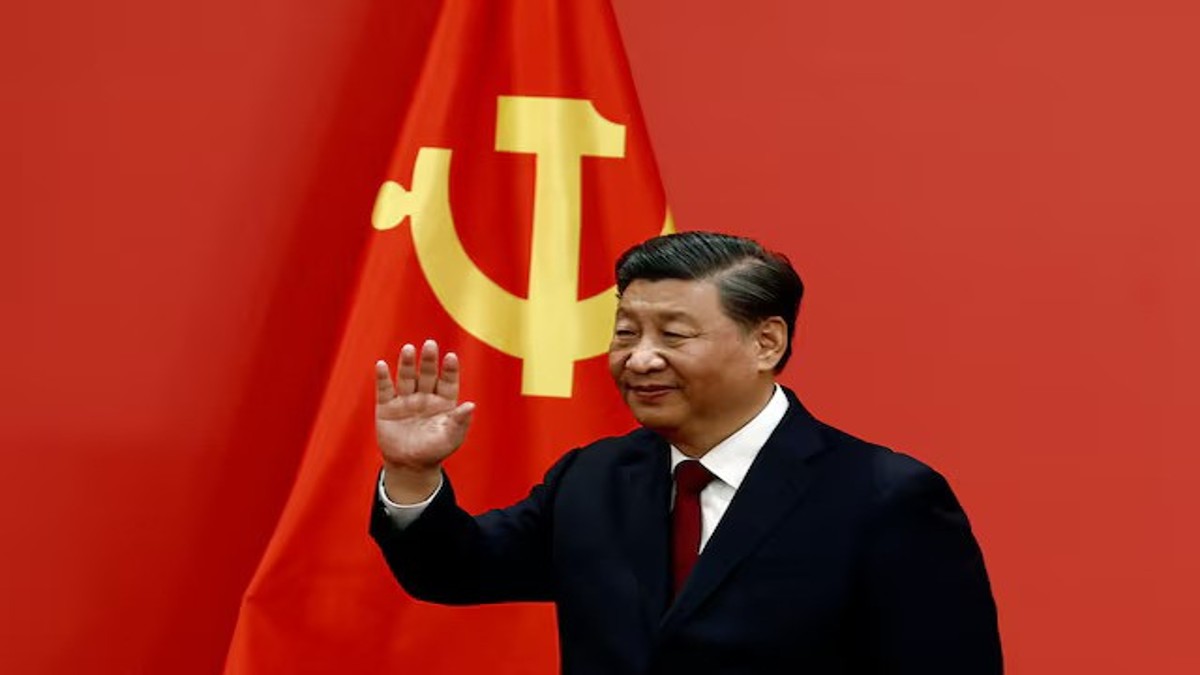

More ShortsPresident Xi Jinping last week met with a group of multinational company leaders, urging them to help protect global supply chains as tensions with Washington escalate.

Beijing is also pushing a consumer goods trade-in scheme to stimulate spending at home. Under the “cash for clunkers” programme, households are being encouraged to upgrade their appliances and electronics.

But economists warn that the recent gains may not last. “We doubt the rest of the year will be much better,” said Julian Evans-Pritchard, head of China economics at Capital Economics. “The budget does allow for more fiscal support in the coming months. But US tariffs, which look set to escalate this week, will start to weigh on exports before long.”

)

)

)

)

)

)

)

)

)